Survey data suggests AI-assisted shoppers behave very differently from the average car buyer.

Across nearly 10,000 respondents and a focused subsample of 438 Carvana buyers, we asked a series of questions about the role AI chatbots play in everyday use, car-shopping research, and willingness to rely on an AI “car concierge.” The results show a clear divide between the general population and Carvana’s customer base—one that points toward a higher comfort level with digital tools among online auto purchasers.

Carvana Customers Are Heavy AI Users

While 43.7% of the general population says they never use AI chatbots, only 11.4% of Carvana customers say the same. Instead, AI usage skews heavily toward the high end for Carvana buyers:

- 29.5% use AI very frequently

- 26.5% use AI frequently

- 25.8% use AI occasionally

This concentration of frequent usage suggests that the typical online auto buyer is materially more AI-engaged than the broader consumer base.

AI Is Already Being Used for Car Research — Especially Among Carvana Buyers

Across all respondents, usage of AI for car research is still early:

- 79.5% have not used AI chatbots for car research

- 12.1% have used AI for researching types of cars

- 8.4% for researching where to buy a car

But among Carvana customers, the pattern flips:

- Only 32.2% have not used AI for car research

- 47.0% have used AI for researching types of cars

- 20.8% for researching where to buy a car

This shows that nearly two-thirds of Carvana buyers have already incorporated AI into their auto research process.

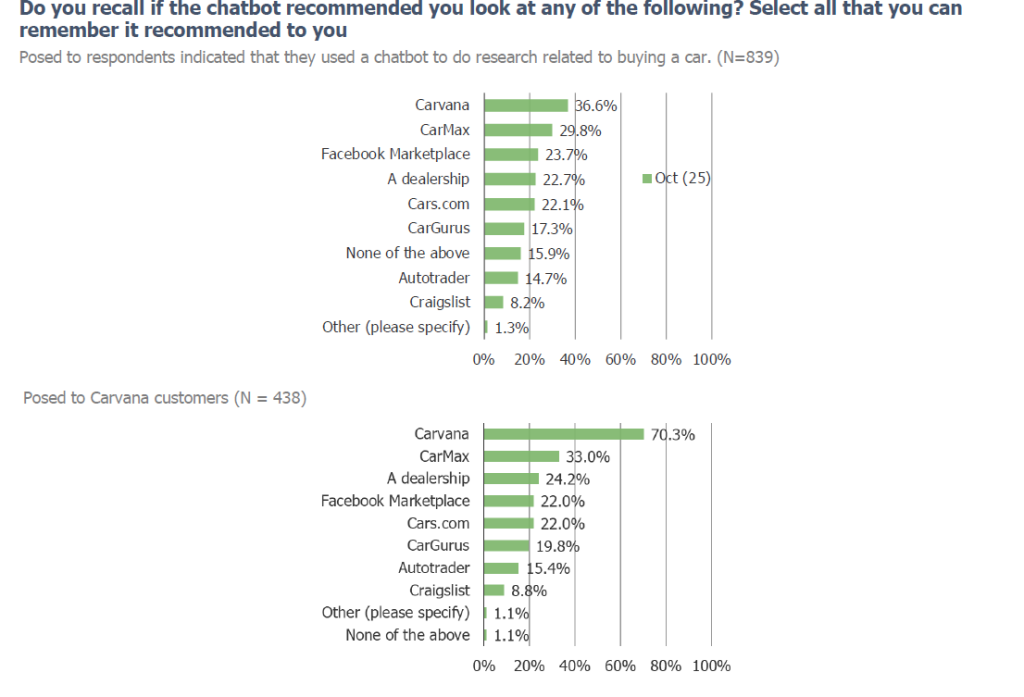

When AI Gives Recommendations, Carvana Wins More Often

Among all shoppers who used AI for car research, 36.6% recall being recommended Carvana—ranking ahead of CarMax and traditional marketplaces.

Among Carvana customers, recall is even stronger:

70.3% say the chatbot recommended Carvana.

While this does not measure causality, it does show that AI tools surface Carvana prominently to a segment of shoppers who ultimately purchased there.

