Survey Audience: 1,000+ US Consumers Per Wave, Balanced to Census

History: 42nd Quarterly Volume (90 Slides)

Tickers Covered: AMZN, ETSY, W, EBAY, OSTK, WMT, TGT, Temu, Shein, Wish

Access: If you are a client, login to view the full report.

If you are not a client and are interested, request access here.

KPIs Covered:

- AMZN Prime | Did former subs find it difficult to cancel? What % of them were unintentionally signed up for Prime.

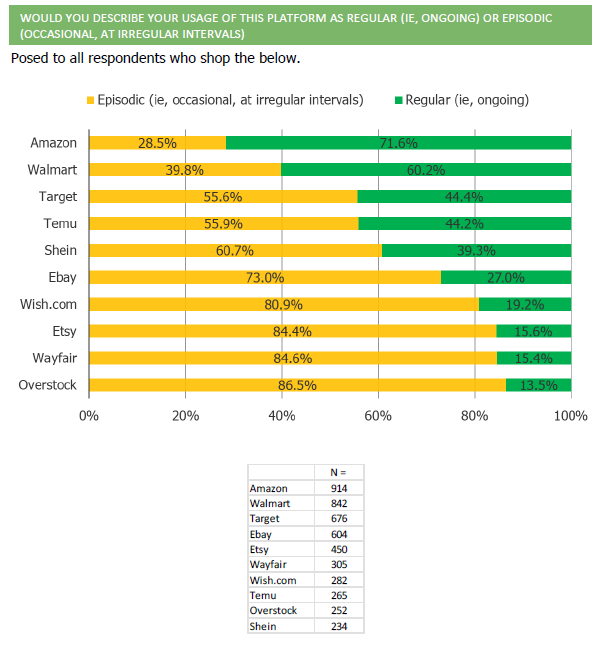

- All Platforms | Do customers shop regularly or episodically/irregularly?

- All Platforms | Episodic Shoppers – what is the catalyst that brings you to shopping the platform episodically?

- ETSY | How much does it matter to customers that they are shopping small business?

- ETSY | How do customers most commonly find themselves shopping Etsy?

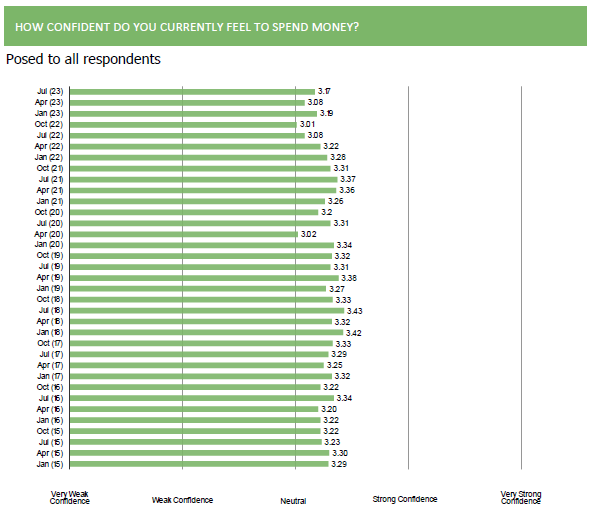

- Consumer spending confidence.

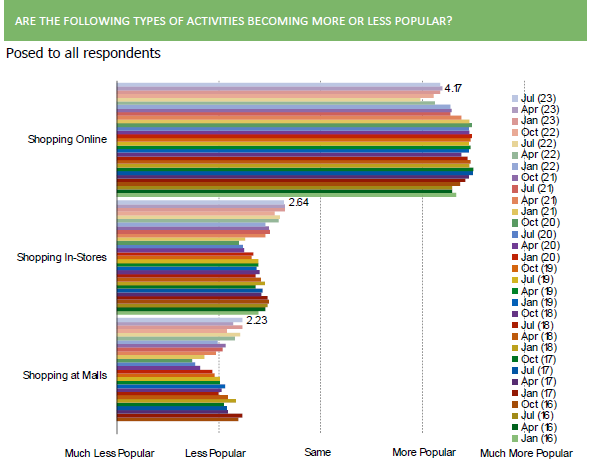

- Popularity of shopping online, vs. in-stores, vs. at malls.

