Blog

Bespoke Survey Insights

Top 5 Takeaways From Our Food Delivery Survey

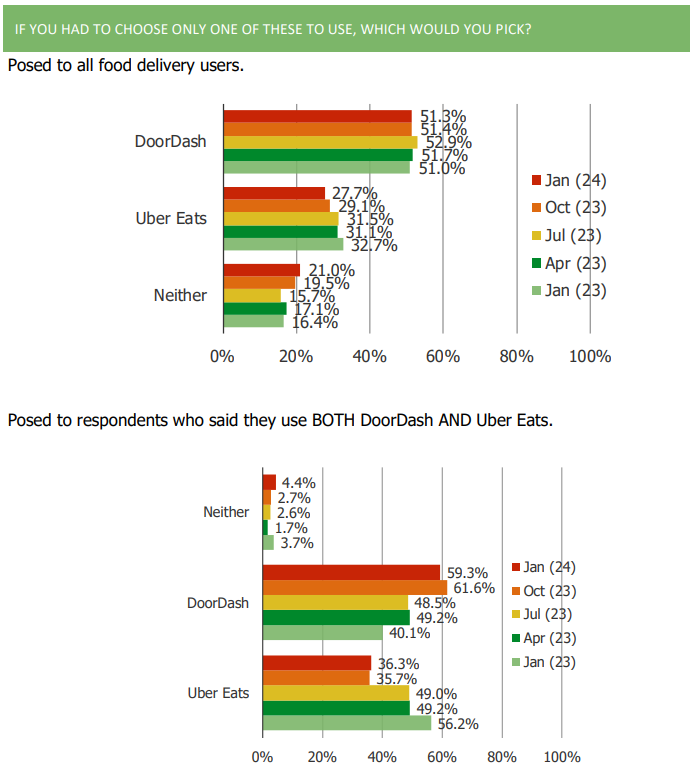

5. Consumers who use both both apps continue to prefer DoorDash over Uber Eats

4. DoorDash continues to be the top app that consumers use regularly or occasionally when ordering takeout food delivery

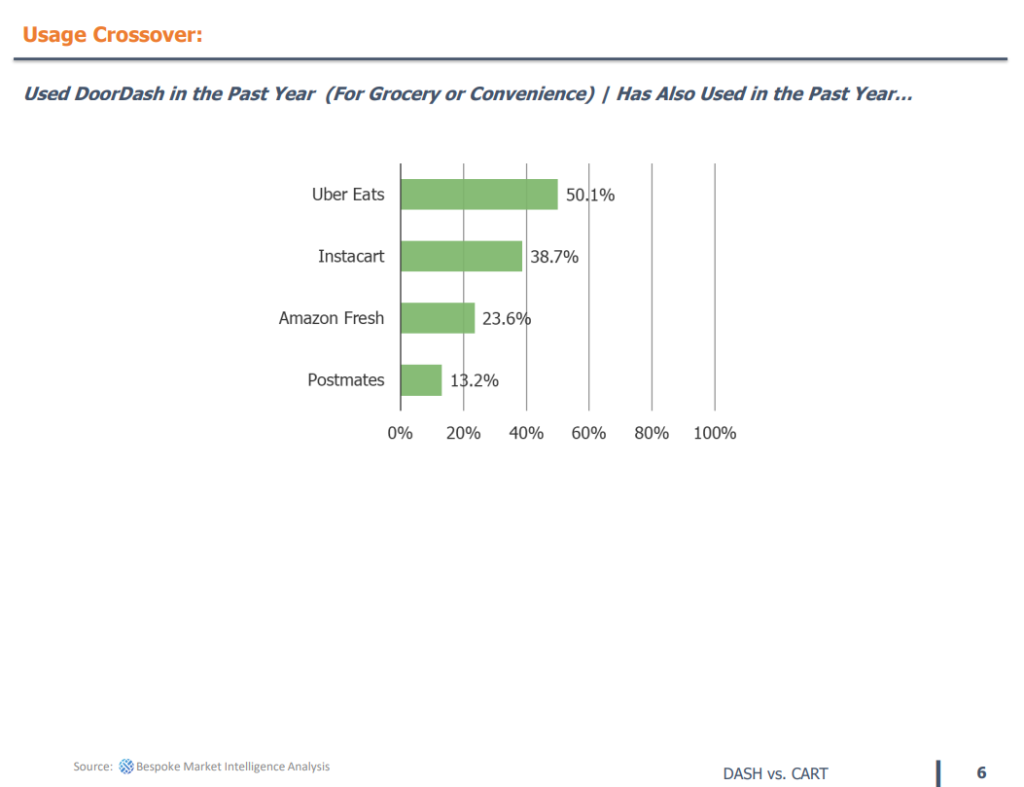

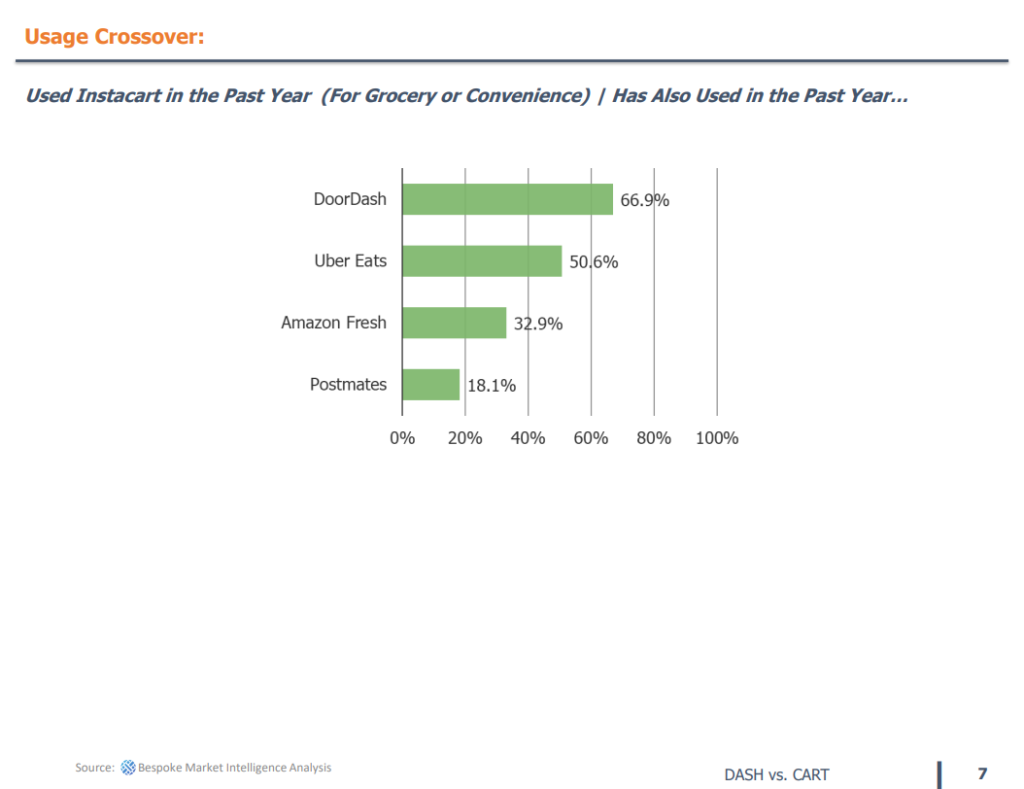

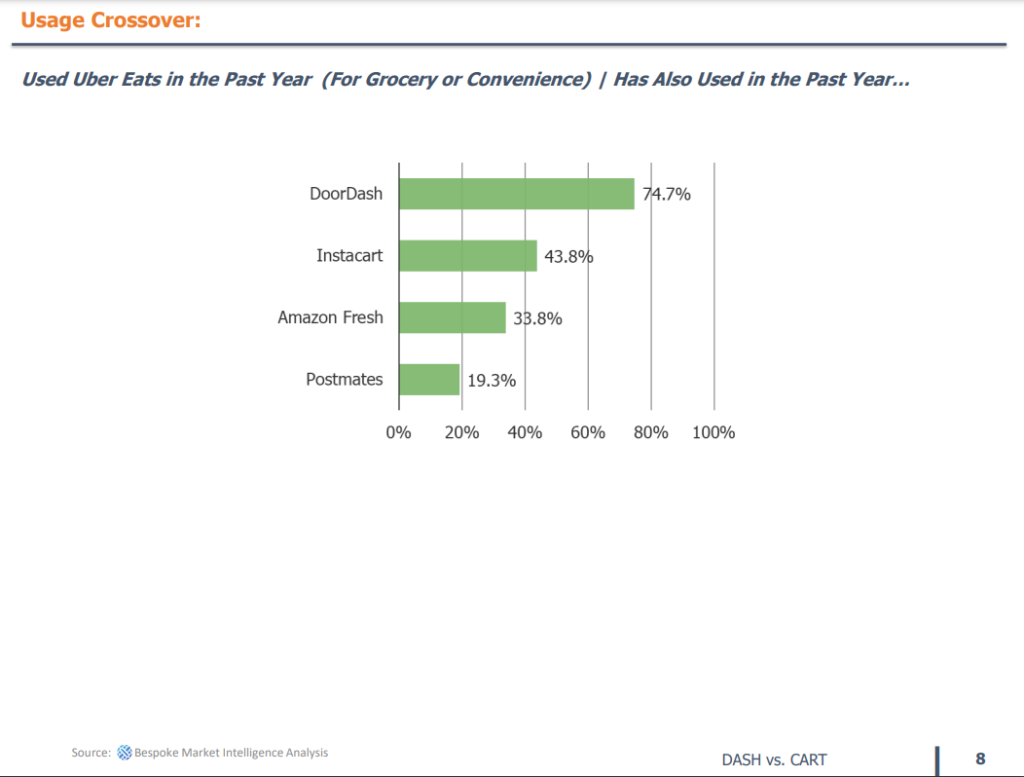

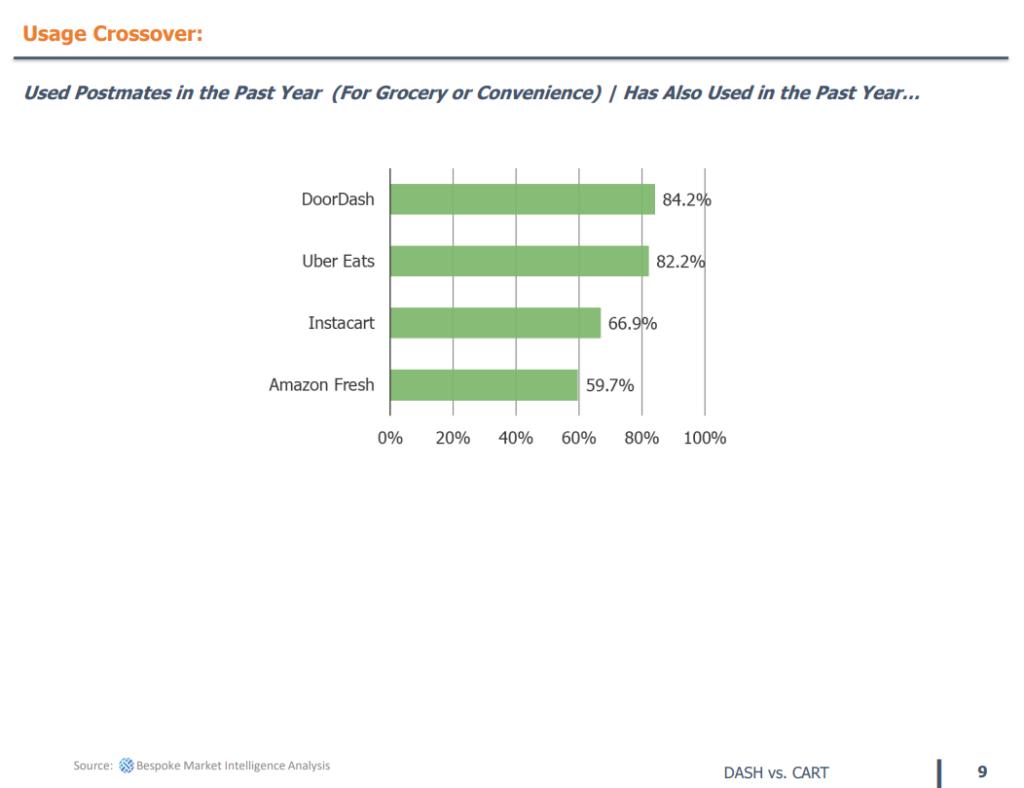

3. DoorDash has gained share in our survey across historical waves (i.e., an increasing share of users of the competition are also using DoorDash and a declining share of DoorDash users are also using the competition)

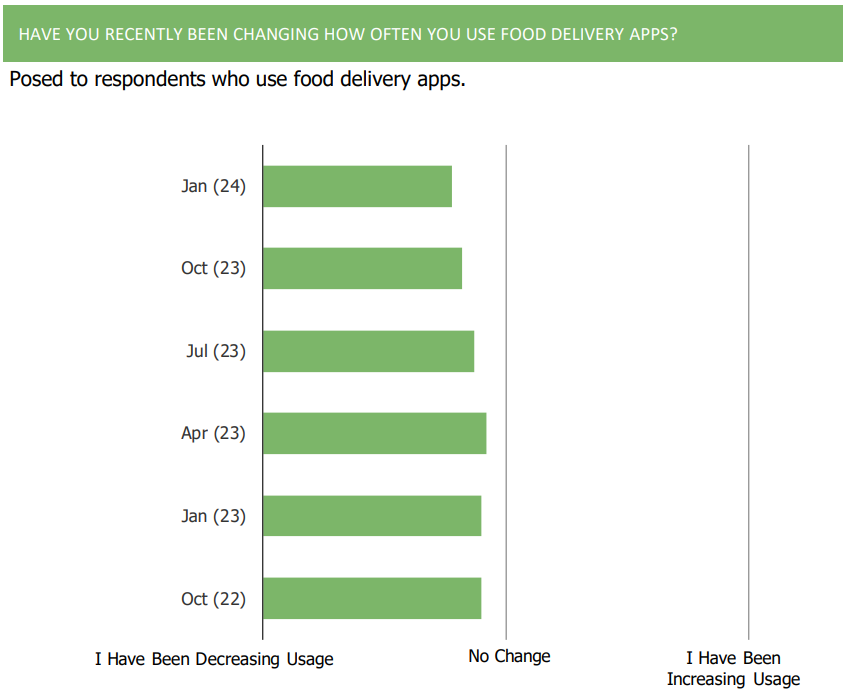

2. Self-Reported food delivery app usage has declined q/q and usage frequency among those who use food delivery softened sequentially in our survey

1. Among those who are using food delivery apps less frequently, the top reasons for reducing usage are nearly all related to cost and spending concerns.

NFLX | Five Takeaways Directly From Subscribers

Are people actually sharing their Netflix accounts less?

That was one of dozens of client questions we sought to answer in the 42nd volume of our quarterly streaming video survey. As we look forward to the 43rd volume of our streaming video survey due for release later this week, we look back at some helpful findings from our October survey.

Contact us for more info about how to get access to volume 43 to see how the data changed compared to three months ago ([email protected]).

