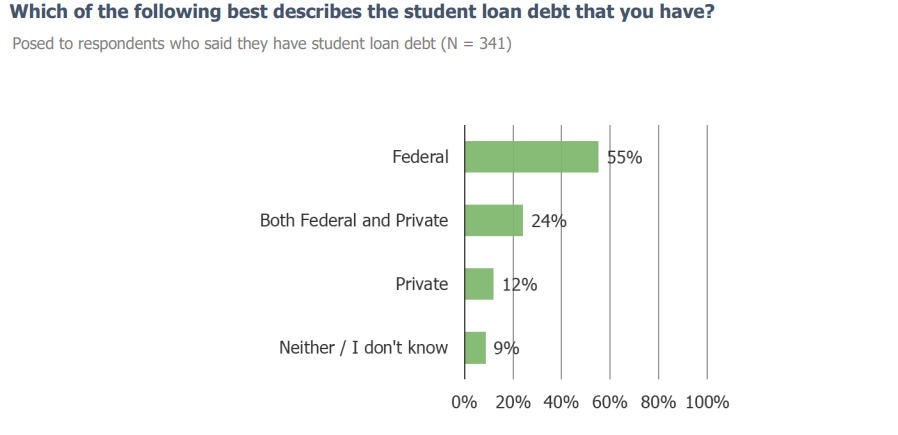

With student loan repayments set to resume in October, there have been questions as to how individuals that are straddled with student debt will react to having to pay off their loans every month. How will discretionary spending change as they resume? What industries will be affected the most? We ran a survey on US Consumers to dig deeper on this.

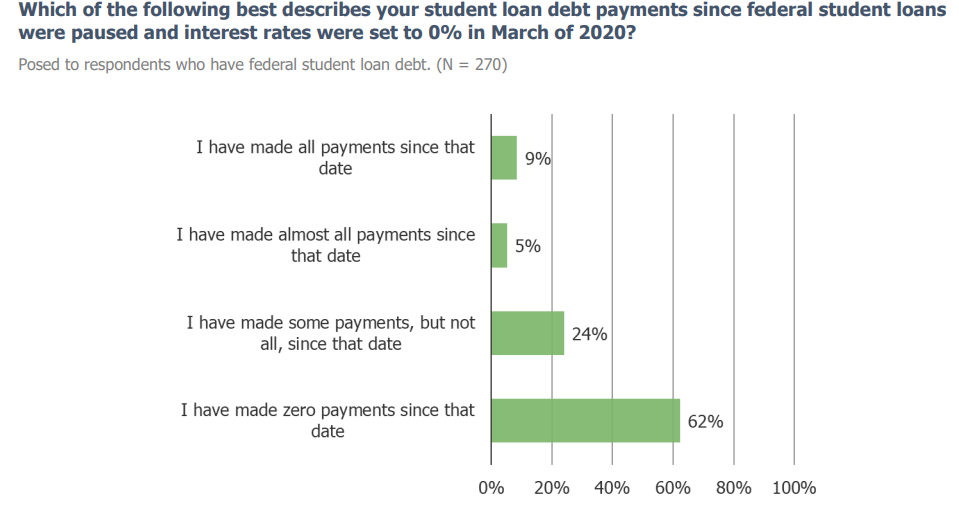

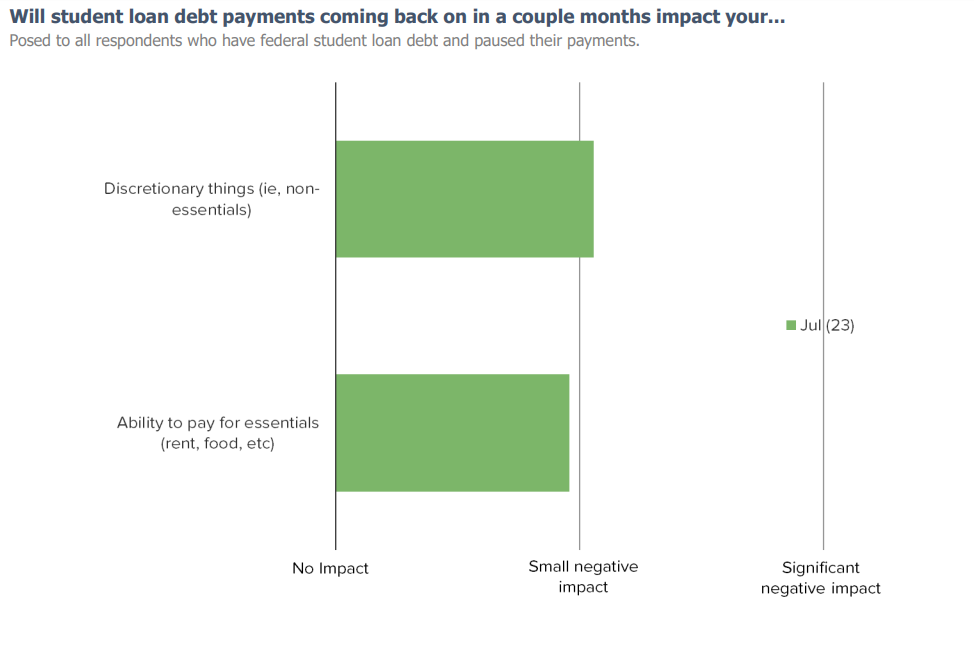

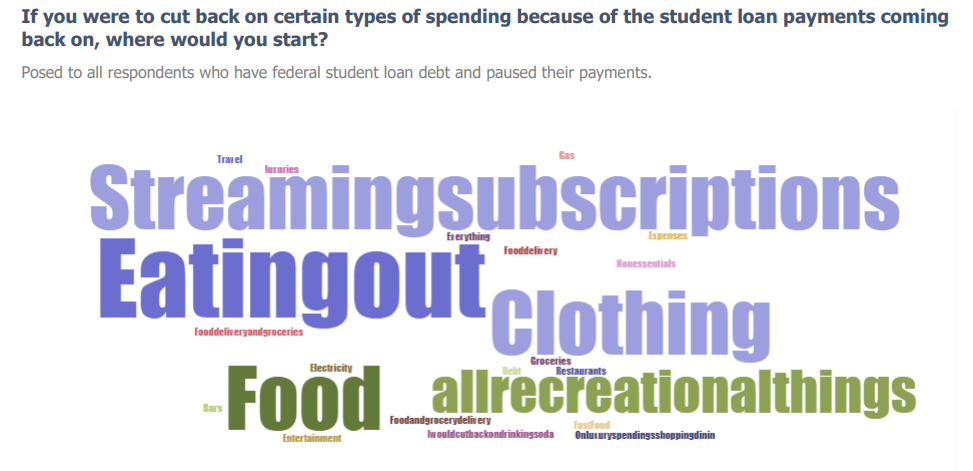

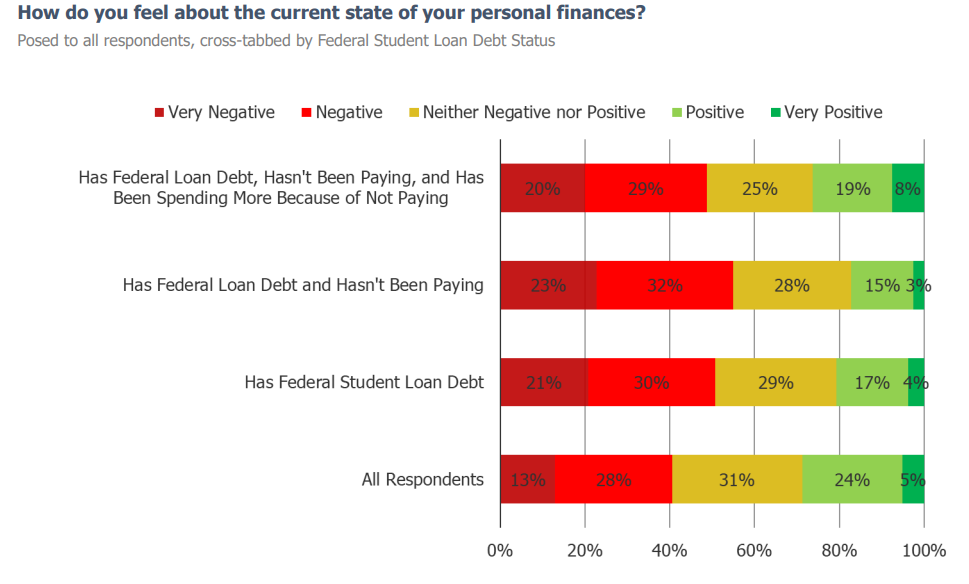

Since the pause on student loan repayments was enacted, a large portion of individuals with loans say that they have not made any payments during the period. 34% of the respondents who paused their federal loan payments said that they increased their discretionary spending because of it. We cross-tabbed our responses by age and found that an overwhelming portion of those who have been spending more, are likely to fall within younger age cohorts (recent university graduates). Of these respondents that paused their payments, a large portion stated that they would have to cut back on their discretionary spending once they resume. The top things that these respondents called out as something they would cut back on include eating out/food, clothing, and streaming subscriptions. Respondents who increased their spending during the pause period have a generally more optimistic view on their personal finances than those who paused their payments and did not increase spending.

We have a number of consumer spending categories throughout the report that show consumer activity by their status with federal student loan payments. We currently have another survey on student loan debt with a much larger N size that we’ll be launching at the end of this week as well. This is a topic we’ll be looking to track a lot more going forward as the pause comes to an end, so if you have any interest in gaining access to our most recent report or any of our future reports, please let us know. Sharing some relevant color below.

Start a trial with us today to get plugged into upcoming results…