On Tuesday, September 19 2023, Instacart became the first venture-backed tech company to IPO since 2021. The stock opened trading at $42 a share, 40% higher than $30 a share which was initially anticipated and closed out its first day of trading at $33.70 a share. Investor sentiment has been wary as market conditions have not been ideal for growth-heavy tech companies.

Here at Bespoke, we published a survey and did some cross-tab work on CART consumers to see how the grocery delivery service is viewed through the lens of a customer. Sharing some key takeaways below..

Findings:

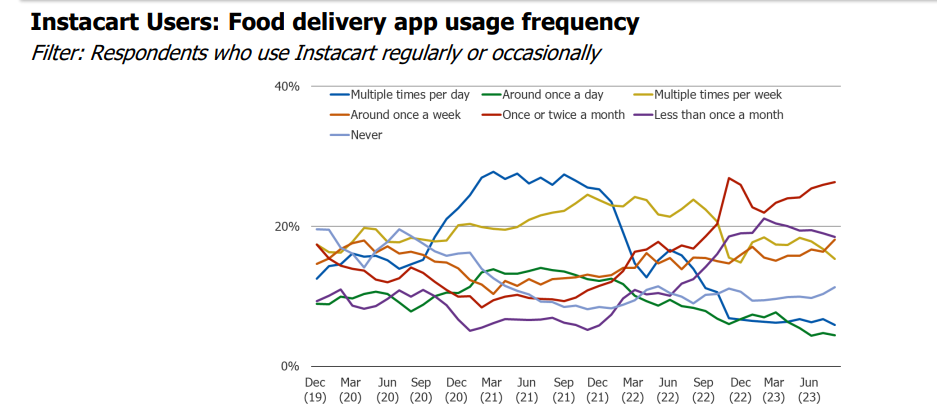

- Instacart usage surged higher during the pandemic. Since peak engagement , the share of respondents who use the service on a regular basis has regressed back to pre-covid levels. The share of consumers who state that they use it on an occasional basis, similarly surged higher during the pandemic, but has held more or less steady since.

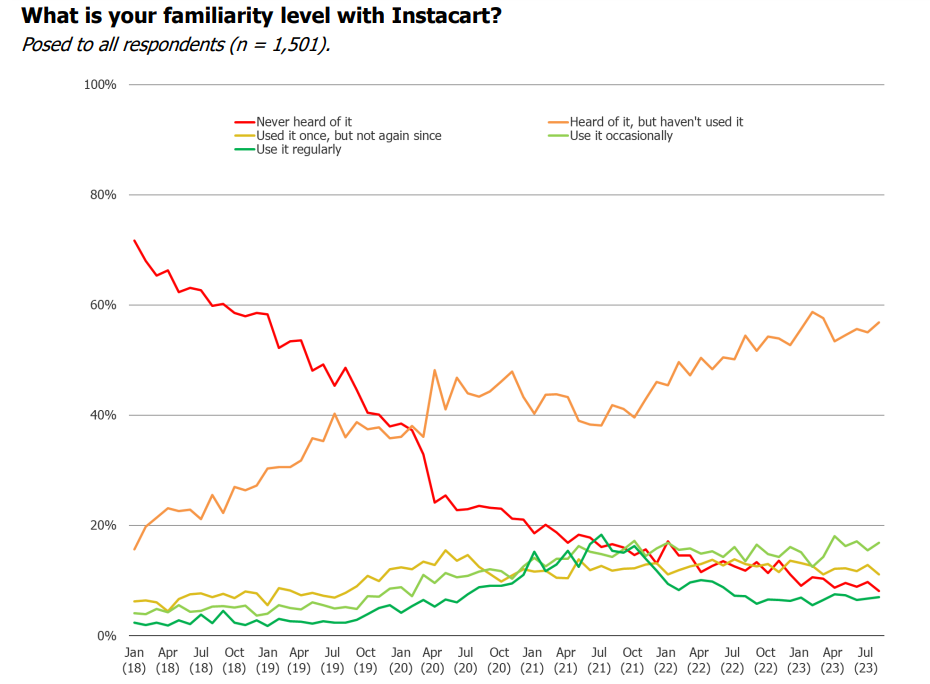

- Overall awareness of Instacart has increased considerably since January of 2018

