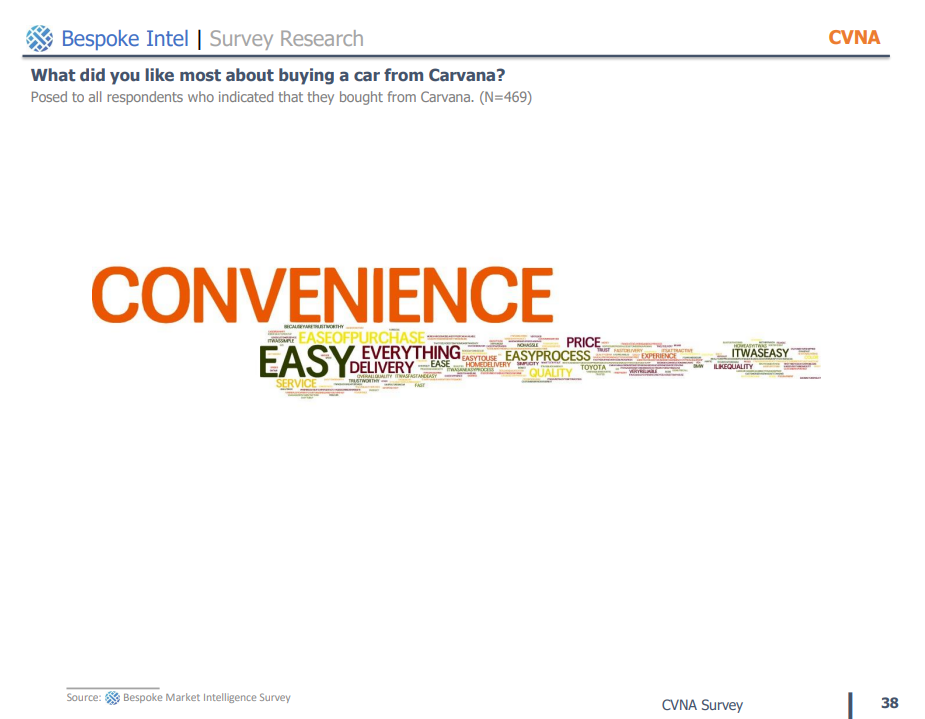

It would be putting it lightly to say that Carvana has been on quite a wild ride this year. In January, we published an article titled “Is Carvana Over? The Consumer Angle.” At the time the stock was trading at around $4.20 per share and there was serious concern that the company would have to file for bankruptcy. Since the time we published that article, Carvana’s stock rose to a high of $62.59 and is currently trading at around $53 per share. In the article we chose to take a different perspective from what we were seeing from the financial community at the time, and decided to deep dive into how customers actually felt about the company. We’ve continued to track consumer sentiment toward Carvana throughout the year by means of a 10,000N survey that we refresh quarterly, and if there’s one thing that we’ve come to realize, it’s that consumers really enjoy the Carvana experience. When it comes to competitive dynamics, Carvana ranked near or at the top in terms of things like pricing, selection, and overall trust, NPS for selling a car to CVNA has improved since January and currently sits at 58, which is a very strong score. NPS from those who bought from Carvana also improved and currently sits at a series high of 69.