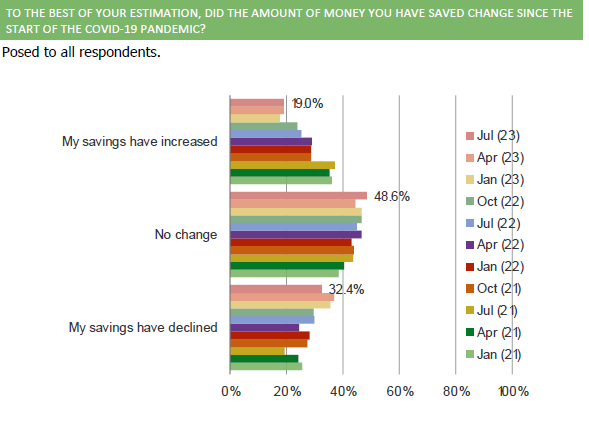

- Savings increased/decreased since Covid tracker.

- Impact on spending if respondents lose job / income declines.

- All Platforms | Perceived changes to sales/promo offers.

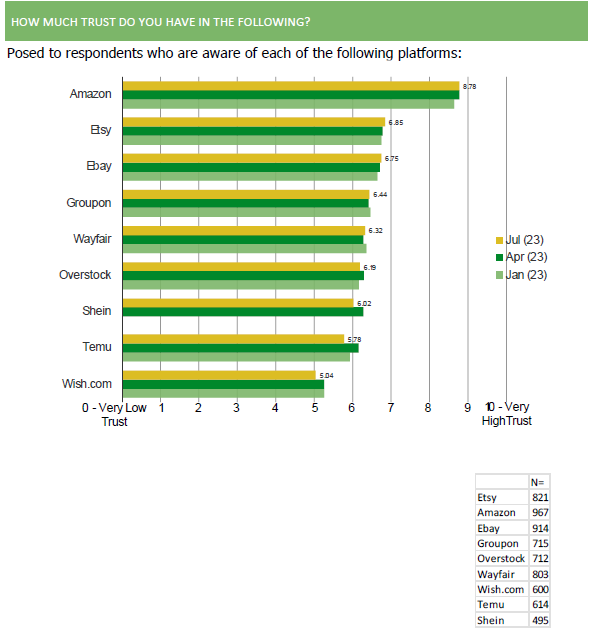

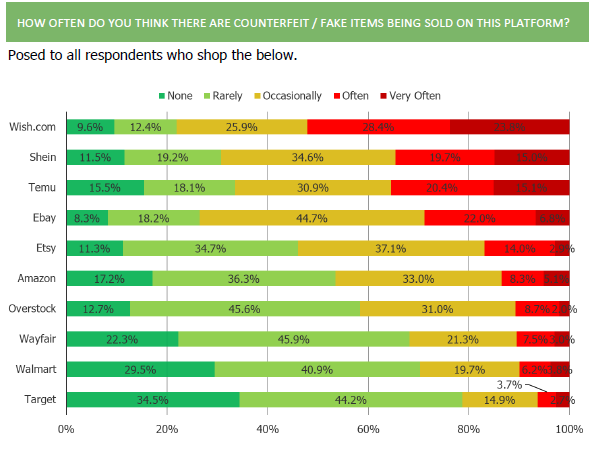

- All Platforms | Consumer trust.

- All Platforms | Customer loyalty.

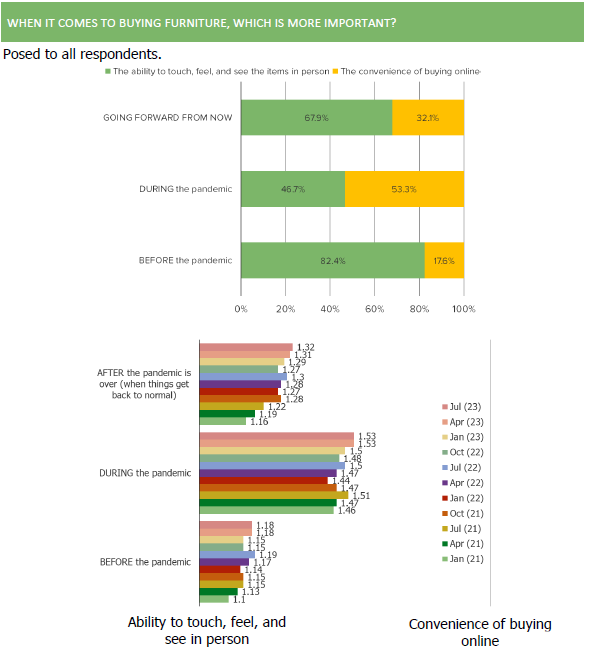

- Furniture Purchasing | In-store vs. Online (pre / during / post Covid).

