Blog

Bespoke Survey Insights

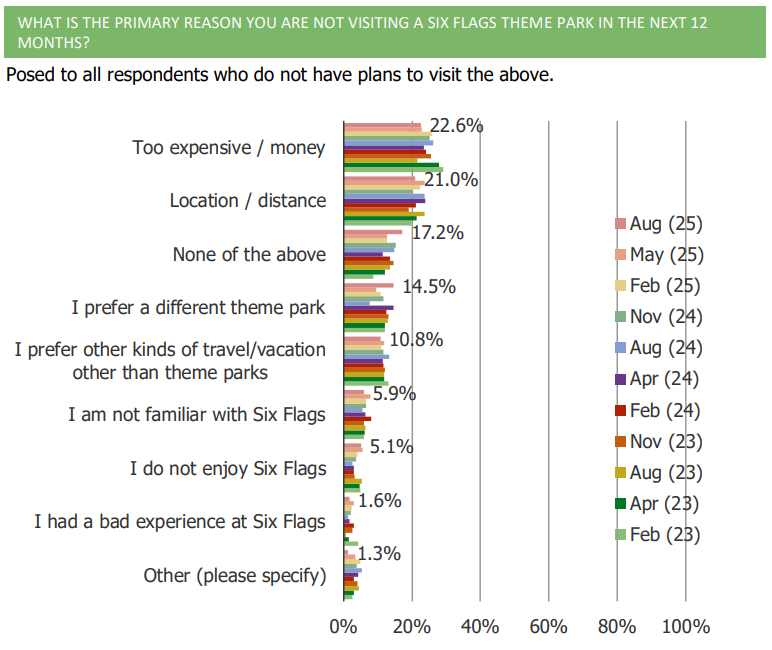

Cost Concerns Around Six Flags Theme Park Visits

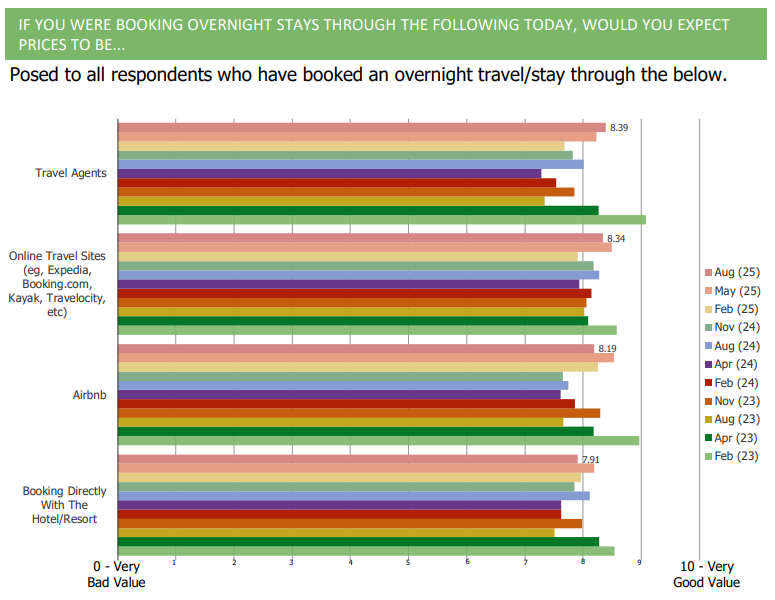

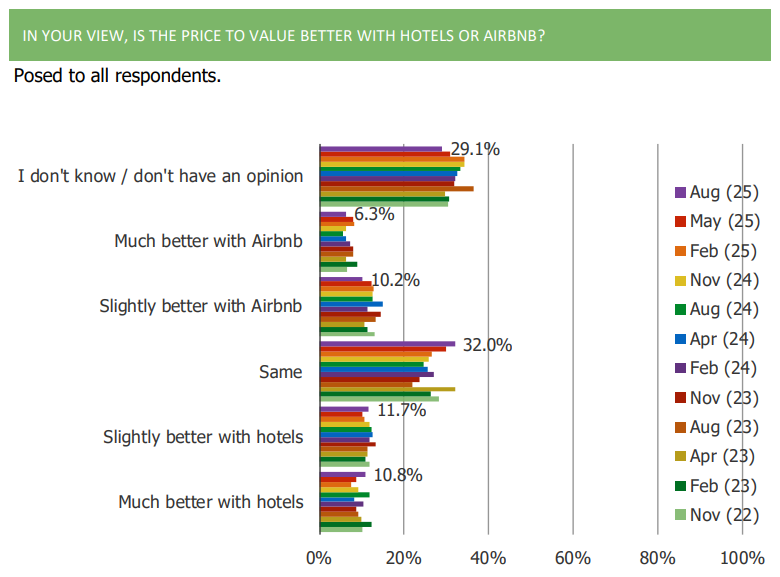

Airbnb Pricing

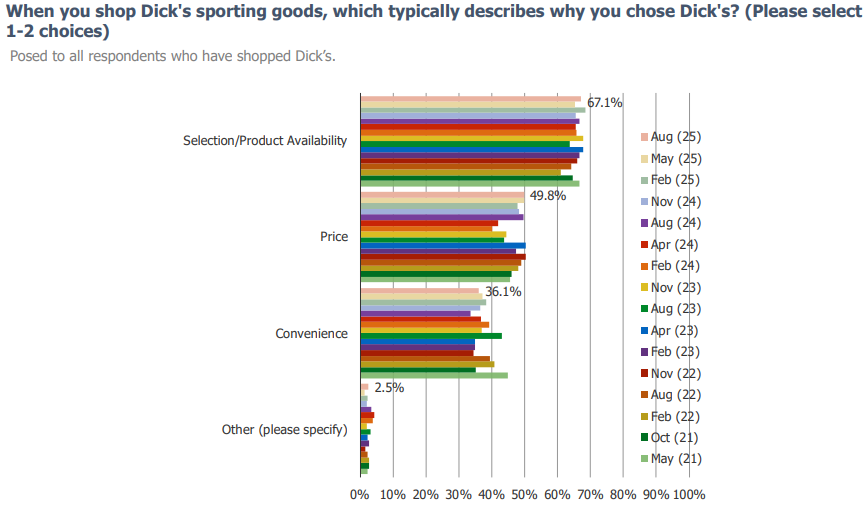

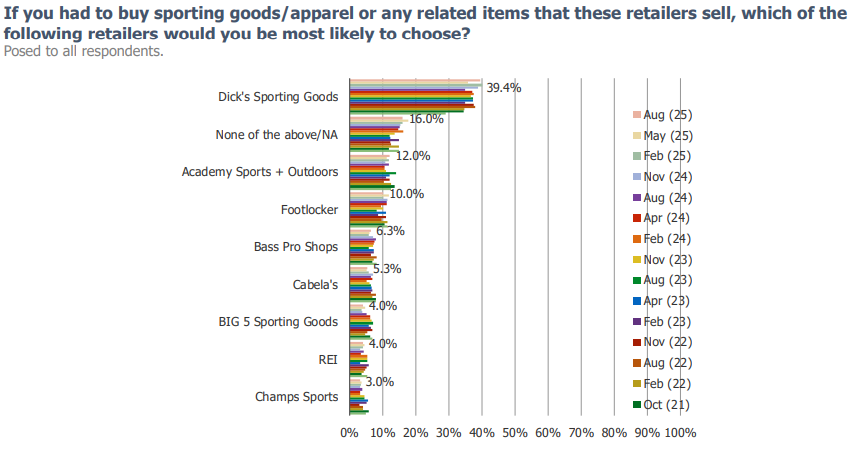

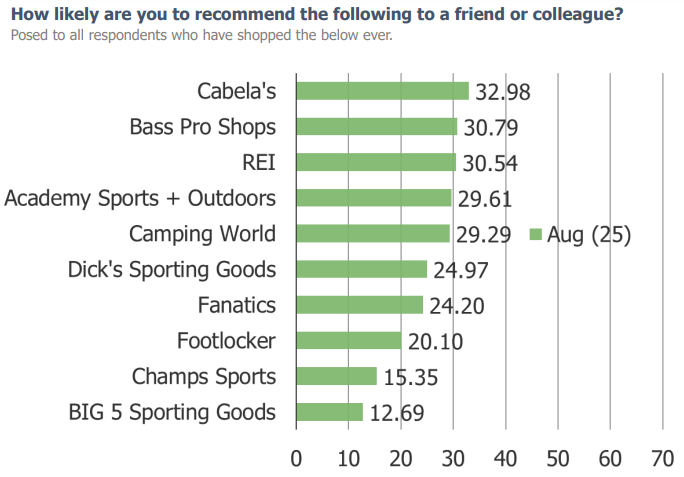

Consumer Attitudes Towards Dick’s Sporting Goods

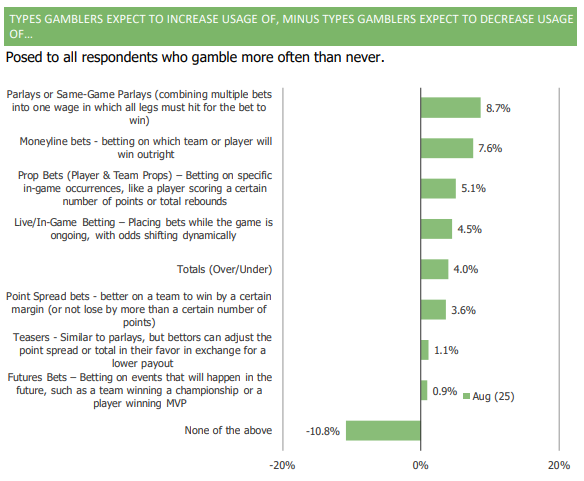

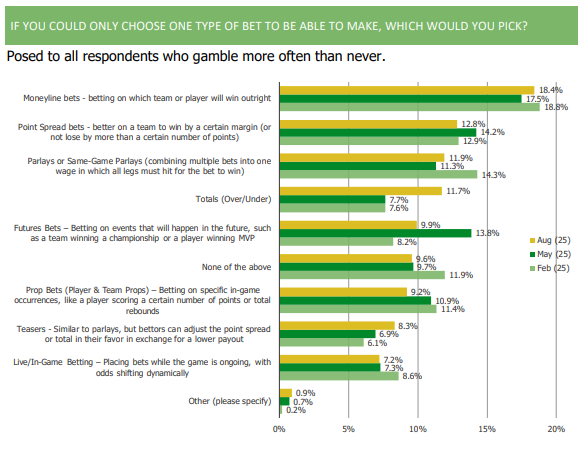

Parlays and Sports Betting

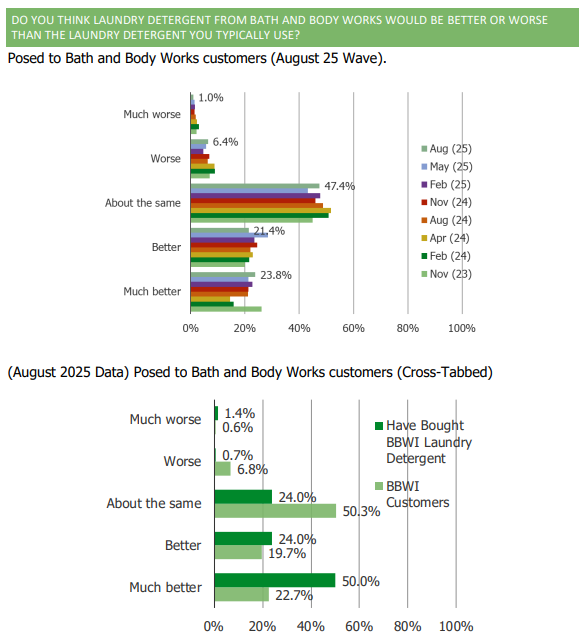

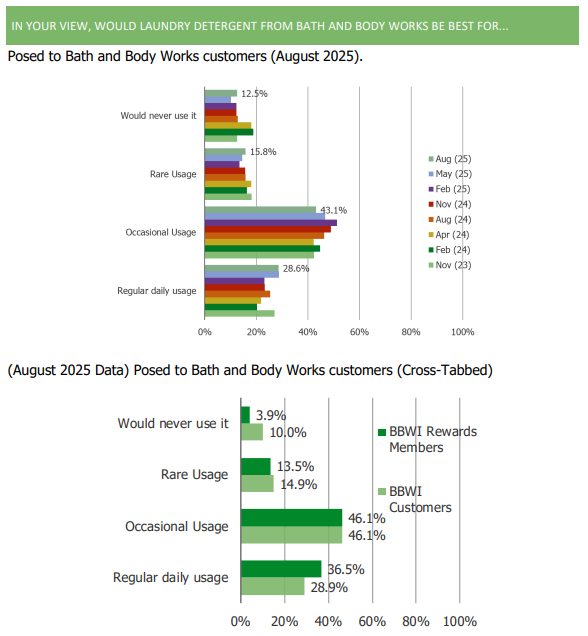

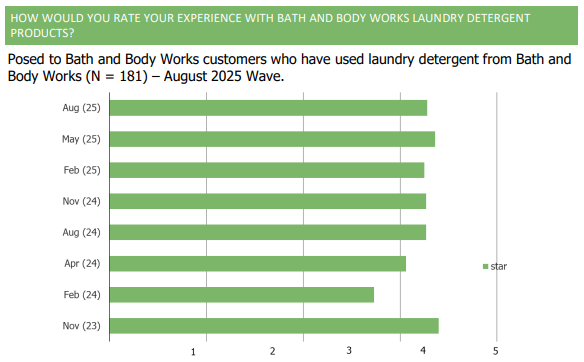

Bath and Body Works Laundry Detergent

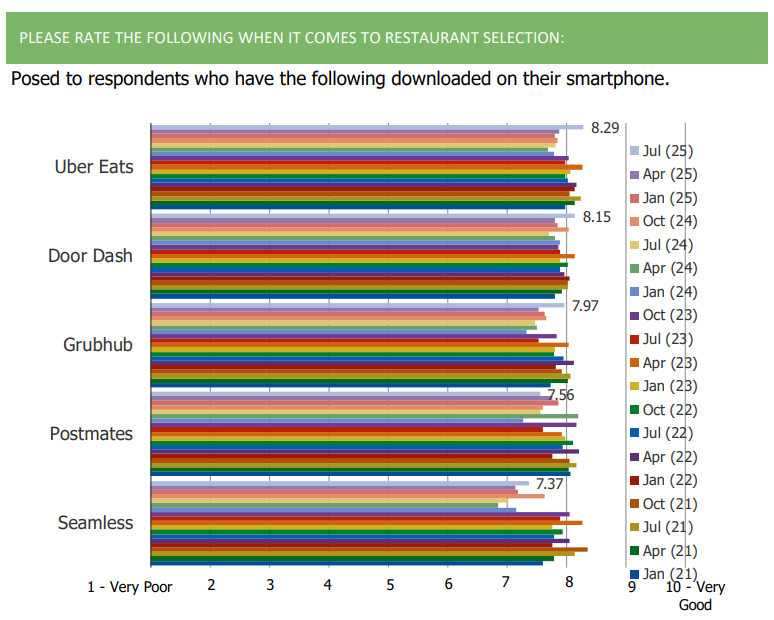

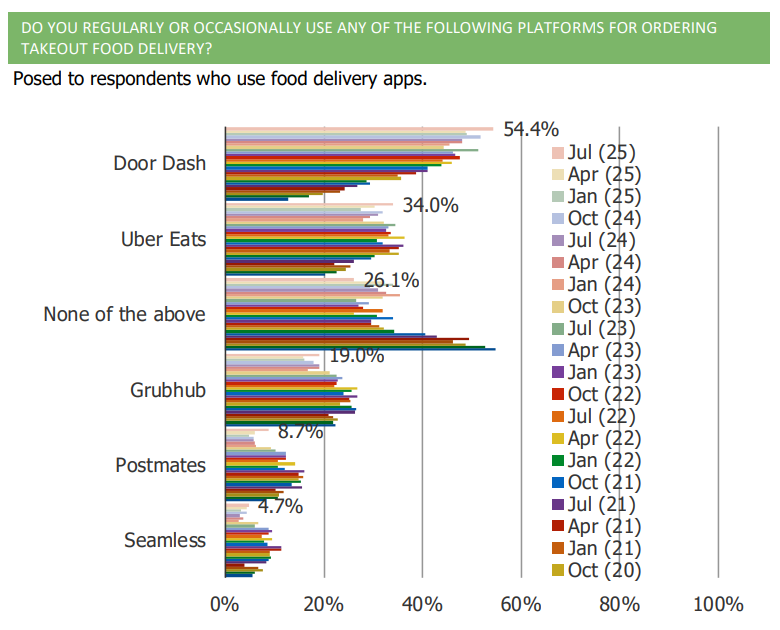

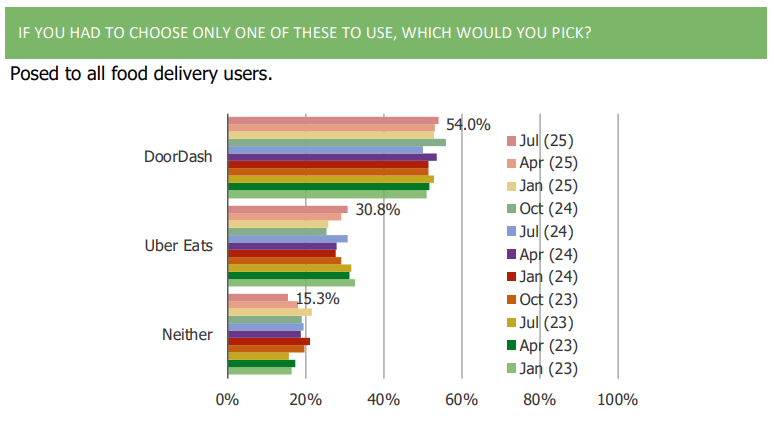

DoorDash vs. Uber Eats

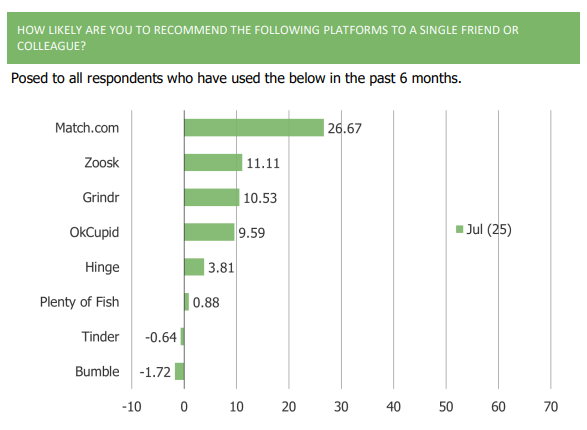

Bumble Consumer Perceptions

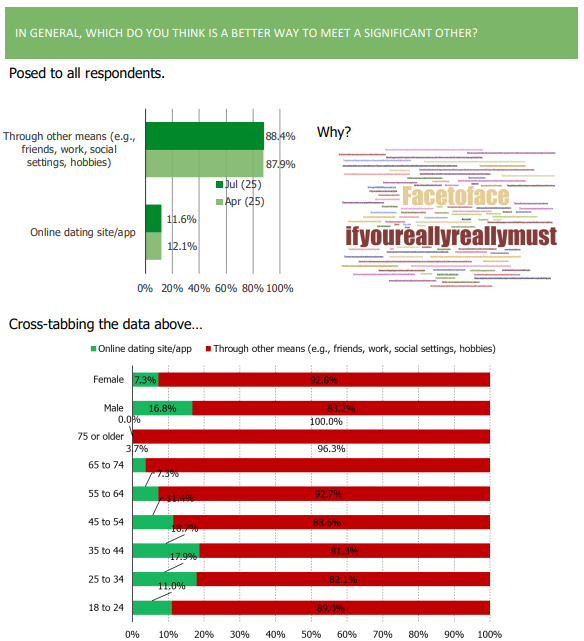

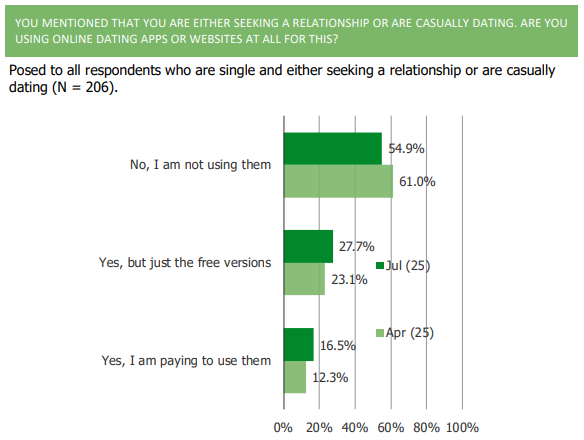

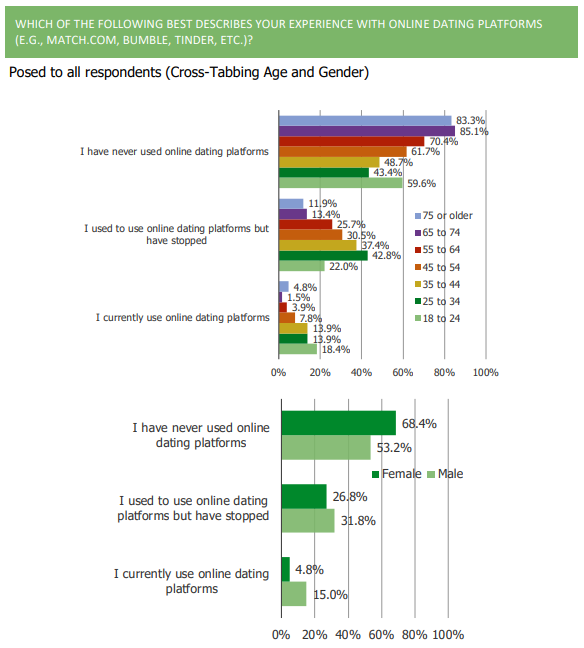

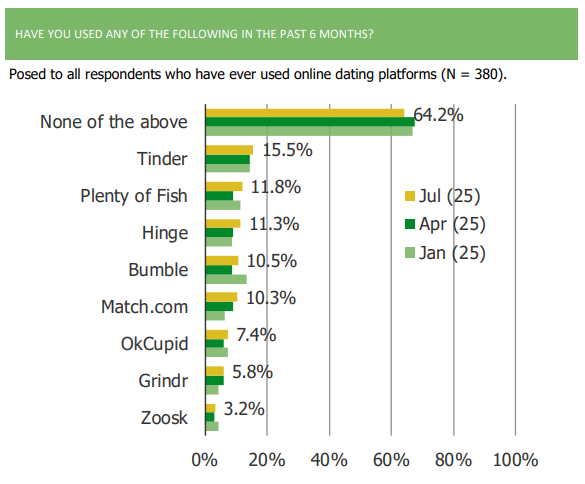

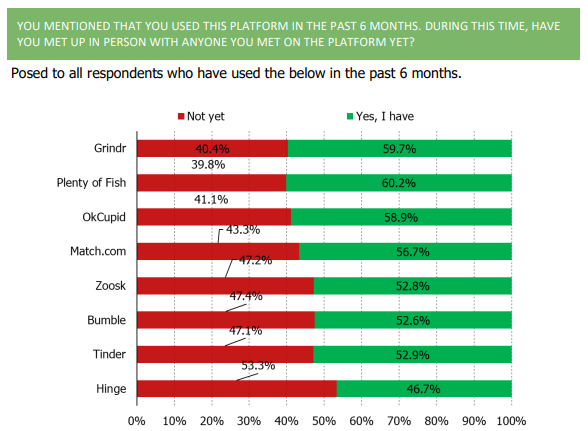

Consumer Attitudes Towards Online Dating

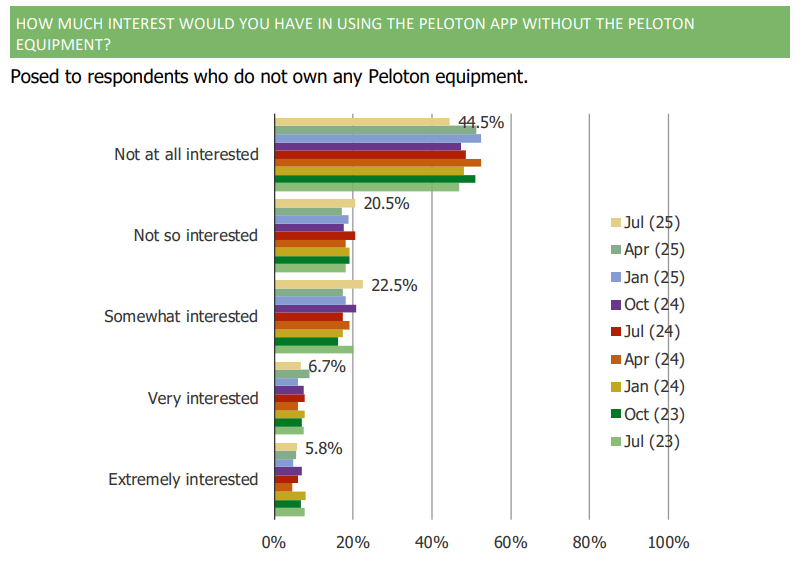

Peloton App Interest

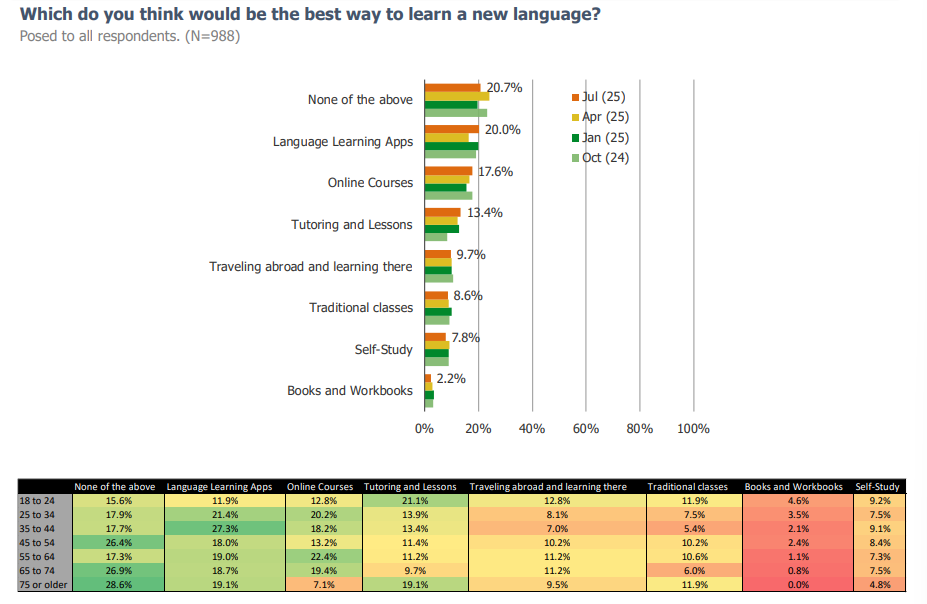

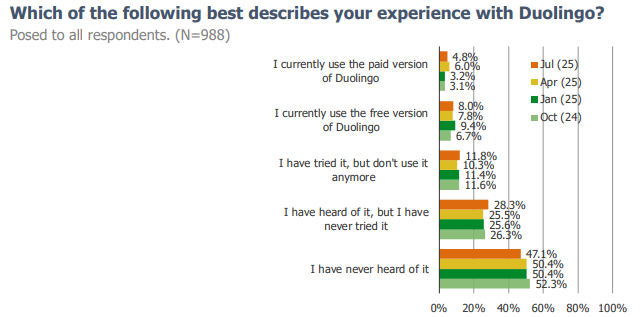

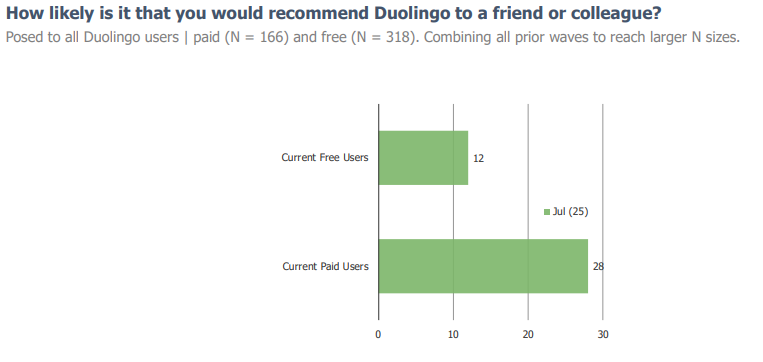

Consumer Views of Duolingo

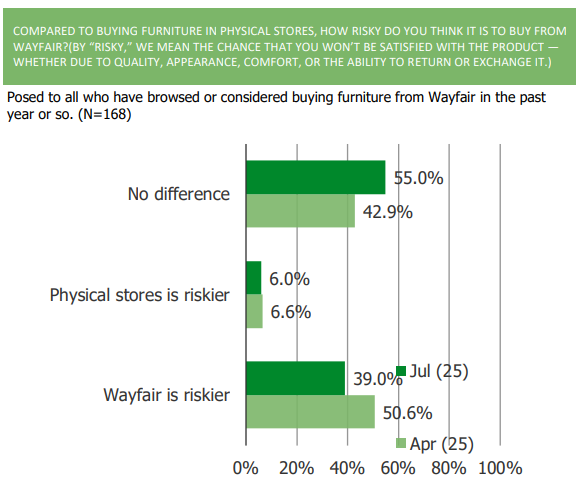

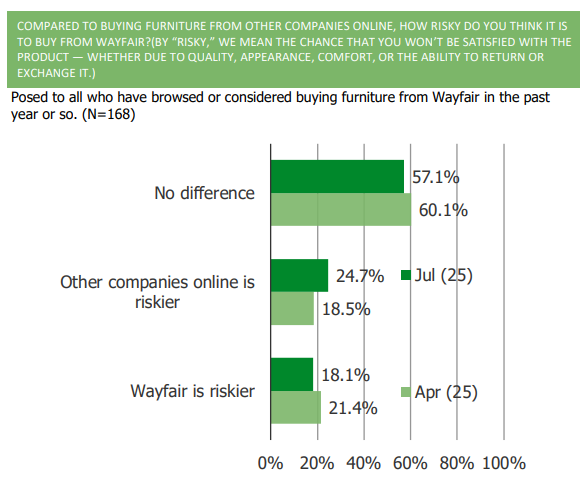

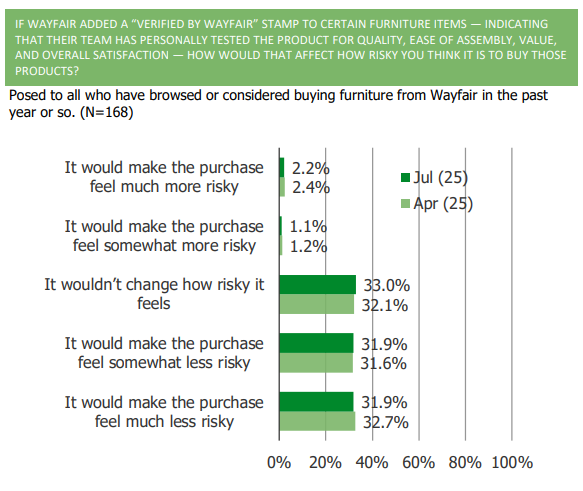

Wayfair Verified Products

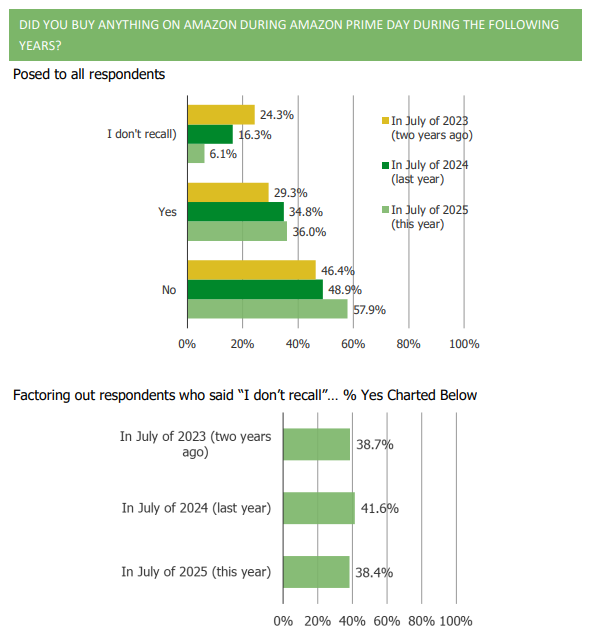

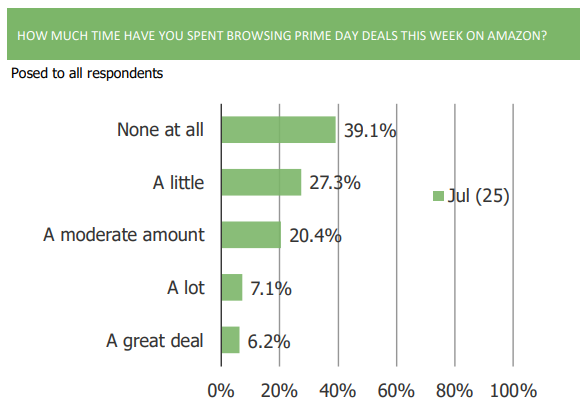

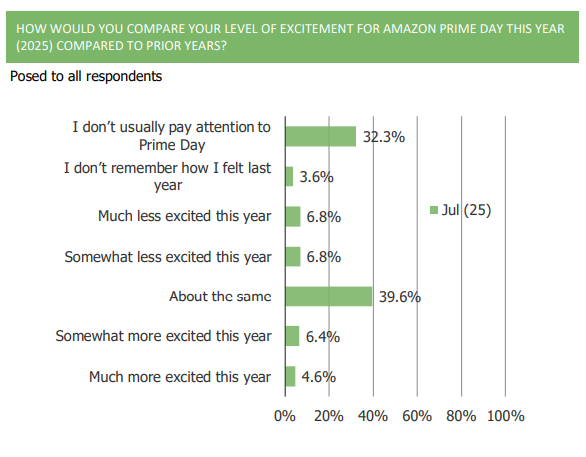

Amazon Prime Day 2025