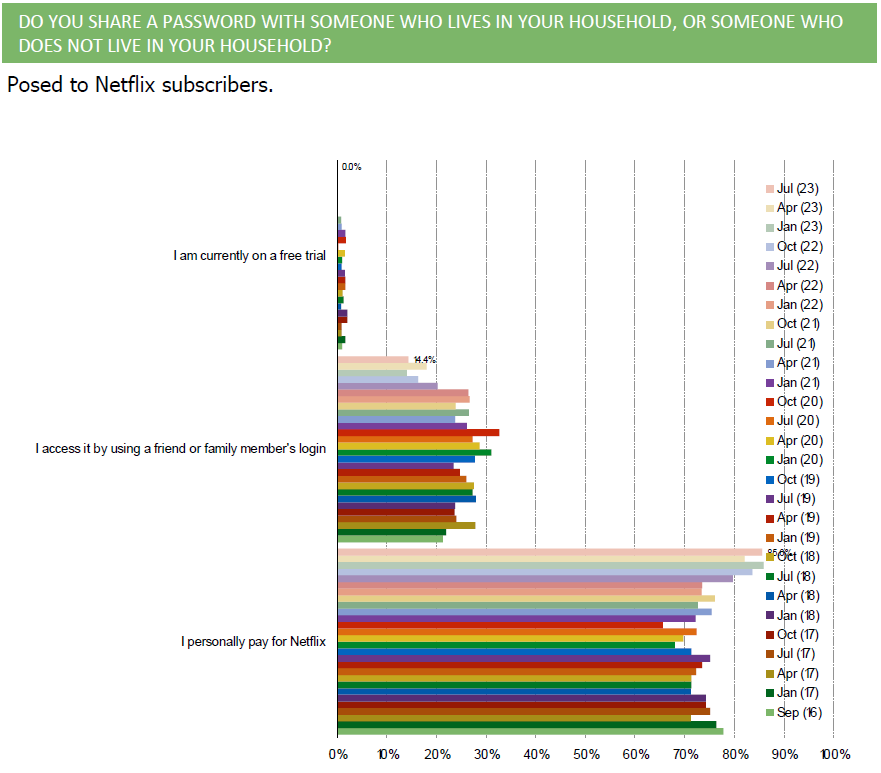

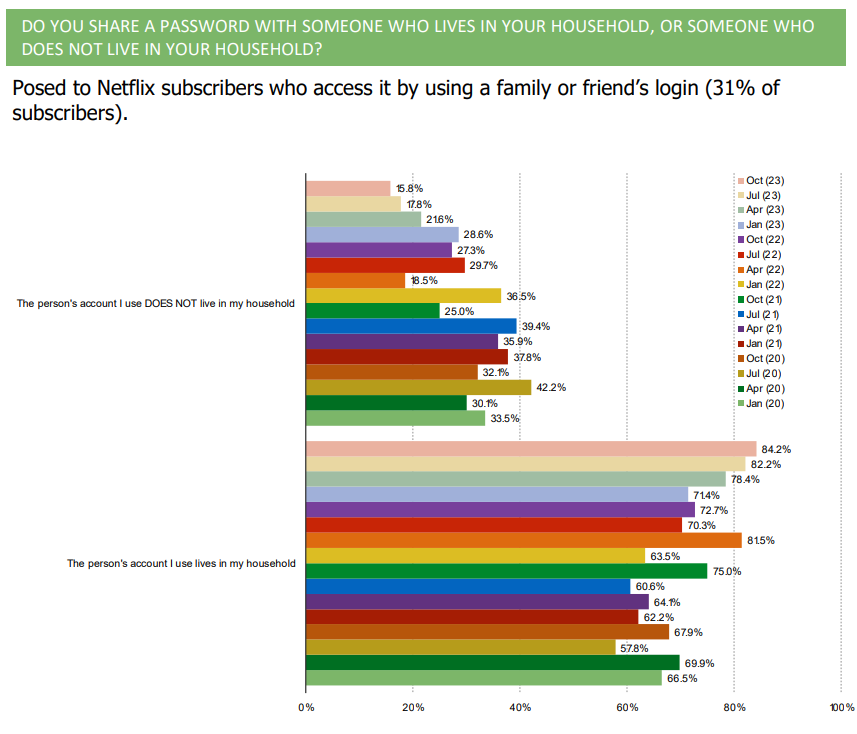

Takeaway 1: Netflix subscribers indicate a reduction in account sharing

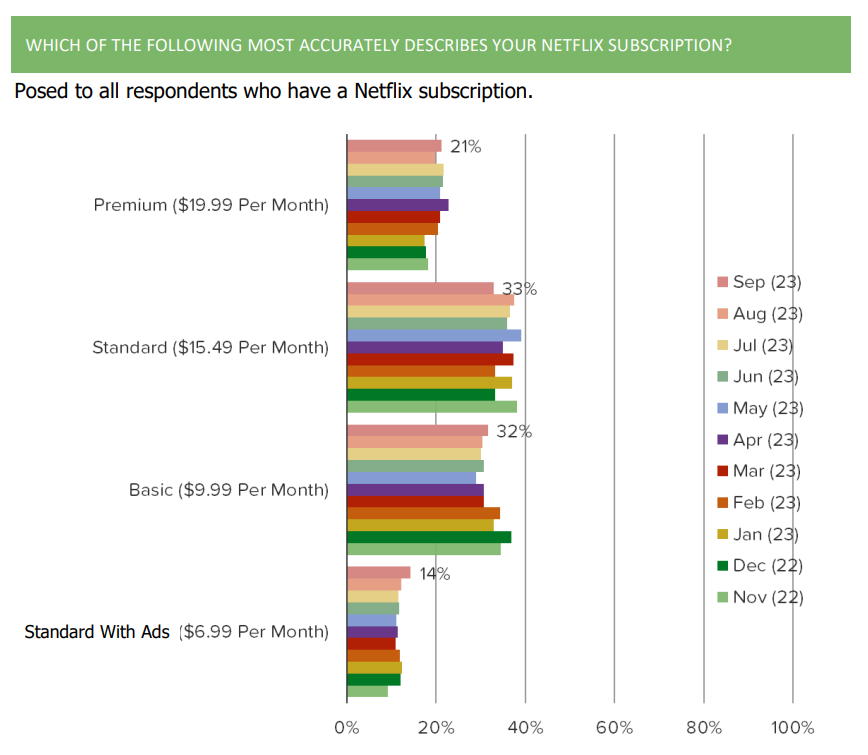

Takeaway 2: The share of Netflix subscribers on the Standard with Ads plan ticked up slightly over the course of the year, but remains the least popular option based on survey responses.

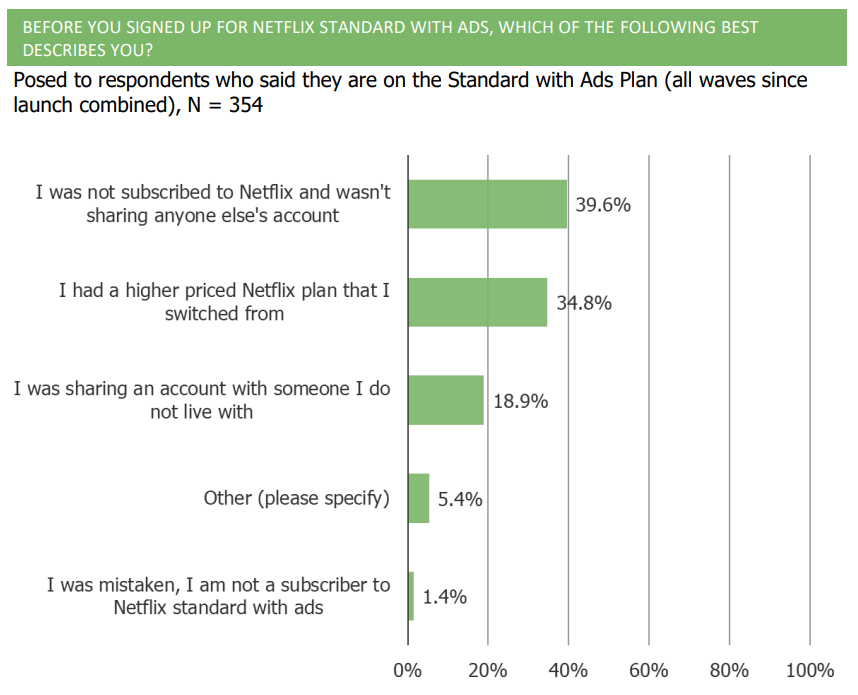

Takeaway 3: Of respondents on Standard with Ads, 18.9% said that they were sharing an account with someone they do not live with before they signed up. 39.6% said they were not previously accessing Netflix in any way and 34.8% said they were on a higher Netflix plan.

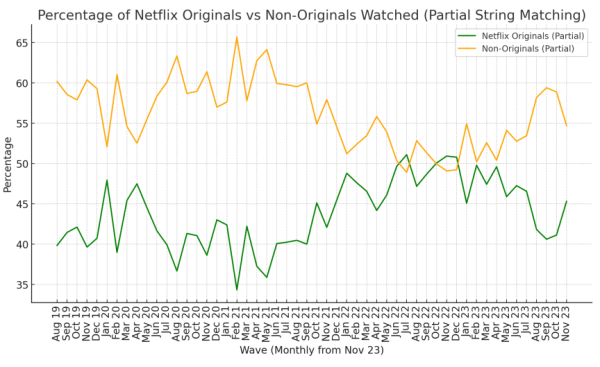

Takeaway 4: Originals are a big part of the Netflix viewing experience.

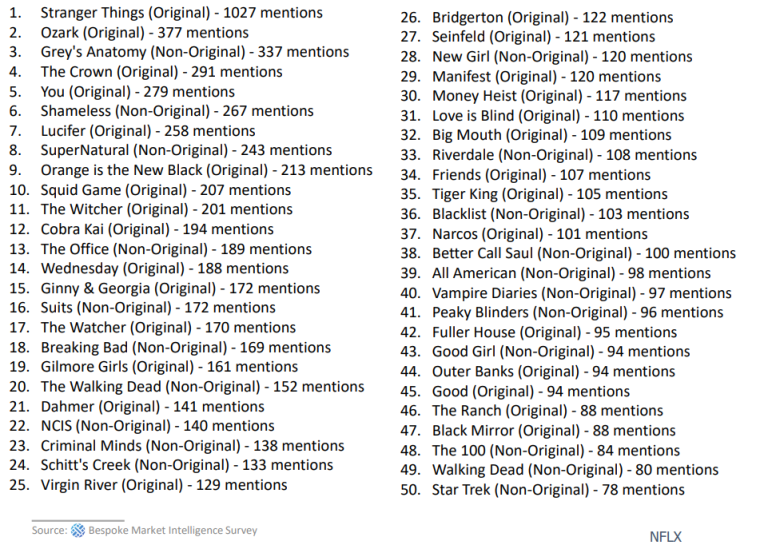

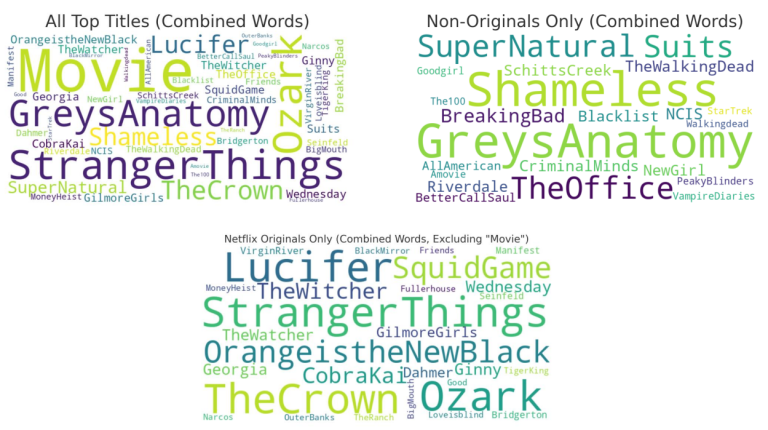

For this analysis, we uploaded 32,000 fill-ins across 40+ monthly waves to ChatGPT 4.0 along with a database of 3200+ titles of Netflix originals and asked ChatGPT to tell us what percentage of the last things watched by respondents each month were originals vs. non-originals.

When we asked ChatGPT to list the top titles mentioned and then asked it to cross-reference the originals database to label each as either original or non-original, 7 out of the top 10 names listed were Netflix Originals, with Stranger Things far and away taking the top spot.

We then asked ChatGPT to create word clouds of titles by category across all 32k+ fill-ins.

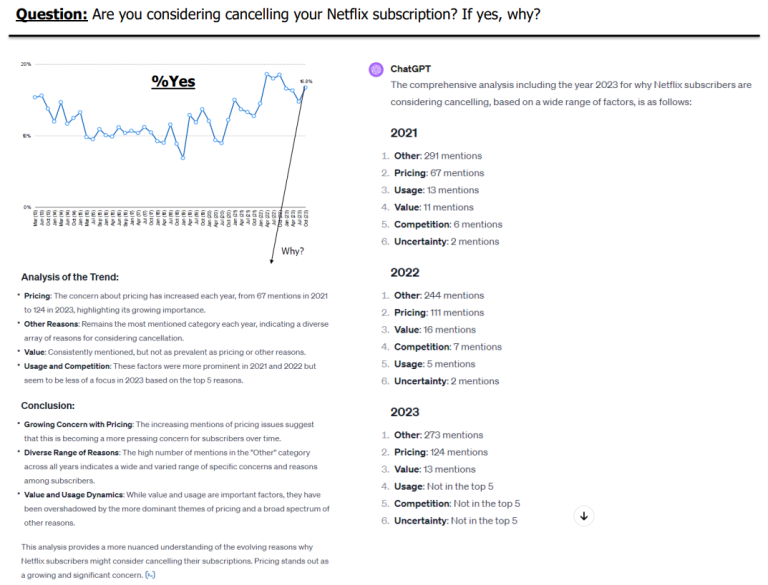

Takeaway 5: Pricing is an ever-present concern among respondents contemplating churning.

When asked if they were considering cancelling their Netflix subscriptions, 16.8% of respondents said yes, with pricing being their top concern. This concern with pricing has increased every year since we began asking this question, from 67 mentions in 2021 to 124 in 2023.

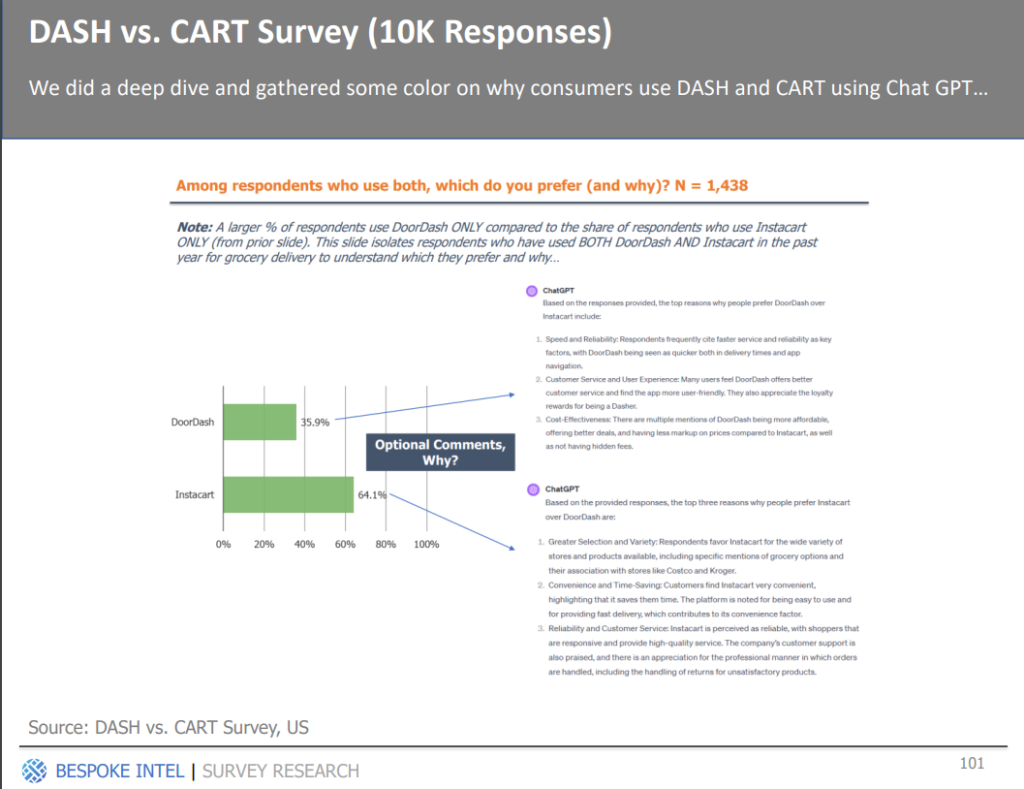

DASH vs. CART | Custom Survey

GLP-1s

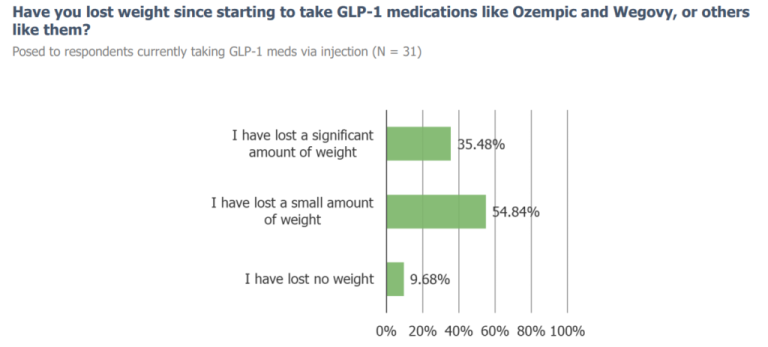

If the second half of our year was to be defined by one topic, that topic would be GLP-1s. With the rise of drugs such as Ozempic and Wegovy, GLP-1 medications have been all the rage in the later half of 2023 due to their weight loss and impulse suppression effects. Still, the share of consumers currently using GLP-1s remains relatively low for the moment as they’re in the early stages of consumer adoption. People on the drugs have reported to be consuming les calories and altering their behavior around food and eating. Across the consumer sector, the negative impacts that the drug has had on the market are most widely reflected on categories such as snack food and casual dining. In terms of TAM projections, there is clearly more interest amongst folks that suffer from conditions such as type 2 diabetes, sleep apnea, and obesity. We believe that the time series data that we will be tracking going forward will be especially useful in figuring out just how much of an effect these drugs will have on the market at large.

Search & AI

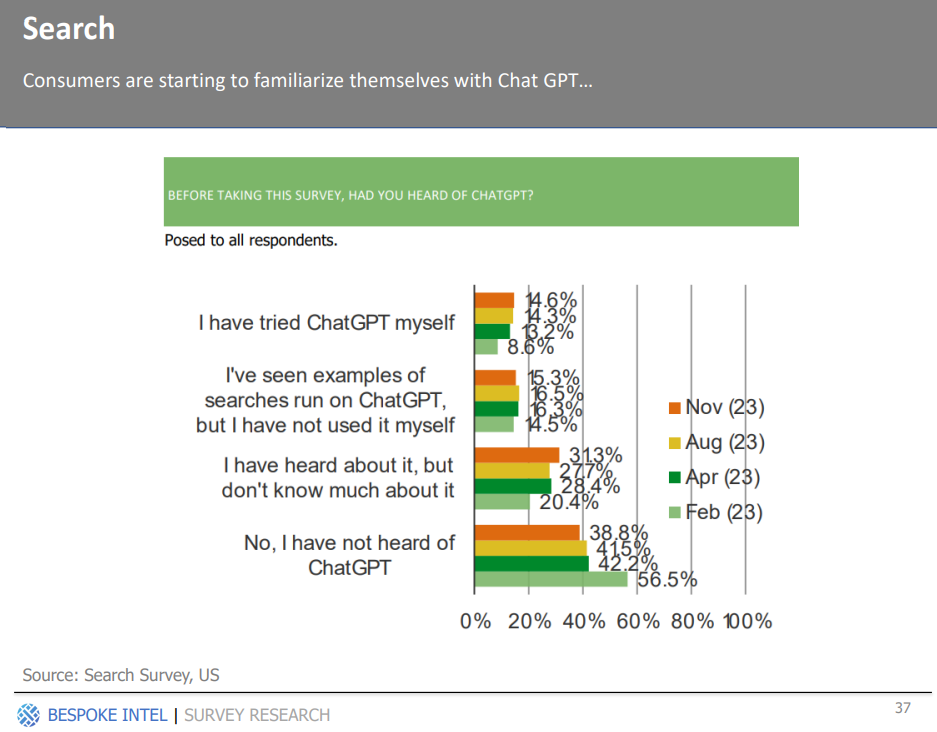

If 2023 will be remembered in history for one thing, it would be the rise of generative AI into the main stream. The introduction of AI chatbots such as ChatGPT have changed the way that we interact with technology forever, and it doesn’t look like it’s going to slow down any time soon. Even in our own work flow here at Bespoke Intel, we have begun implementing AI features into our research process to analyze our free text data. Over the course of the year we’ve run numerous surveys tracking AI chatbot and search trends. Awareness of the availability of AI chatbots has increased considerably over the course of the year. The share of consumers who use AI chatbots occasionally has increased sequentially over the course of the year, but the share that uses them regularly has declined M/M.

Temu

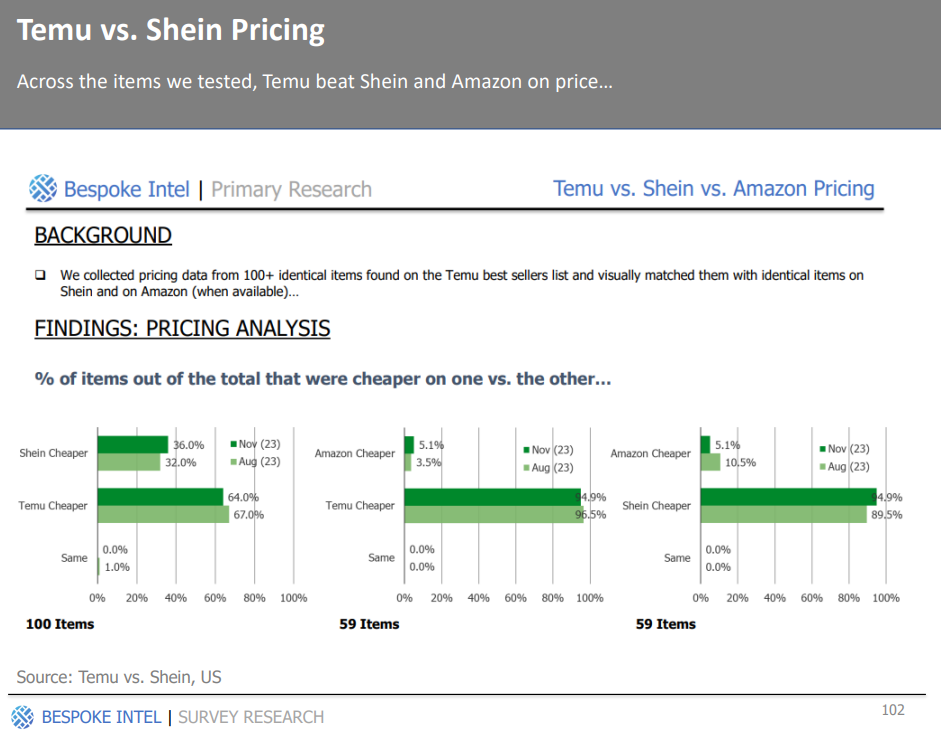

Over the course of 2023, we’ve seen interest in Temu turn from a whisper to a roar. Since the beginning of the year, we’ve ran numerous surveys covering the Chinese ecommerce platform and have seen adoption rise dramatically. Although engagement has stabilized over the past few months, the dichotomy of Temu customers has become clearer: regular consumers that enjoy the platform’s affordability. The consumer base tends to swing towards younger demographics, skews female, and use the site for clothing purchases more than anything else. While adoption has increased, many current Temu consumers do not view the platform as a replacement for other platforms that they use. The appeal of Temu varies within the real of eCommerce, with some shoppers choosing to remain loyal to the legacy websites such as Amazon, Walmart, and Target. There is lots of cross-over among customer bases, specifically with companies like Zara, Gap, Burlington, H&M, and TJ Maxx.

Student Loans

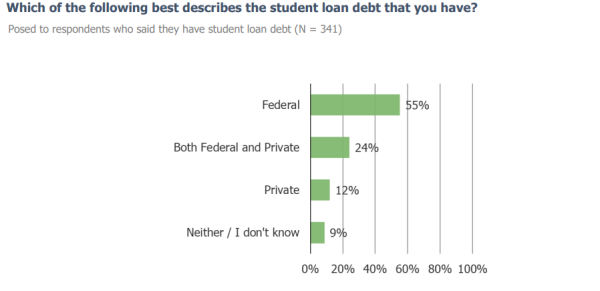

With federal student loan payments resuming back in October of this year, it’s been one of the most hot button issues over the course of 2023. Back in September before the payments resumed, we ran a large N survey on consumers to see how they would react to having to make payments going forward. 34% of respondents who had their student loans paused stated that they had increased their discretionary spending because of it. We cross-tabbed our responses by age and found that an overwhelming portion of those who have been spending more, are likely to fall within younger age cohorts (recent university graduates). Of these respondents that paused their payments, a large portion stated that they would have to cut back on their discretionary spending once they resume. The top things that these respondents called out as something they would cut back on include eating out/food, clothing, and streaming subscriptions. Respondents who increased their spending during the pause period have a generally more optimistic view on their personal finances than those who paused their payments and did not increase spending. Personal care and beauty were the most resistant to cuts, followed by tobacco, streaming music subscriptions, video games, furniture, and streaming video subscriptions.

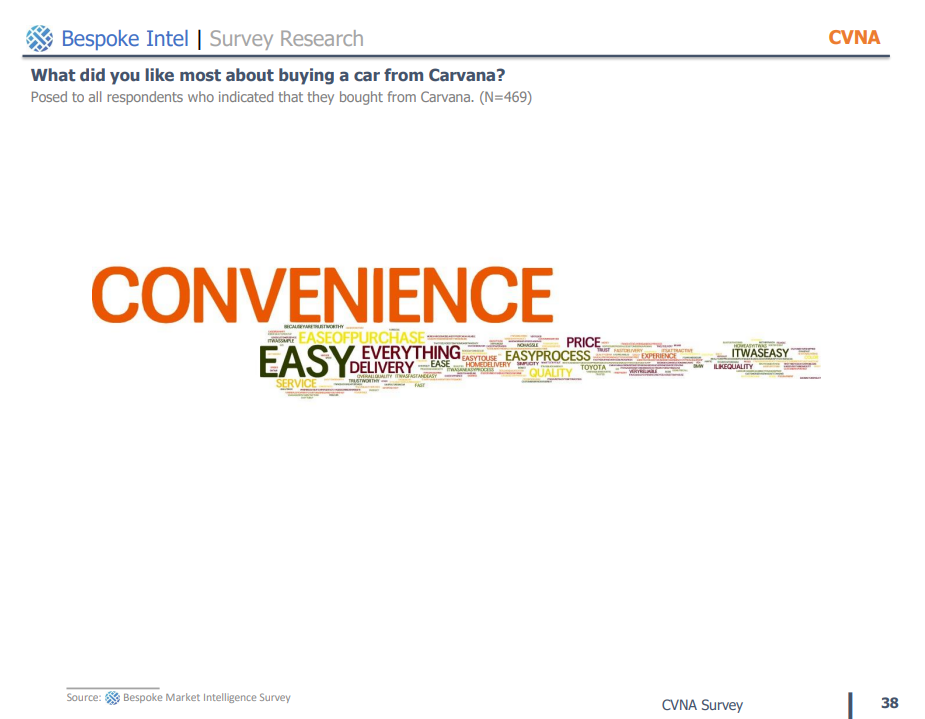

CVNA

It would be putting it lightly to say that Carvana has been on quite a wild ride this year. In January, we published an article titled “Is Carvana Over? The Consumer Angle.” At the time the stock was trading at around $4.20 per share and there was serious concern that the company would have to file for bankruptcy. Since the time we published that article, Carvana’s stock rose to a high of $62.59 and is currently trading at around $53 per share. In the article we chose to take a different perspective from what we were seeing from the financial community at the time, and decided to deep dive into how customers actually felt about the company. We’ve continued to track consumer sentiment toward Carvana throughout the year by means of a 10,000N survey that we refresh quarterly, and if there’s one thing that we’ve come to realize, it’s that consumers really enjoy the Carvana experience. When it comes to competitive dynamics, Carvana ranked near or at the top in terms of things like pricing, selection, and overall trust, NPS for selling a car to CVNA has improved since January and currently sits at 58, which is a very strong score. NPS from those who bought from Carvana also improved and currently sits at a series high of 69.

Food Delivery

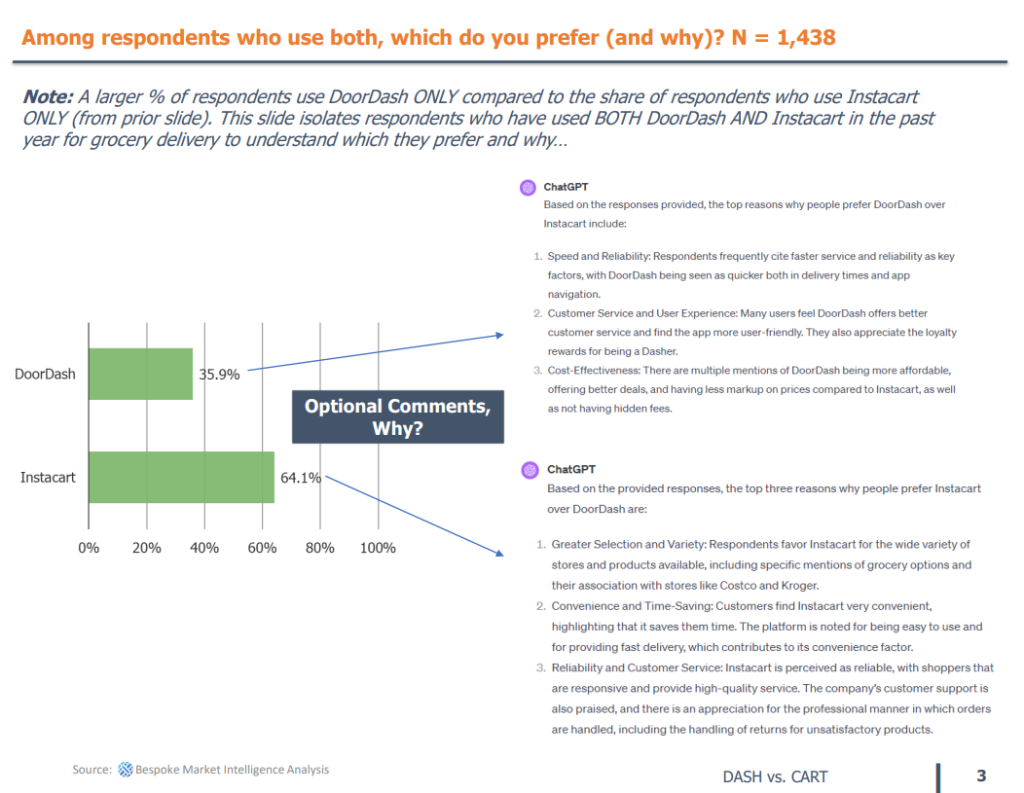

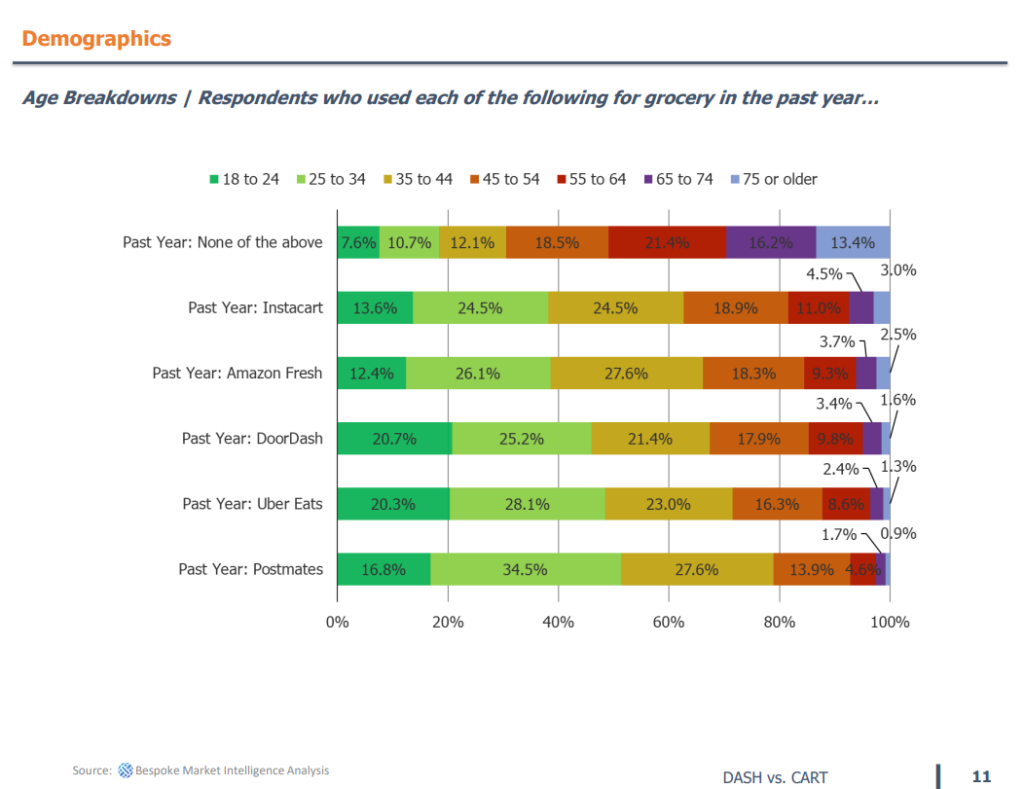

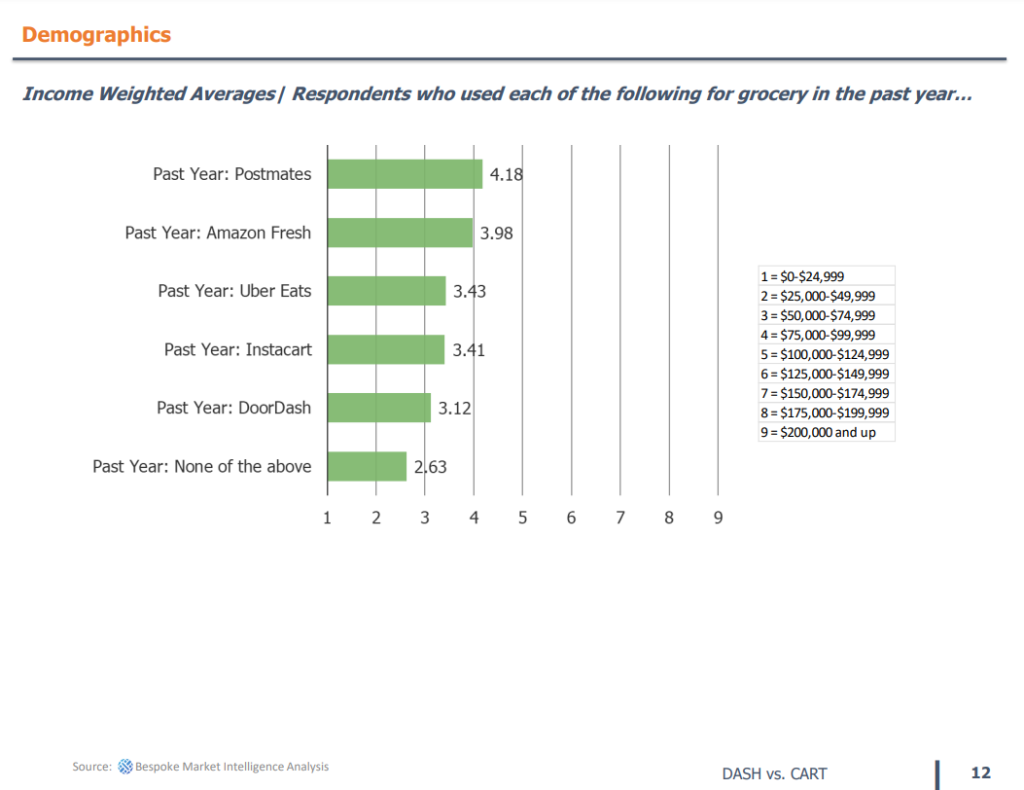

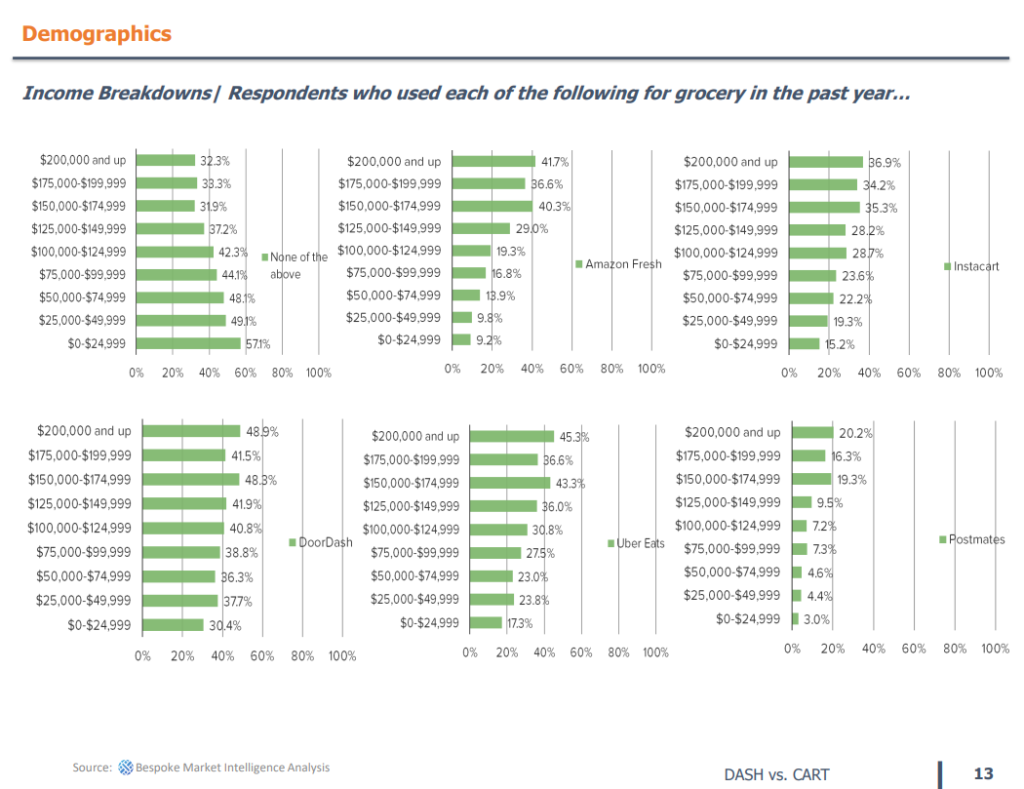

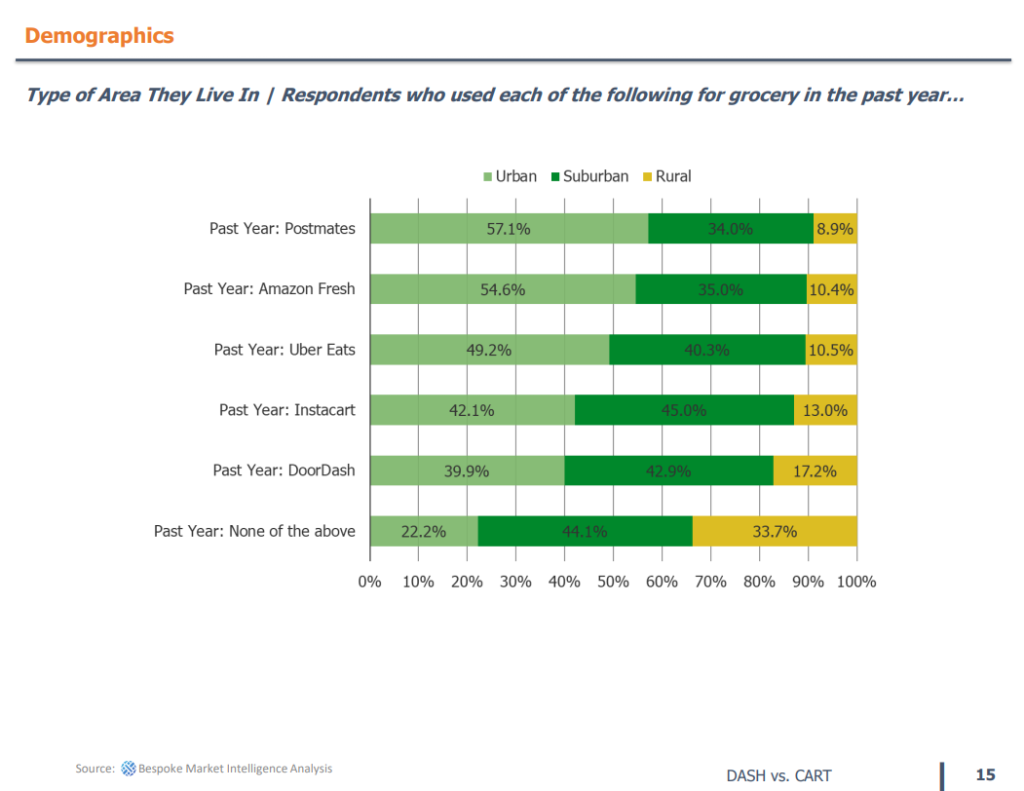

Consumers broadly view food delivery as more of a luxury than a necessity. DASH continues to lead all food delivery platforms in terms of popularity, with UBER coming in at second. We ran a deep-dive analysis on consumers that use both DASH and CART for food delivery purposes to gauge why each customer base preferred one over the other. We found that those who prefer DASH do so because of the speed and reliability aspects of the platform, with DASH being seen as quicker in both delivery times and app navigations. Respondents who favored CART tend to do so because of the greater selection and variety on the platform.

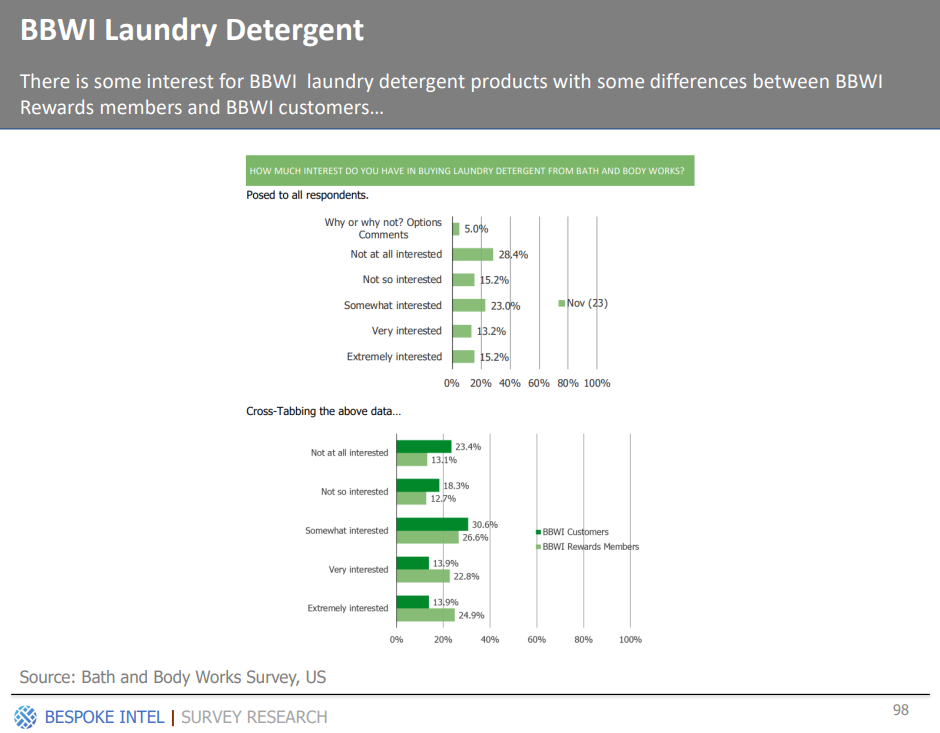

BBWI

Throughout 2023, we found that Bath and Body Works was one of the names that garnered the most interest from our clients. BBWI continues to have one of the strongest brand reputations among consumers relative to key competitors. Many of BBWI’s customer base prefers shopping in-store as opposed to online, and interest in their new line of laundry detergent products has increased over the past year.

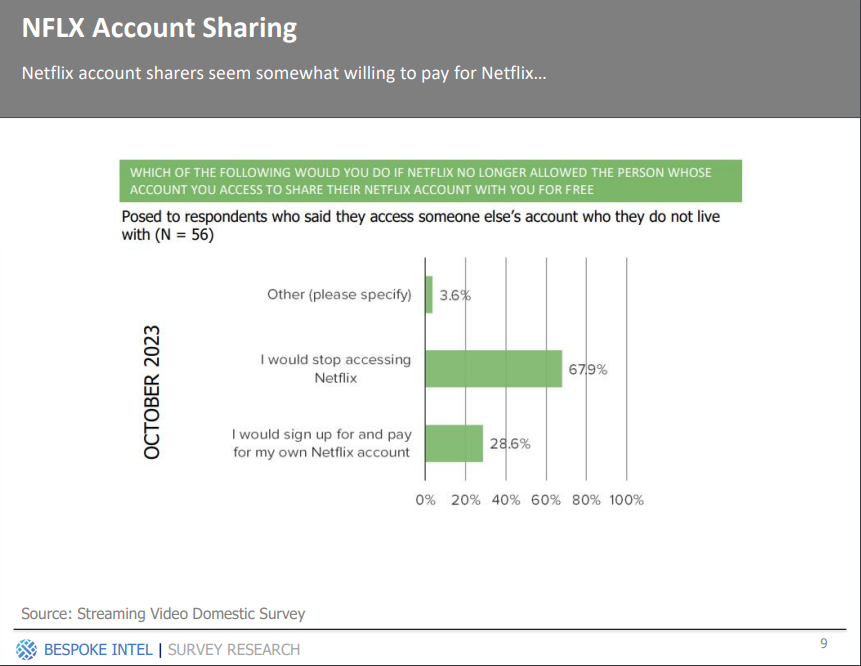

NFLX

A major theme through 2023 has been the account sharing crackdown that Netflix has implemented. We’ve been running surveys asking consumers what they would do in the event of an account sharing crackdown since it was a mere rumor amongst the investment community, and have continued to run them throughout its’ widespread implementation. We’ve found that the share of respondents whose account they access that does not live with them has declined sequentially through the year. Among those who pay for Netflix themselves, a declining percentage said they let someone living outside their household access their Netflix account. Of those who access someone else’s Netflix who they do not live with, the share who said they had trouble accessing the account in the past month increased from 11.6% in July to 23.2% in our October wave. Around a quarter of paying Netflix subscribers report having had to enter a code to re-authenticate Netflix in the past 6 months (16.1% of those who access someone else’s account who they don’t live with report having to re-authenticate). The share of Netflix subscribers on Standard with Ads ticked up slightly q/q, but remains the least popular option based on survey response. Of respondents on Standard with Ads, 18.9% said they were sharing an account with someone they do not live with before they signed up. 39.6% said they were not previously accessing Netflix in any way and 34.8% said they were on a higher price Netflix plan.

Social Media

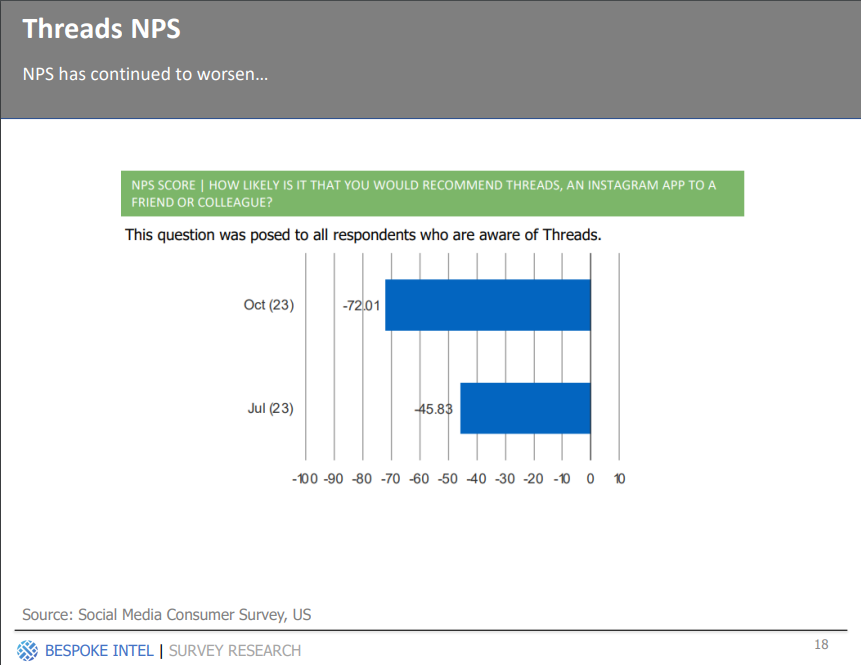

From the turmoil at Twitter (now X), to the introduction of Threads, to the continued dominance of TikTok, it’s safe to say that 2023 was another big year in the realm of social media. When Threads was introduced we saw it jump off to a hot start, with many believing that it could pose a real threat to the dominance of X. Since its July launch however, it has fizzled out in terms of main stream popularity and has not been gaining traction with consumers m/m according to our surveys. Respondents indicated that Threads usage would be incremental to their overall social media usage as opposed to a replacement for any of them. Threads NPS has continued to worsen over the course of its lifespan from -45.83 in July to -72.01 in October. Consumers continue to point toward data privacy issues being a top concern relating to social media, but the majority have no plans on deleting their accounts any time soon. Feedback towards Instagram Reels continues to skew positive, and sentiment towards Reels has improved in relative comparisons to TikTok.