- Face mask demand trends.

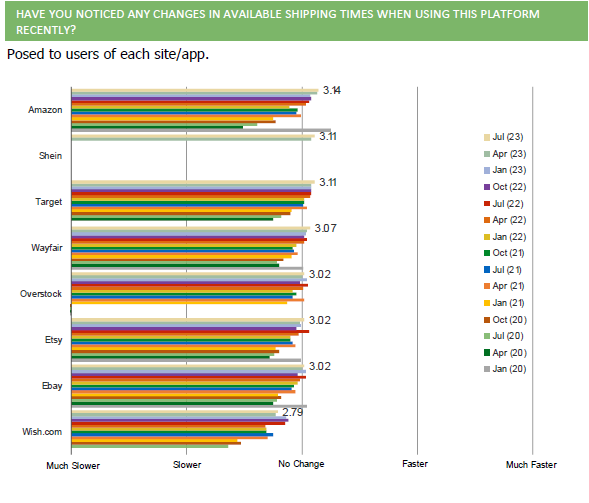

- All Platforms | Shipping time feedback.

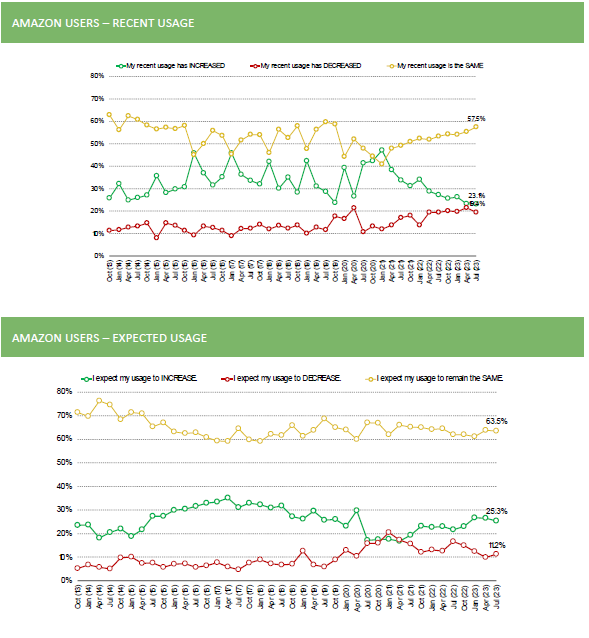

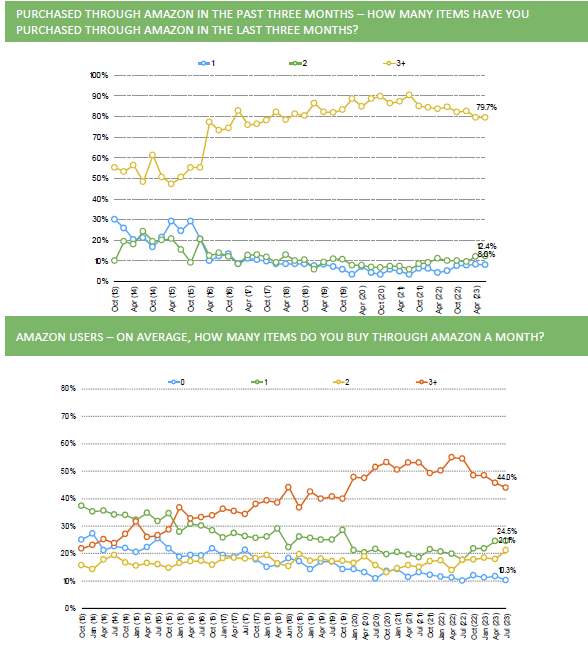

- AMZN / ETSY / W | Shopping engagement, number of items bought per month, mobile purchases, recent shopping feedback, expected shopping feedback, etc.

- W | Share of furniture items purchased from Wayfair, cross-shopping with Amazon for identical items, sentiment toward Amazon vs. Wayfair on pricing, selection, and visualization, comparing Wayfair to other online/in-person shopping experiences.

- All Platforms | Credit scores of each customer base.

Excerpt of Charts: