Blog

Bespoke Survey Insights

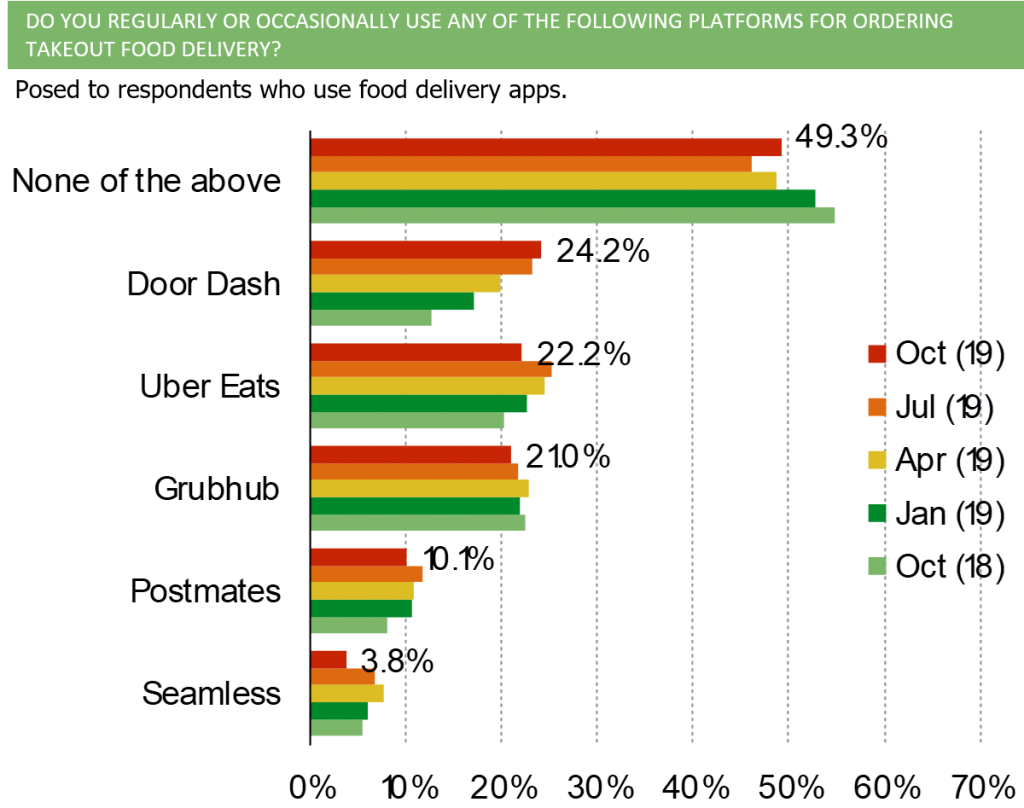

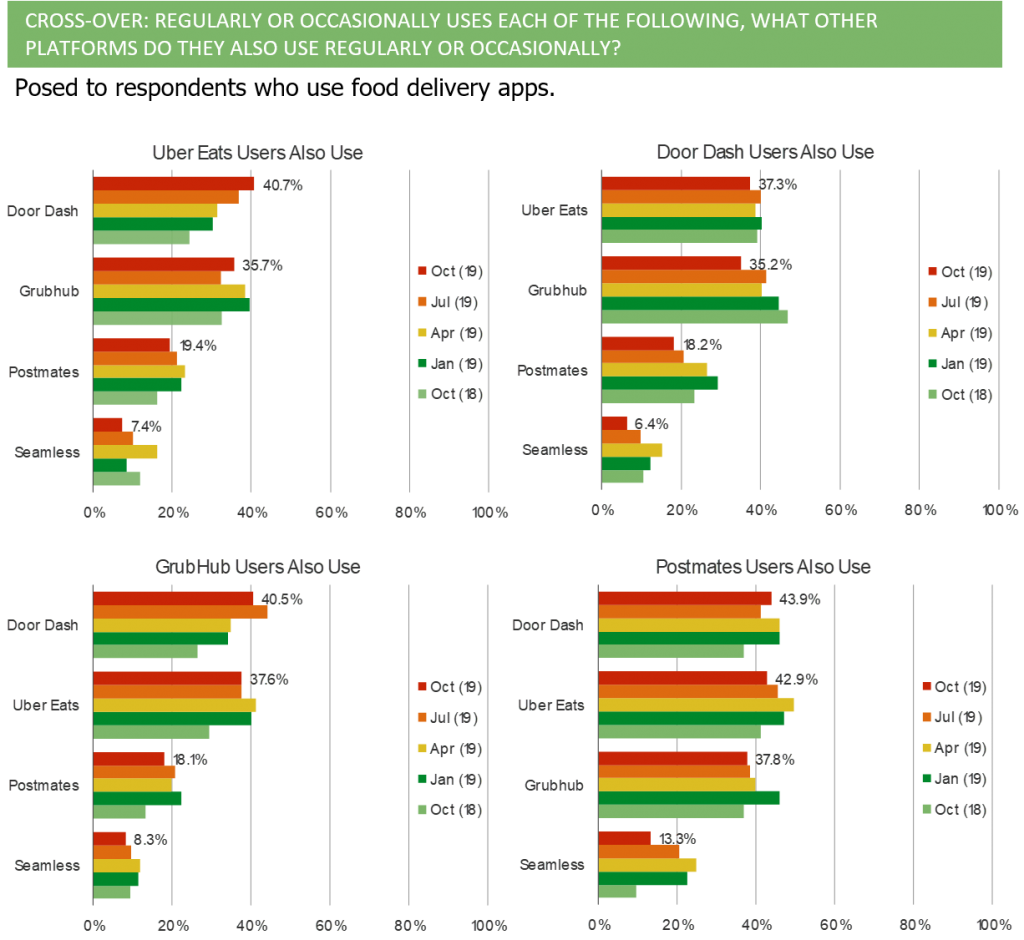

DoorDash Dominating

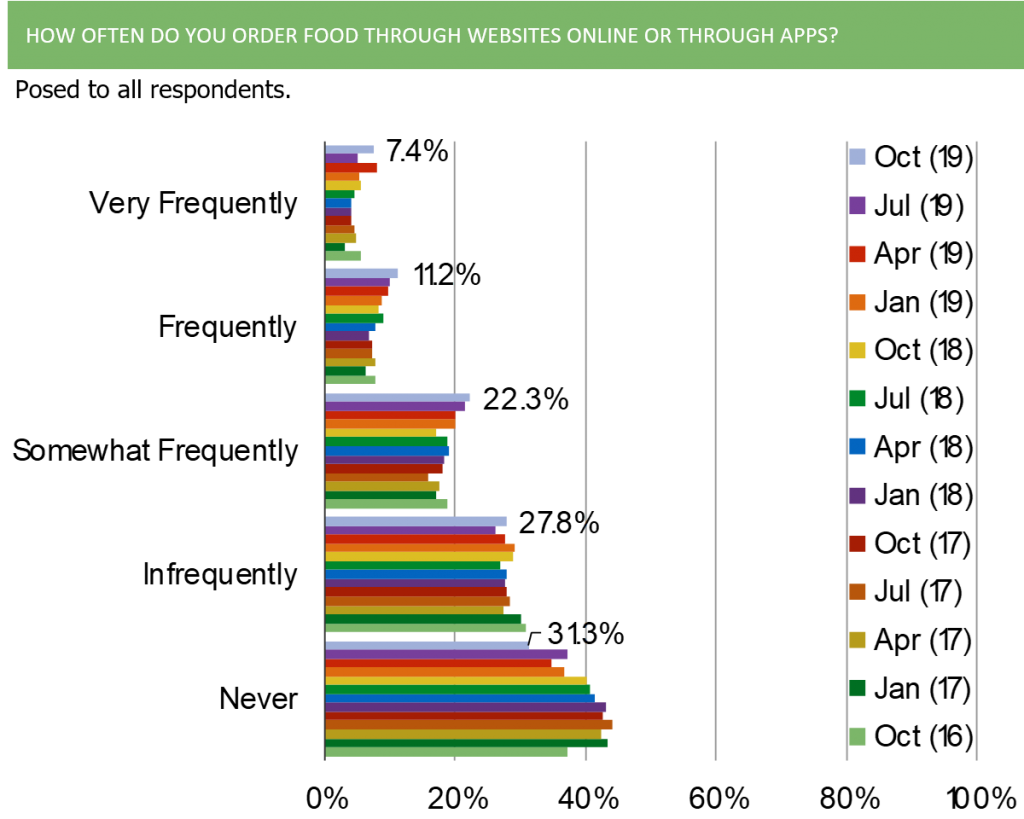

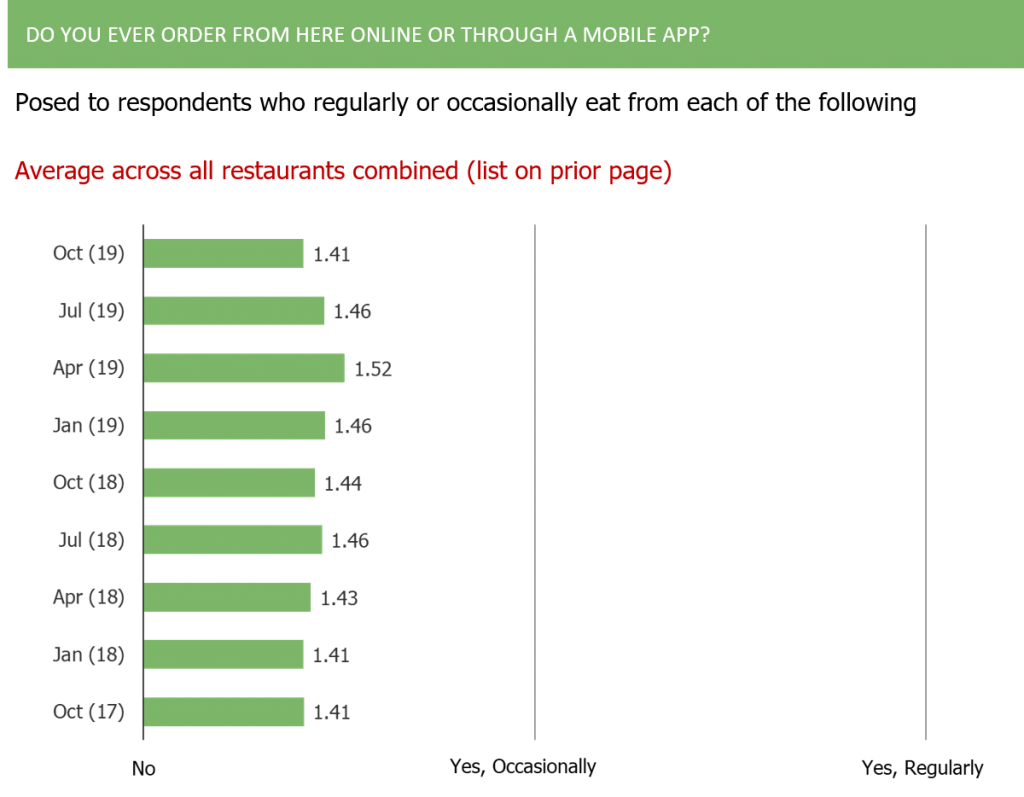

Third party delivery apps have come more into buyside focus recently. The disruption being brought to the space will create inflection points for winners and losers. We have useful insights with history on casual dining, third party delivery, meal kits, grocery delivery, etc. One of the bigger changes we’ve noticed in our data DoorDash’s quick ascent in our charts. Flagging it below as just a small slice of our interesting primary research on the space.