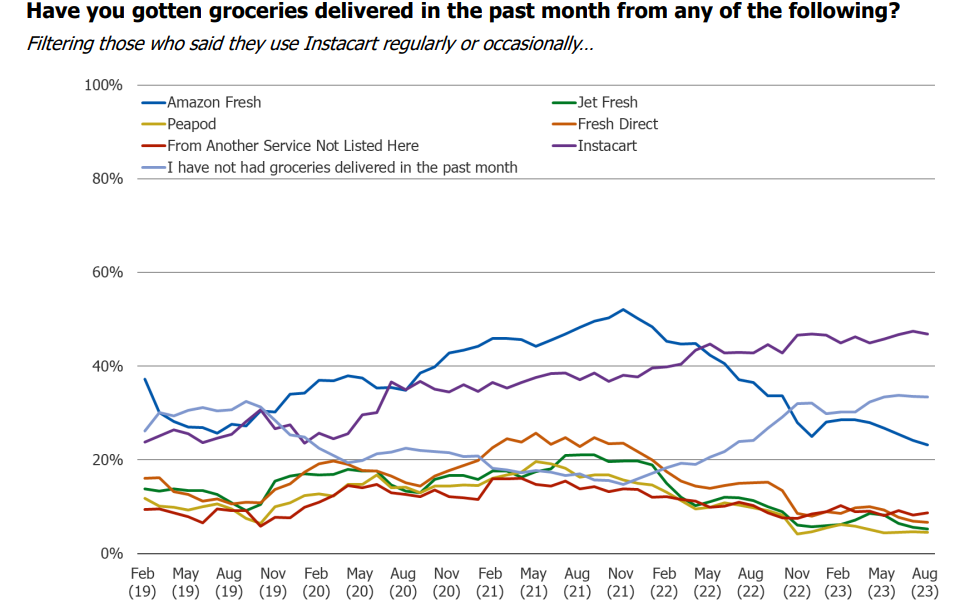

- Instacart users have been less likely to order from Amazon Prime since the beginning of 2022 (monthly usage of Instacart has increased slowly over time). That said, the share of Instacart users who did not have groceries delivered at any point in the past month has increased during the same time period.

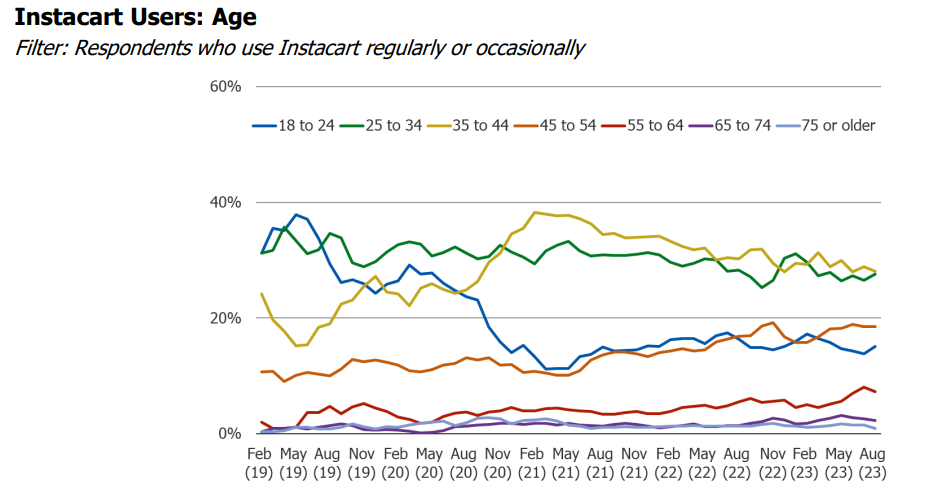

- During the pandemic, Instacart user demographics shifted towards being more male than female and older cohorts adopted usage in a major way, as did higher income bands.

Excerpt of Charts: