Each quarter we run a survey tracking consumer trends within the fitness industry. In the latest wave of the survey, we did tons of deep-dive work on Peloton to better understand their customer demographics and how consumers view the company.

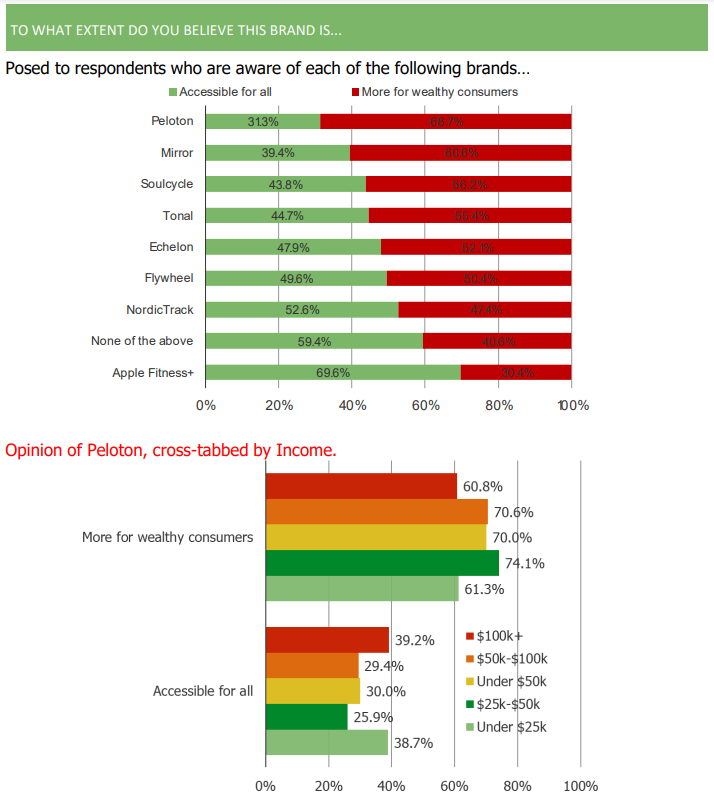

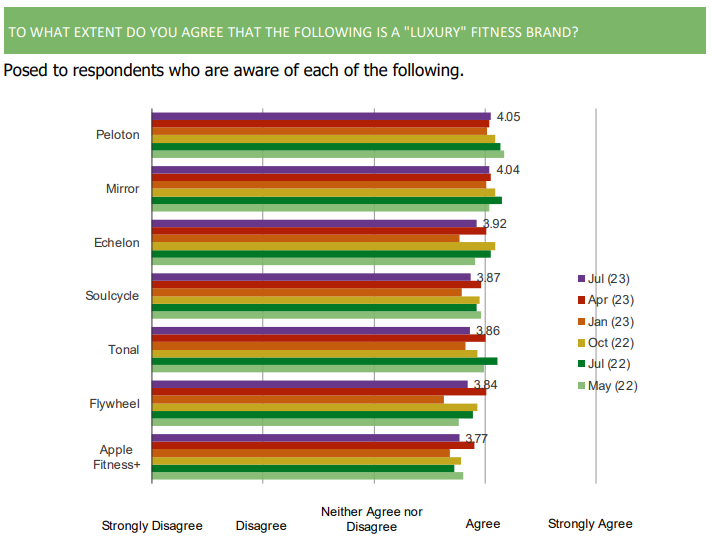

Of all of the fitness brands that we tested in the survey, Peloton was the most likely to be viewed as “more for wealthy consumers” as opposed to “accessible for all.” To add to this, there is a significant level of divergence in how Peloton is viewed by existing customers and how the broader pool of consumers view the company. Existing customers see Peloton as a high quality, luxury fitness brand while the majority of the broader consumer population sees it as just an expensive fitness trend. That being said, over the course of the survey there has been some degree of gradual decline in the share of consumers who view the company as a “luxury” brand.

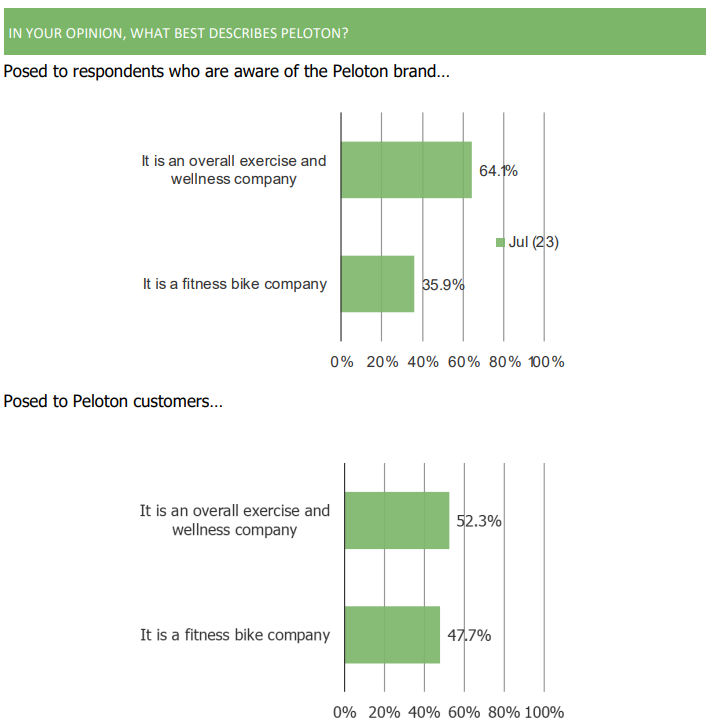

The share of consumers who are aware of Peloton but do not own any products from them are more likely to view Peloton as an overall fitness and wellness company, as opposed to just a fitness bike company. Among consumers that do not currently own any Peloton equipment but are considering buying some, an increasing share expressed interest in purchasing the bike while a declining share expressed interest in the tread. Overall fitness product interest is on the upswing after reaching a series low in October of 2022. The data isn’t where it was during Covid, but has improved relative to recent history.

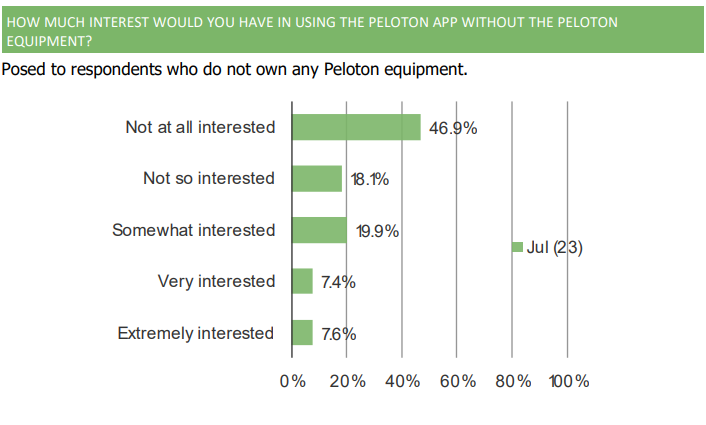

Back in May, Peloton announced a brand relaunch that included revamping their app by adding a tiered subscription feature. Peloton encouraged people to use the app even if they did not own Peloton products, so we asked consumers how interested they’d be in using the Peloton app without owning any of the equipment. We set a baseline level of interest in the share of non-Peloton equipment owners and found that around 15% of these respondents would either be “interested” or “very interested” in using the app despite not owning any equipment. Of the cohort of consumers that does own Peloton equipment, the share of them that only use the Peloton app has increased in recent quarters.