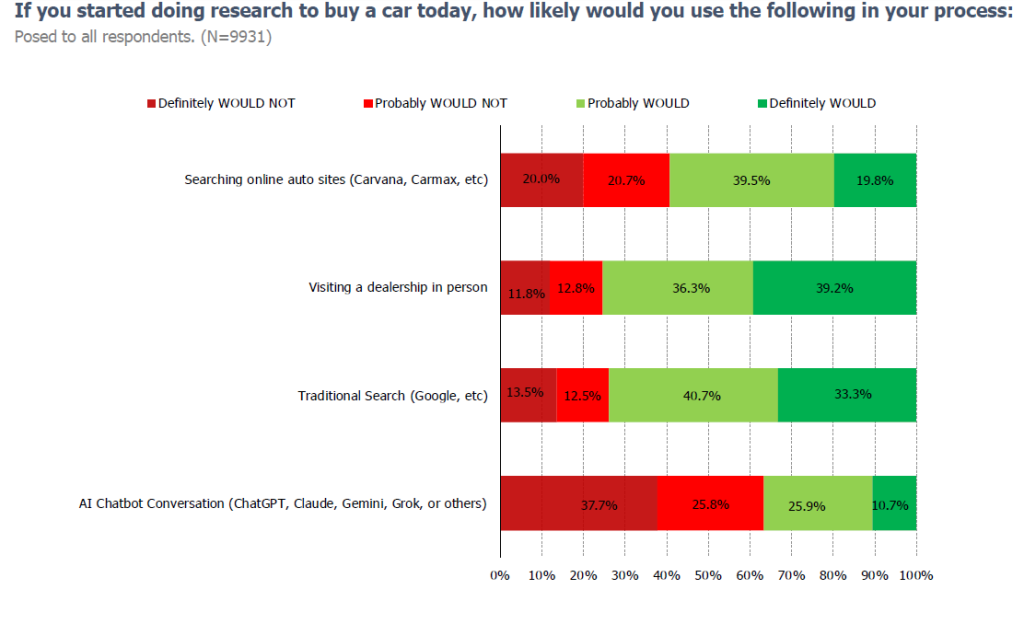

AI Is Less Likely to Be Used Today Than Traditional Search—but a Non-Trivial Share Would Still Use It

When all respondents are asked how likely they would be to use different tools if starting car research today:

- 74.0% would probably or definitely use traditional search

- 59.3% would probably or definitely use online auto sites

- 56.1% would probably or definitely visit a dealership

- 36.6% would probably or definitely use an AI chatbot

AI is behind other channels, but more than one-third of consumers say they’d consider it—striking for a tool that only recently entered the research workflow.

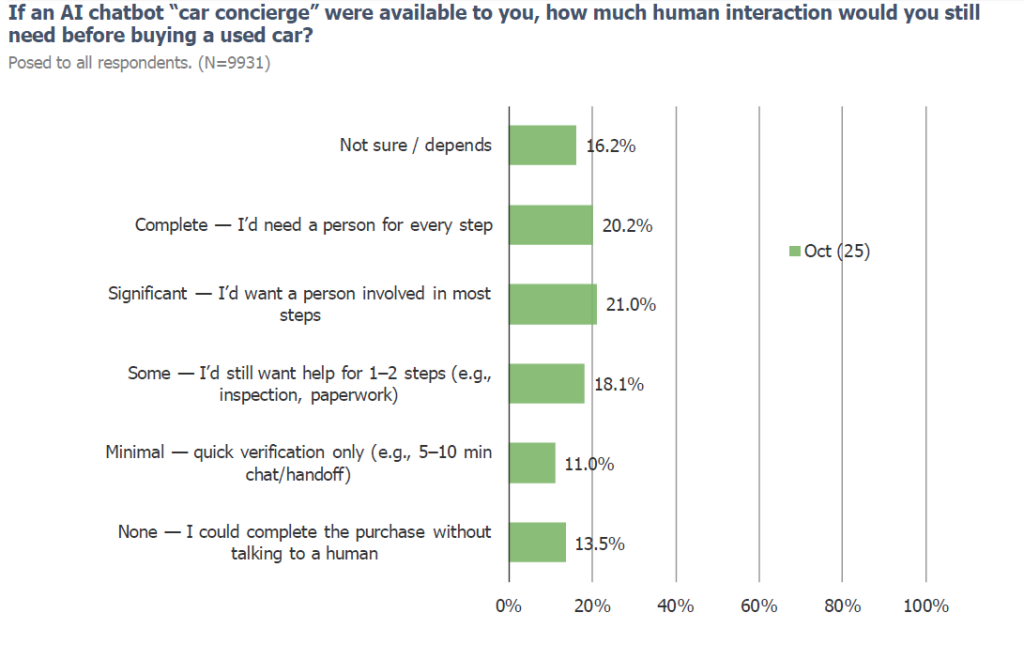

A Meaningful Minority Is Open to Minimal Human Involvement with an AI “Car Concierge”

When asked how much human interaction they’d need if an AI concierge were available:

- 11.0% say they would need only minimal verification (e.g., 5–10 min chat)

- 13.5% say they could complete the purchase with no human interaction

- 18.1% say they’d need help for only 1–2 steps

Taken together, roughly 42% of respondents could envision a purchasing path with limited or zero human involvement if AI guidance were available.

This does not imply immediate behavioral change—but it signals that a measurable portion of consumers already view AI as capable of handling most of the purchase journey.