bespoke intel

buyside metrics & Consumer Data Observations.

Buyside Intelligence Report

Areas of top interest during the past quarter

- Social Media Advertising Executives 100%

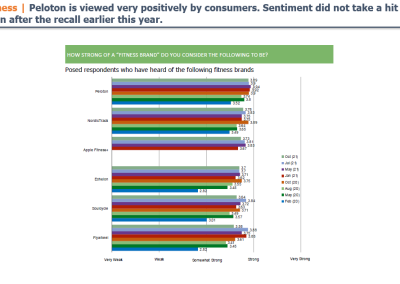

- Fitness 96.3%

- Sporting Goods Retail 88.9%

- Video Gamers 81.5%

- Sports Gambling 81.5%

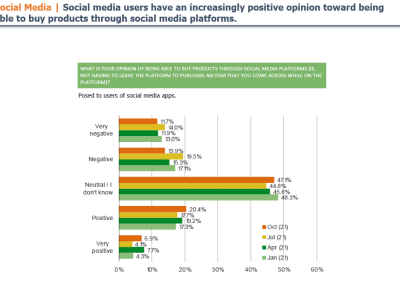

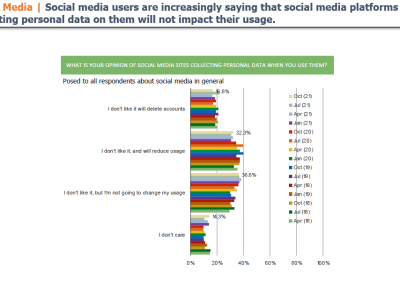

- Social Media Consumers 70.4%

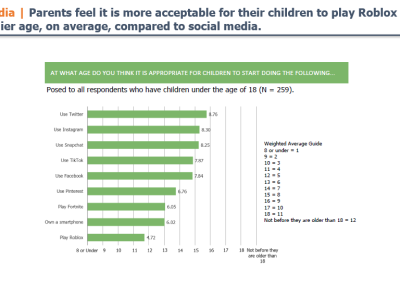

- Social Media Average Age and Platform Cross-Over 66.7%

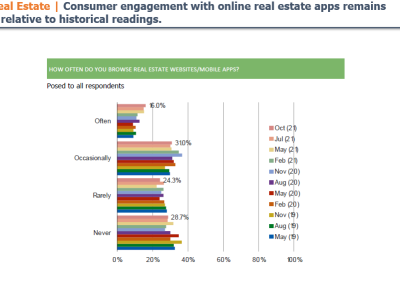

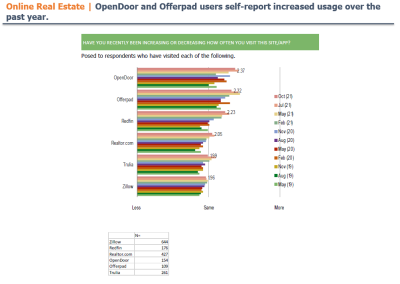

- Online Real Estate 66.7%

- Inflation Awareness and Expectations 66.7%

- Shein and Competitive Dynamics 63%

