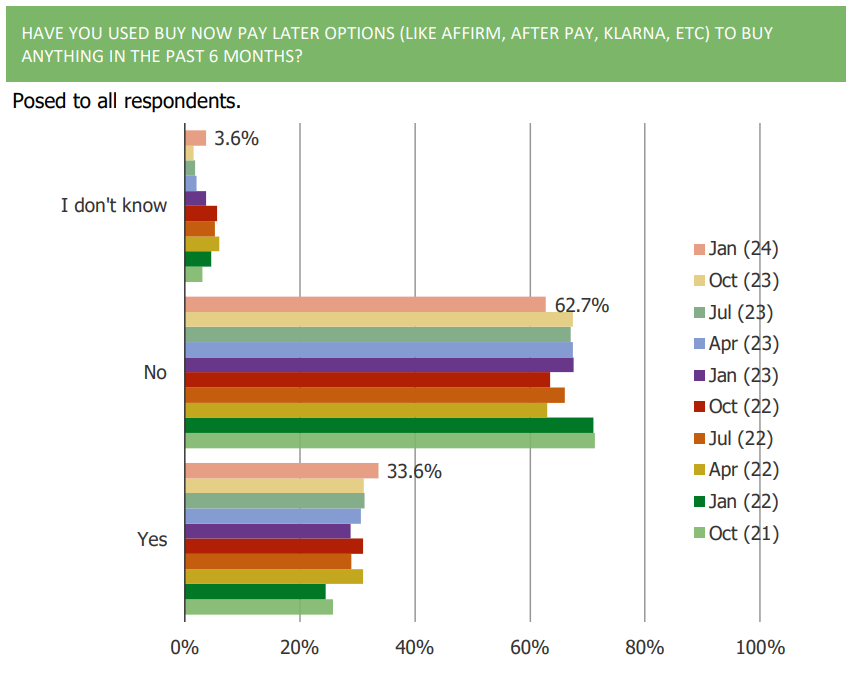

1. The share of consumer who have used BNPL options has increased q/q and sits at series highs.

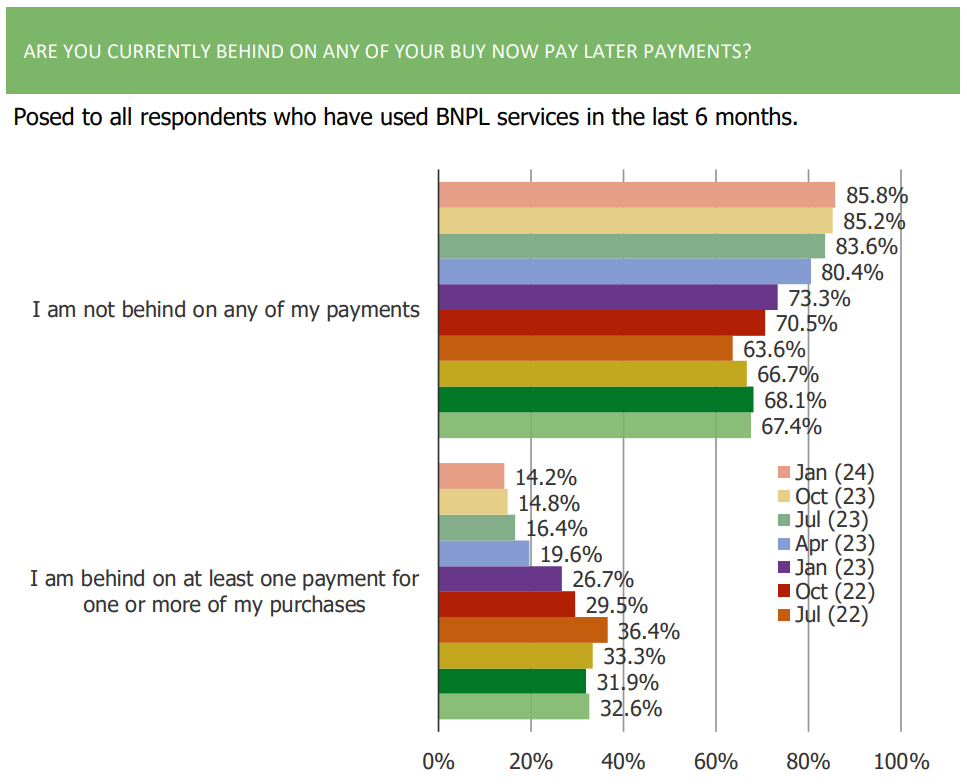

2. Delinquency rates on BNPL have improved slightly with over 85% saying they are not behind on payments.

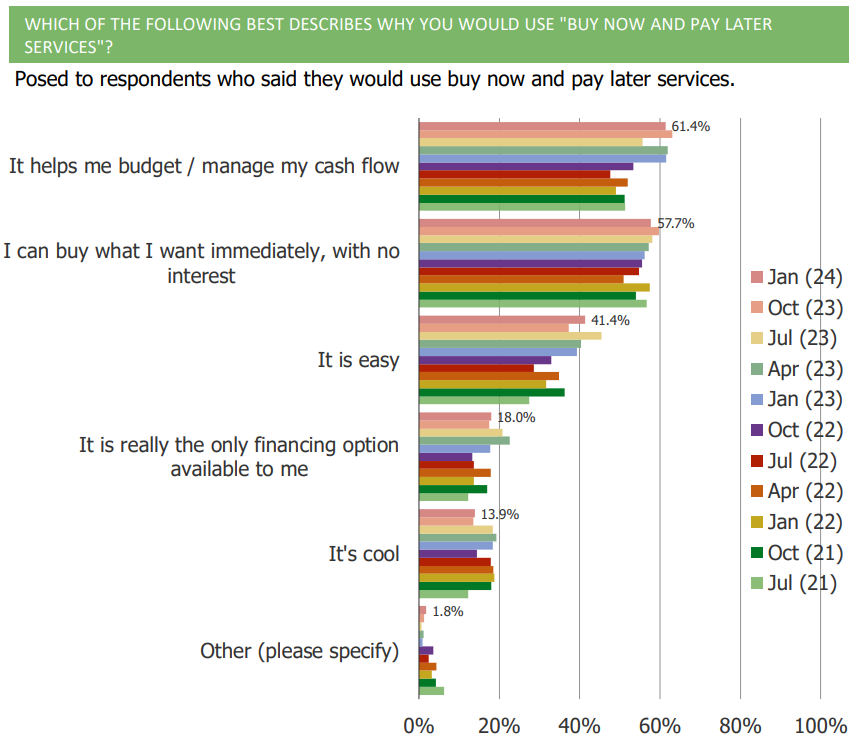

3. 61.4% of respondents note that they would use BNPL services because it would help them budget/manage their cash flows.

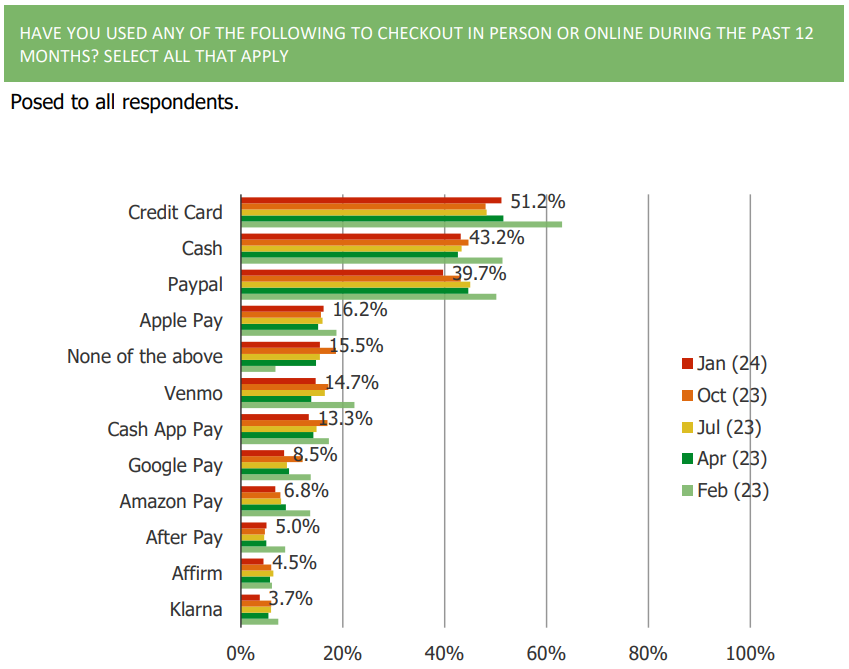

4. Overall, BNPL offering such as Affirm, Klarna, and AfterPay continue to lag far behind credit cards, Apple Pay, and cash in terms of usage.

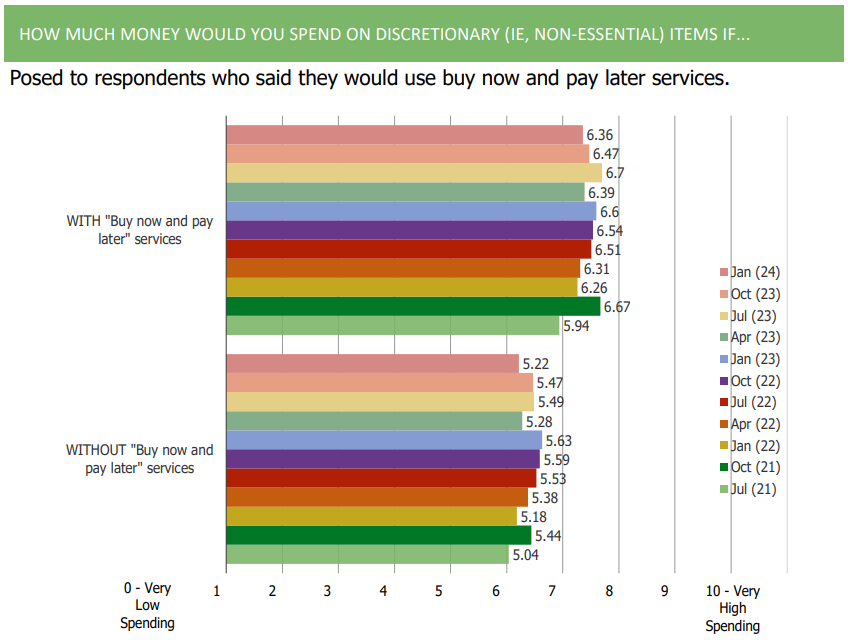

5. Consumers continue to note that they would increase their discretionary spending behavior with BNPL services vs. without.