With this increase in usage of third party food delivery apps we’ve seen a large uptick in interest in scoping how this is/will impact DPZ. The data we have on DPZ and third party food delivery apps is a great example of how powerful primary research can be at providing a deeper understanding of a situation than other investors might have at the moment. If you would like to discuss any of this with us please let us know! ([email protected] or 914-630-0512).

SNAP India

Use cases for social media platforms in India vary greatly. Below is a rundown of what account holders with each platform use it for.

The word clouds below serve as an interesting excerpt from our detailed survey of social media trends in India. If you are interested in our primary research on this topic, please let us know ([email protected]).

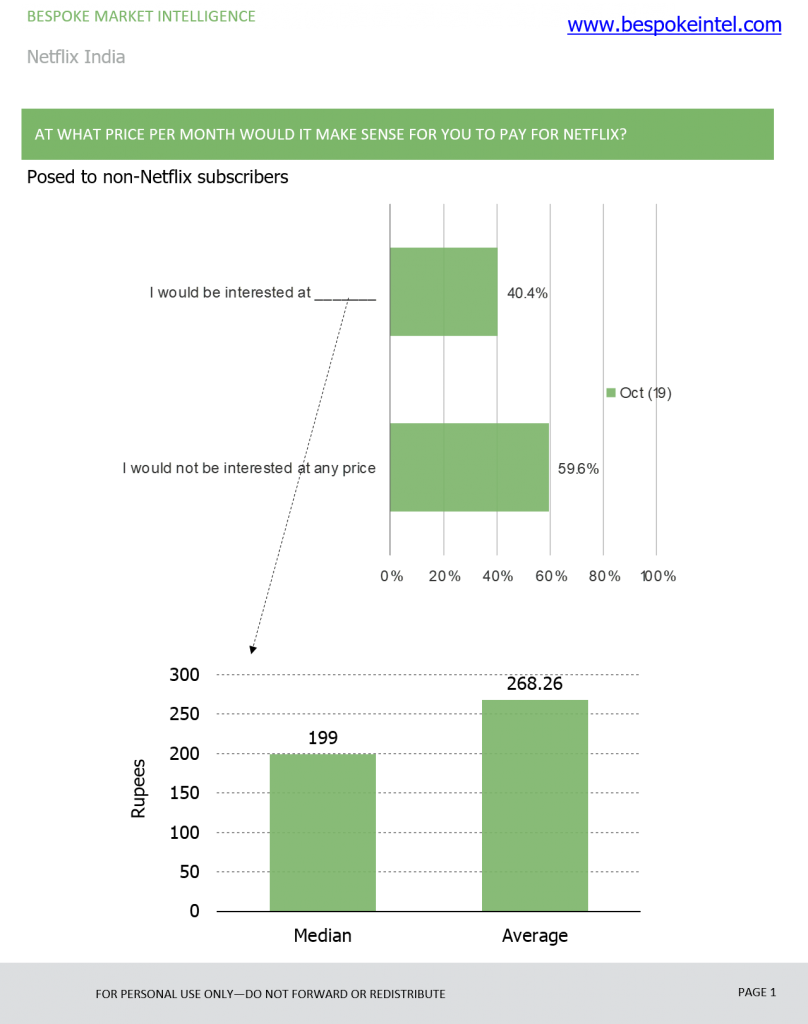

NFLX India – Interest In Signing Up

With increasing competition in the US putting NFLX under pressure, investors are spending a lot of time focusing on the international landscape. India is a battleground that seems to be of interest at the moment, so we decided to launch coverage of NFLX in India to go along with our existing survey deep dives in the US (27 quarterly volumes) and UK (15 quarterly volumes).

This is only a small slice of our data, but it is interesting nonetheless. 40.4% of non-subscribers would be interested in a paid subscription. The median price they would be willing to pay is Rs 199. That is the exact price that Netflix chose for its mobile only plan released in India this year.

In addition to being an interesting data point, these results make a good argument for why using survey data is important. It is no coincidence that Netflix chose the exact price point that would appeal to the median non-subscriber. They likely ran survey like this one their own! By seeing the rest of our insights in our full report, you will be armed with the types of insights companies you invest in likely use.

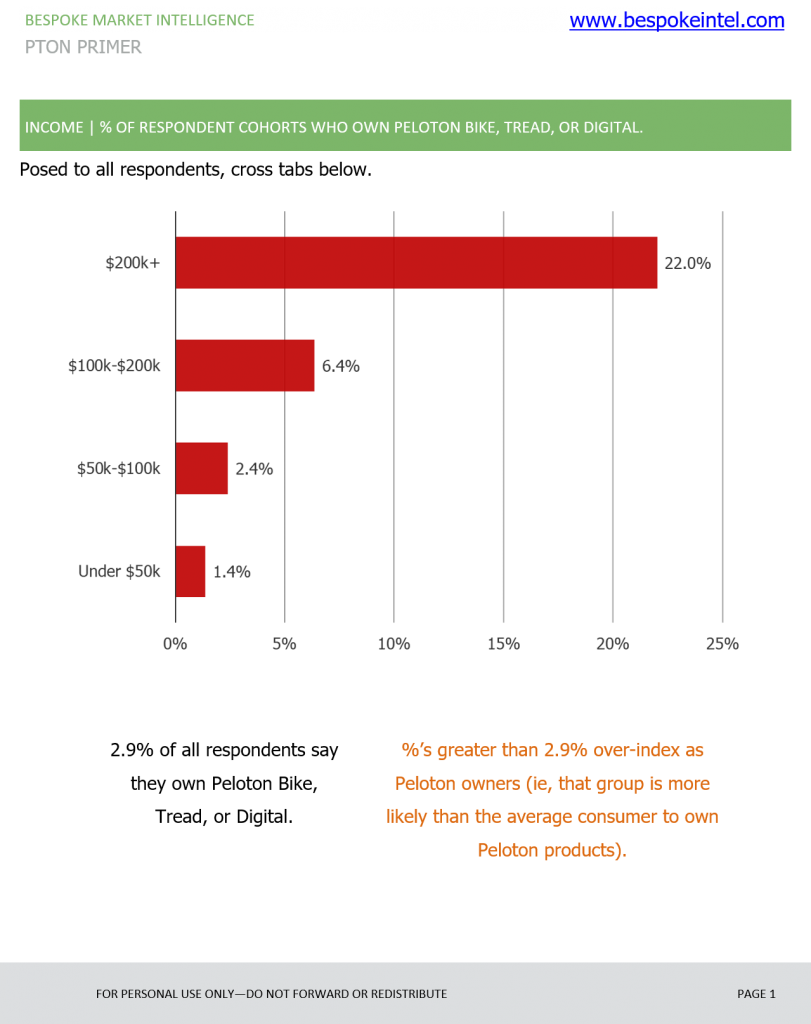

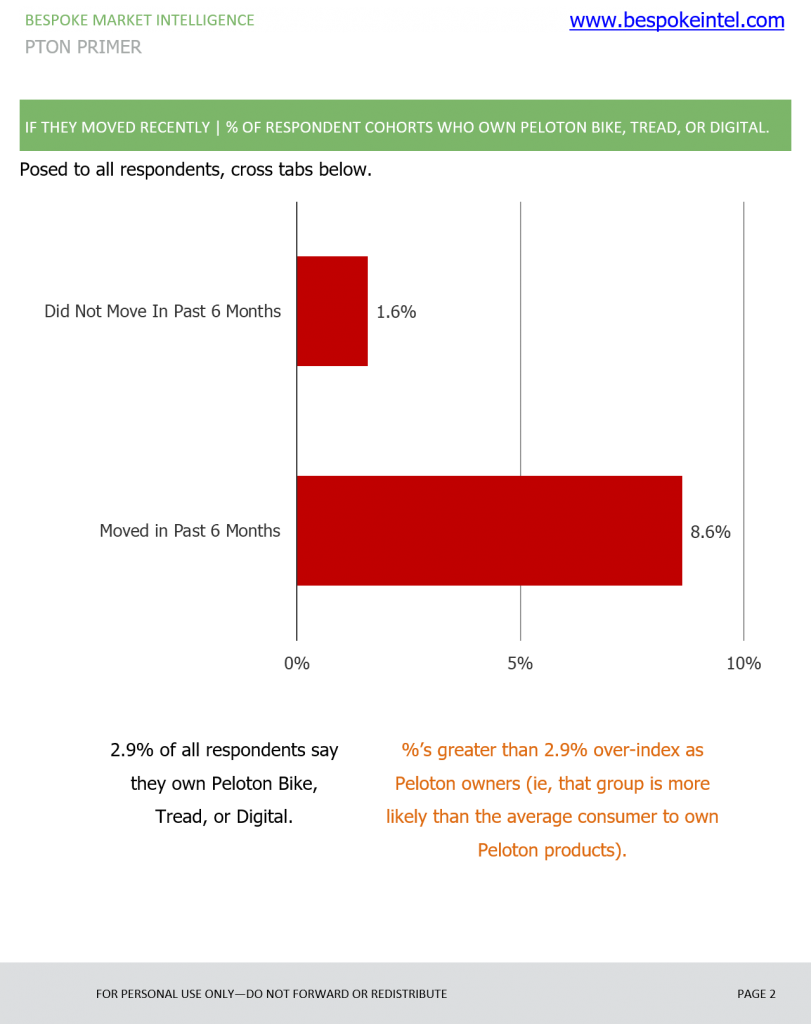

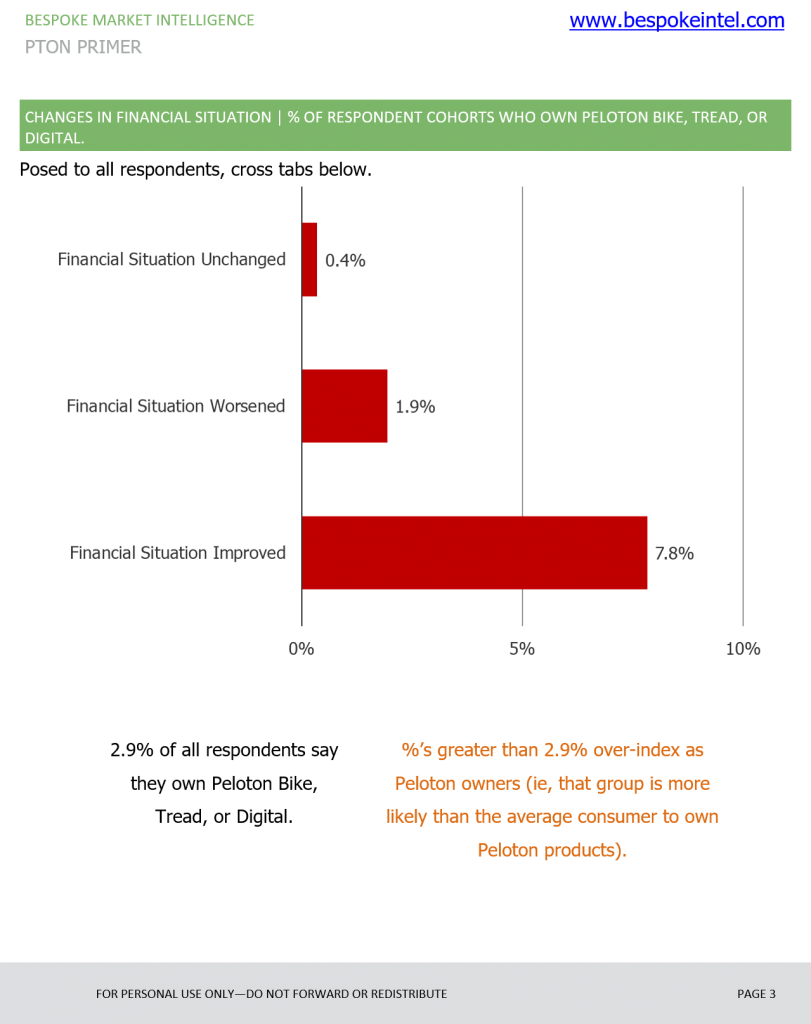

PTON Demand Considerations in The Event of Recession

Our PTON survey results have a balance of positives in negatives for investors to consider. Below is one area we are highlighting because we haven’t heard it being discussed as much. Consumers who are higher income, consumers whose financial situation has improved in the past year, and consumers who have moved recently are considerably more likely to own Peloton products. The main reason we are highlighting these slides is this: if we move into a recession, the customer segments/profiling that over-index the most as Peloton customers could impact the demand outlook. As noted earlier, our report includes a balance of positives and negatives (including a customer base that is very excited about the brand). We just wanted to flag an interesting and worthwhile thought exercise around threats to the upcoming demand landscape.

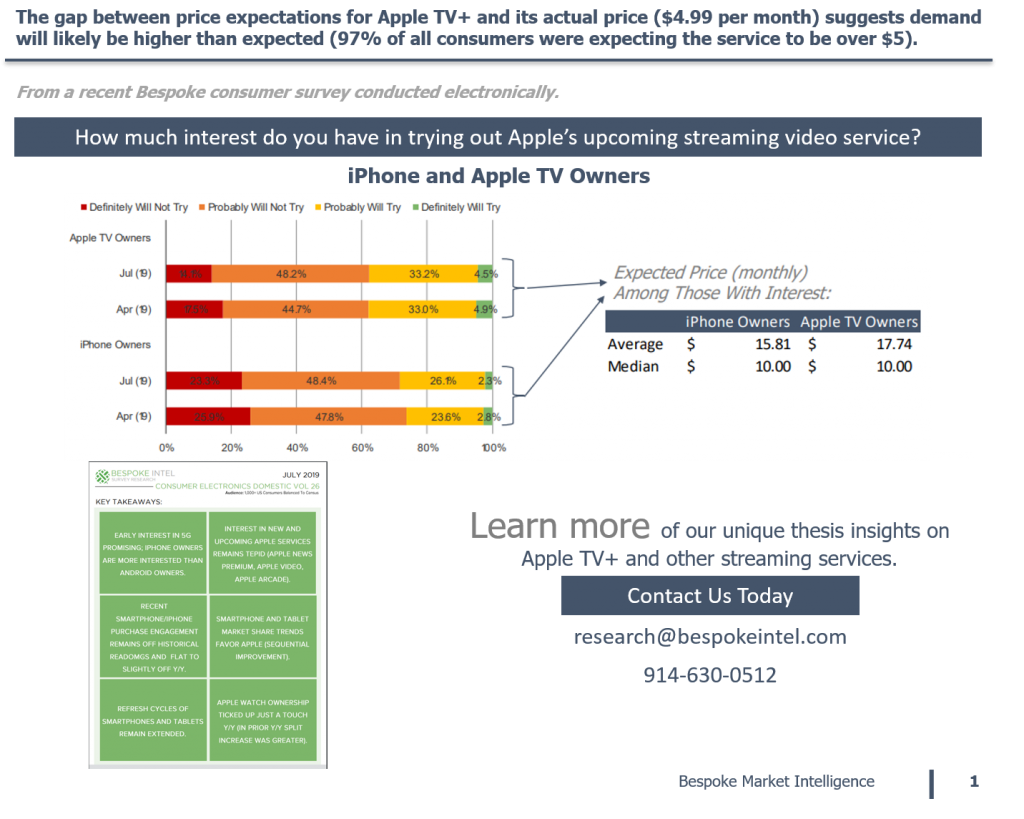

AAPL TV+ Price Surprise

Sentiment: AAPL In China

ETSY Free Shipping

Millennials and CPGs

Chewy Gains Mindshare

Furniture | Buying Online

Social Media | Privacy

Video Game Consoles