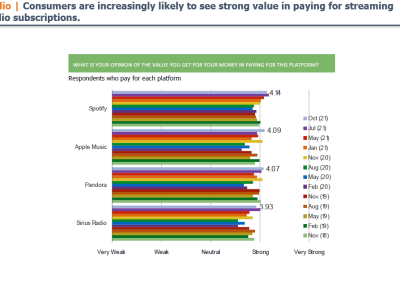

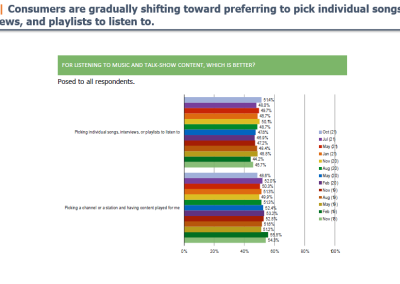

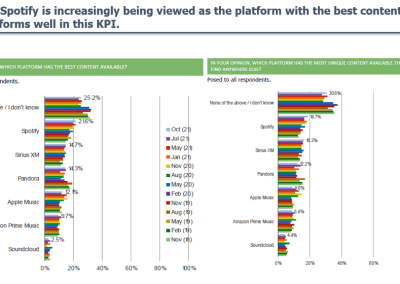

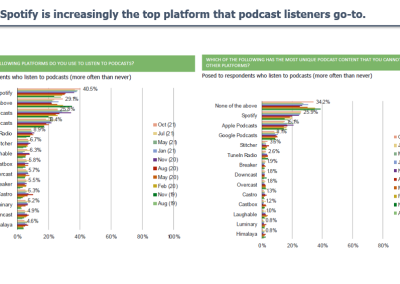

- Streaming Music and Satellite Radio 63%

- Recent and Expected Consumer Behavioral Changes 59.3%

- US Macro and Covid Update 59.3%

- Holiday Shopping Preview 59.3%

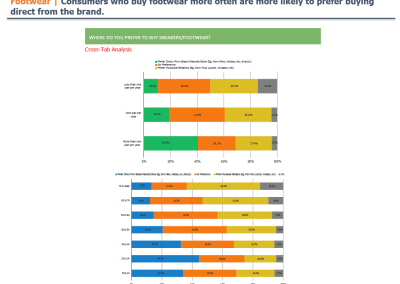

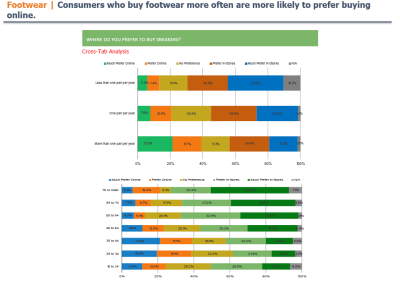

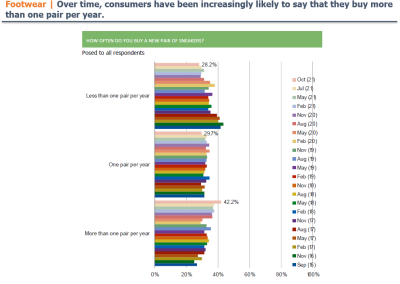

- Footwear 59.3%

- Department Stores 59.3%

Aggregated report opens/downloads from research we sent during the past quarter. Below is a ranking of engagement within the top fiftieth percentile – so they are all reports that are heavily engaged with!

- Online Retailers 51.9%

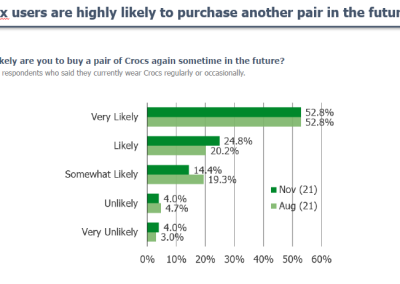

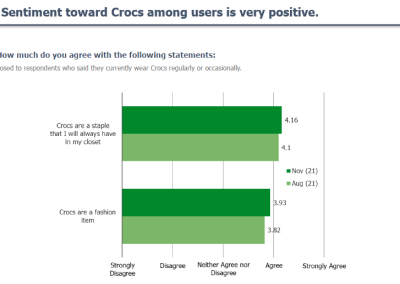

- CROX 48.1%

- Low Cost Retailers 48.1%

- Food Delivery 44.4%

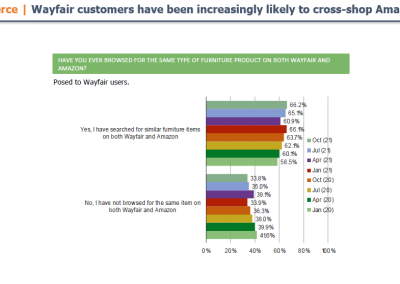

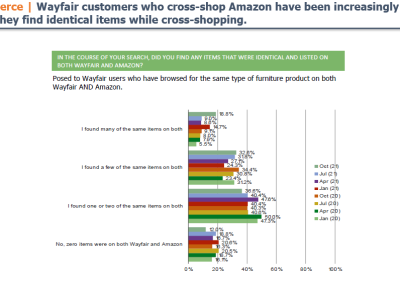

- AMZN and W Pricing Analysis 37.0%

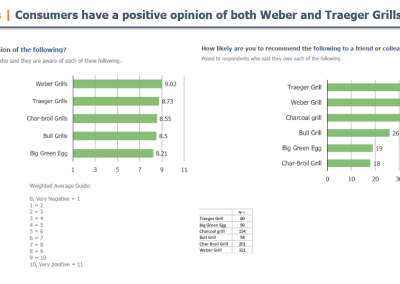

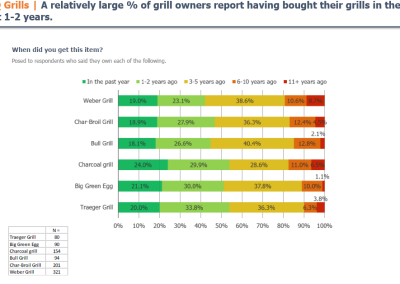

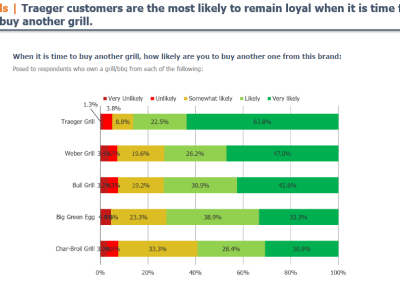

- BBQs 33.3%

- Ride Sharing 29.6%

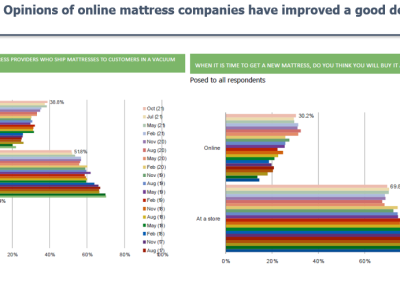

- Mattresses 29.6%

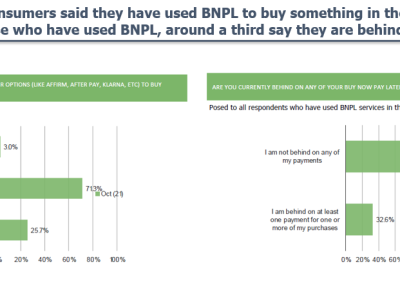

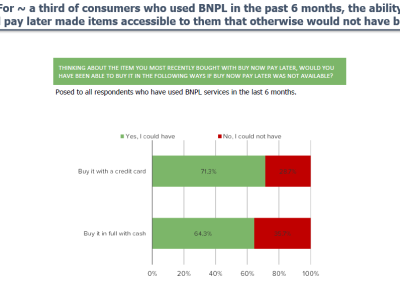

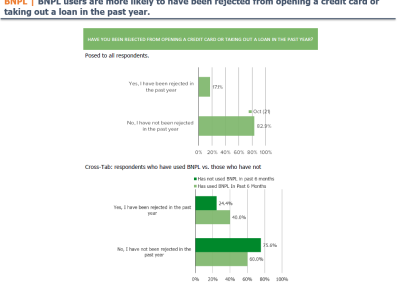

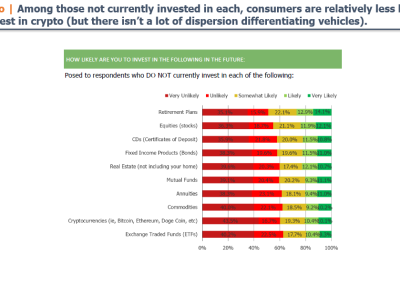

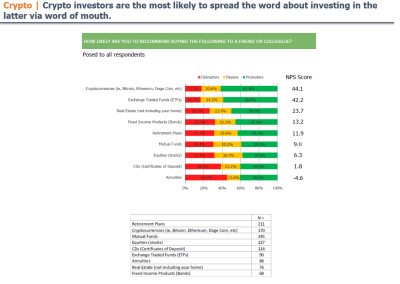

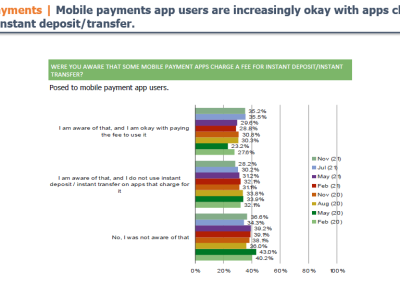

- Crypto, Financial Products, and Mobile Payments 29.6%

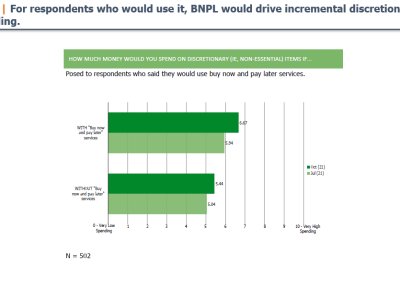

- Buy Now, Pay Later 29.6%

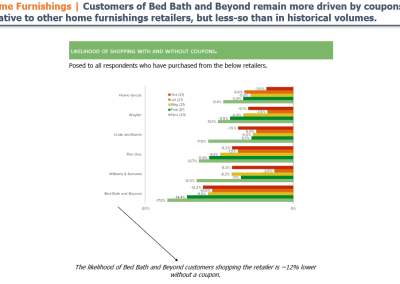

- Home Furnishings 22.2%

- CPGs 22.2%

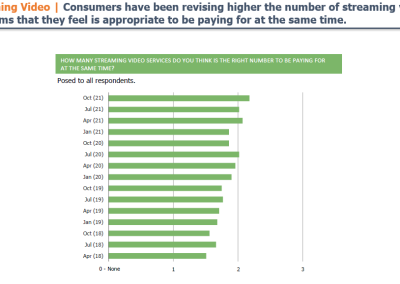

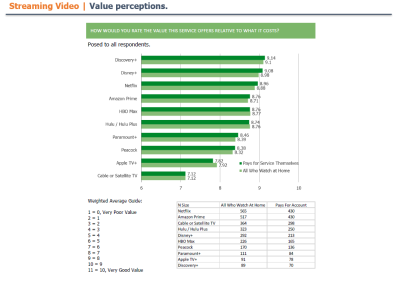

- Streaming Players 18.5%

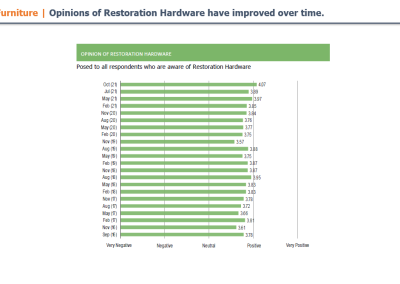

- Furniture 14.8%

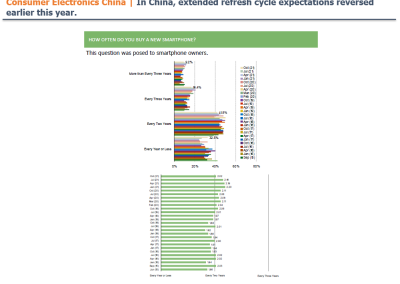

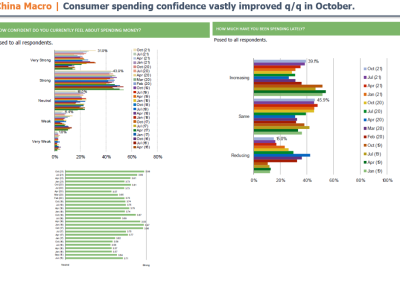

- Consumer Electronics China 14.8%

- Online Dating Apps 11.1%

Details

From our View Point | Some Anecdotal Observations

CONSUMERS ARE…

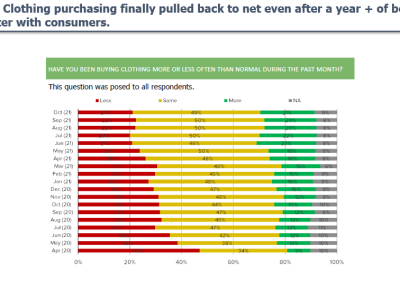

- Shopping online more often.

- Going direct to the brand more often.

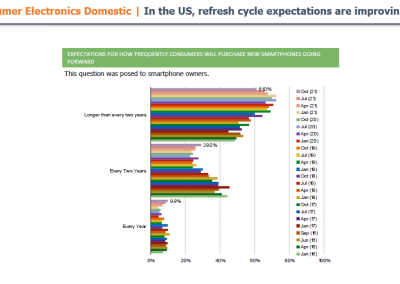

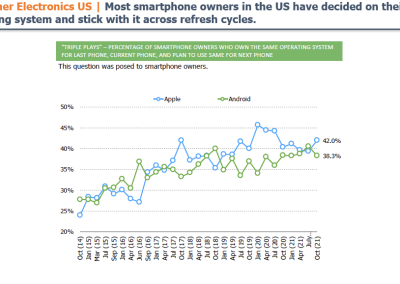

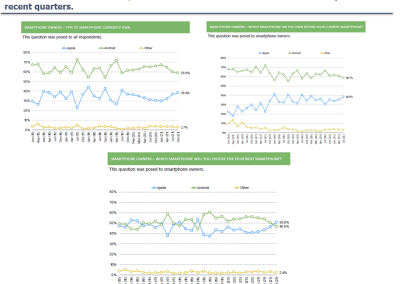

- Pulling forward smartphone refresh cycles (after years of stretching).

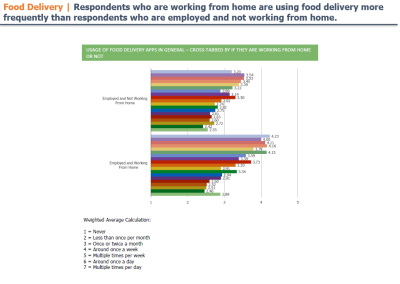

- Using food delivery more often, with WFH driving usage higher.

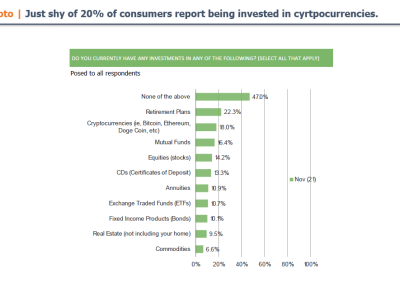

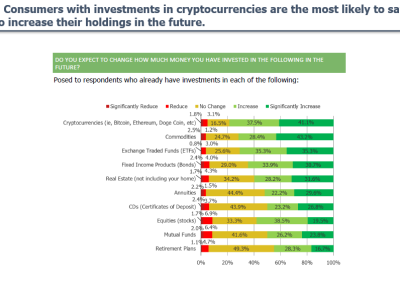

- Increasingly interested in cryptocurrencies

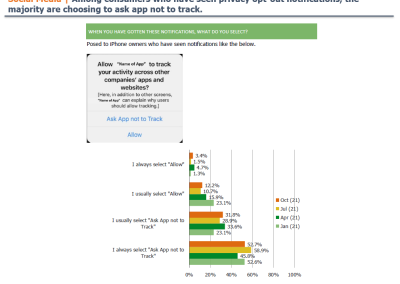

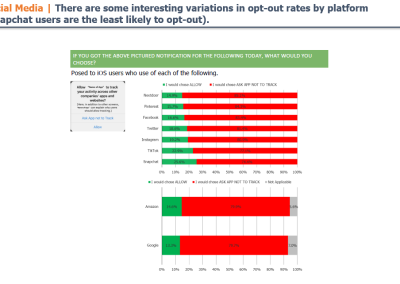

- Opting out of privacy when prompted, but caring less to take matters into their own hands when not prompted.

- When listening to music, consumers are shifting preferences to picking individual songs and podcasts instead of playing a station

- Increasingly okay with paying instant transfer fees when using mobile payments apps.

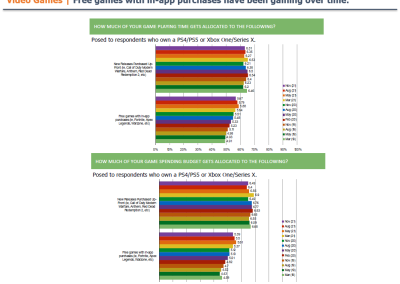

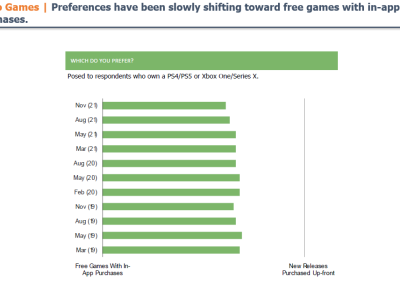

- Video gamers are increasing engagement with free games with in-game downloads.

- Reporting changes in weight during the pandemic (more likely to have gained than lost).

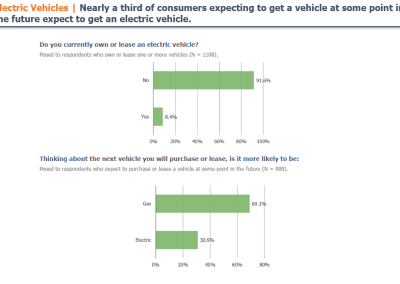

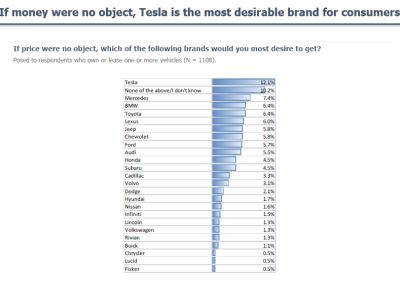

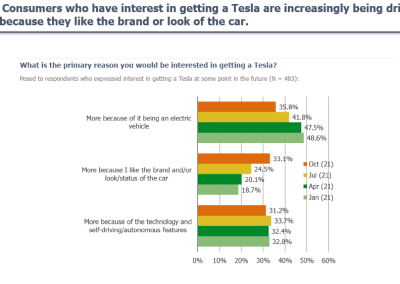

- Increasingly interested in getting an electric car for their next vehicle.

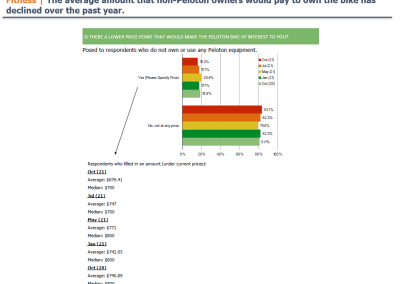

- Interest in at-home fitness peaked in May of 2021. Interest remains elevated relative to pre-pandemic levels, but lower than May of this year.

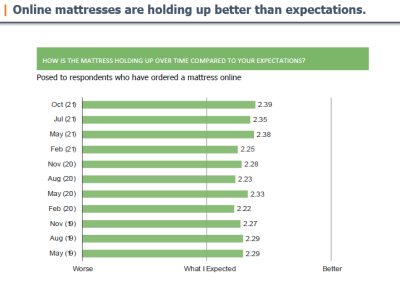

- Purchasers of online mattresses are increasingly reporting that the mattress is holding up better than their expectations.

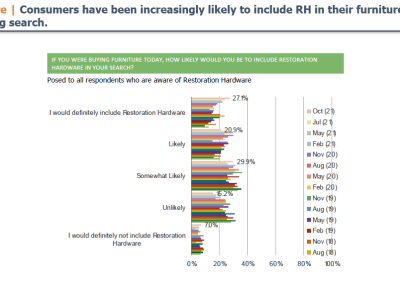

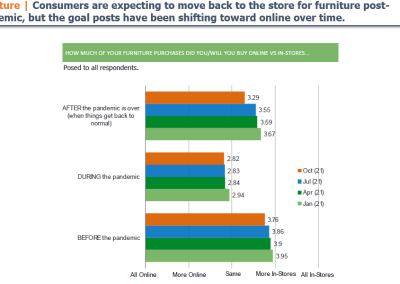

- Shifting furniture shopping online, but showing some desire to return to in-store after Covid concerns subside.

- Inflation expectations for the next year have been on the rise, but the 5 and 10 year views have remained more anchored.

CLIENTS ARE…

- Hedge funds clients are increasingly asking for help with custom surveys on private investments.

- Increasingly interested in data on upcoming IPOs.

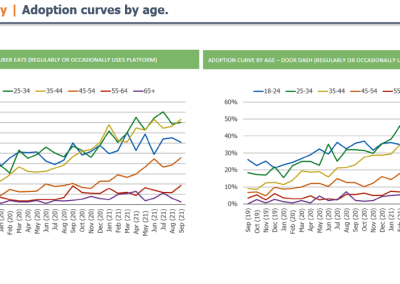

- Increasingly using survey to diligence demand curves by age cohort to help project TAM.

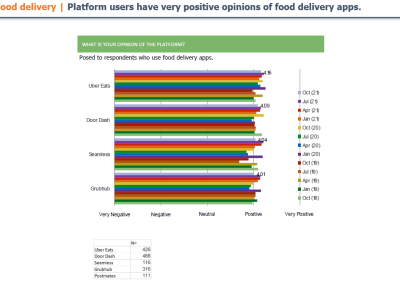

- Increasingly interested in understanding NPS for existing and potential investments. And, as an extension of that, truly understanding where the most / least healthy relationships exist across the market between brands and customers.

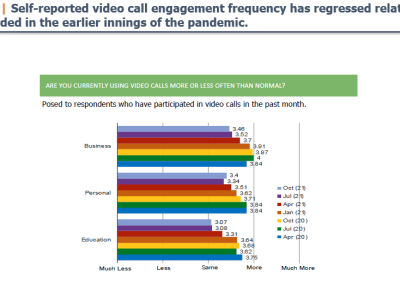

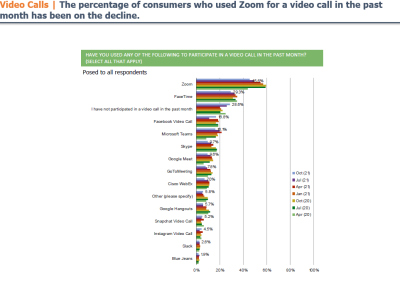

- Increasingly interested in understanding consumer behaviors adopted during the pandemic and which will persist post-covid and which will regress. And, as an extension of that, understanding how changes to things like stimulus, work from home, inflation, etc will impact consumption and behavior patterns.

- Private equity clients have expressed frustration sourcing deals through typical channels that they have used historically. They are looking for new ways to develop relationships with potential targets earlier in the process.

- Among private equity clients, we saw an increased interest in conducting research in companies in skincare, beauty, and fashion end markets.

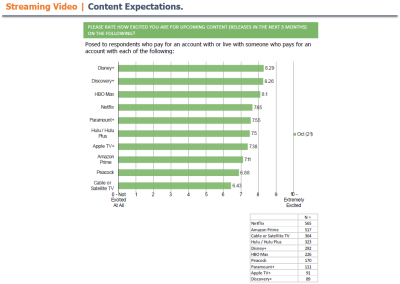

- Among hedge fund and mutual fund clients, the top area of interest BY FAR at the moment is Peloton / Fitness. Other areas that we get asked about the most include Food Delivery, Video Games, China Consumer Trends, Social Media (especially privacy issues), eCommerce, Streaming Video, Sporting Goods, Specific Retail Brands (CROX, FIGS, for example), etc.

Buyside Intelligence Report

Research Portal | a word cloud to recap 2021.

The word cloud to the right aggregates all report views/downloads in our client research portal during all of 2021 and expresses frequency by the size of the word in the cloud.