Blog

Bespoke Survey Insights

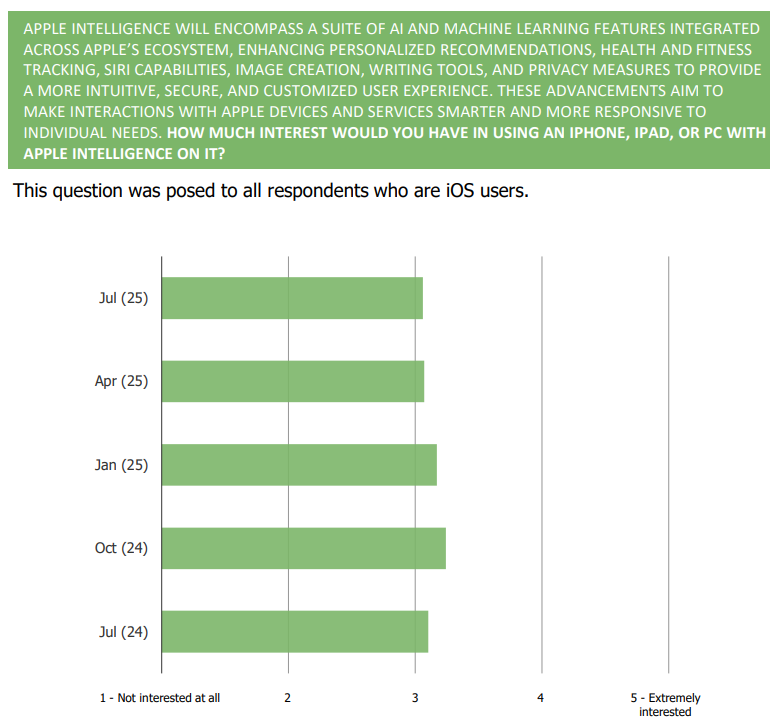

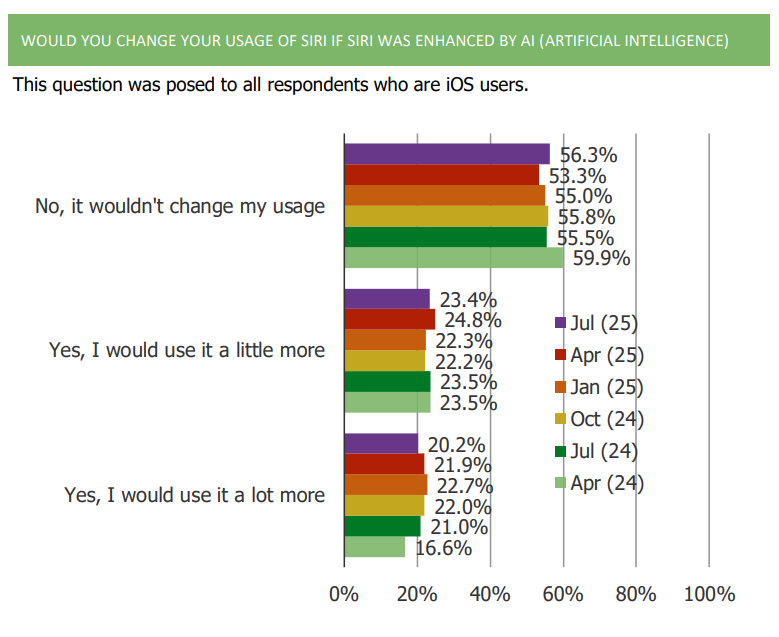

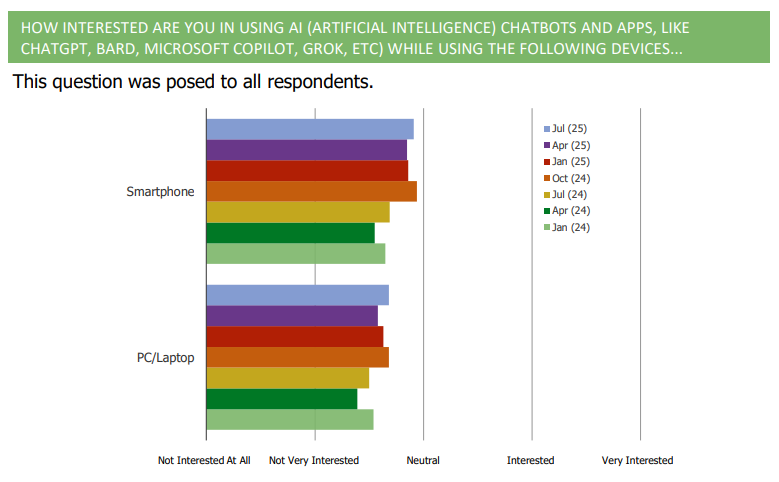

AI and Apple Intelligence

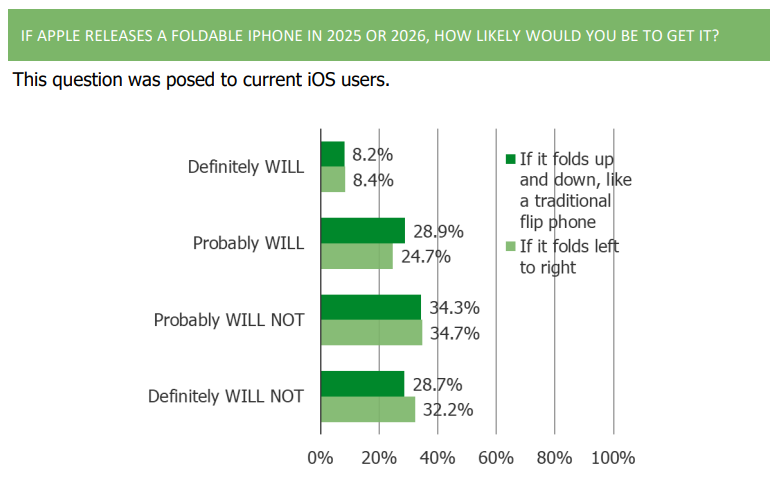

Apple and Interest in Foldable Phones

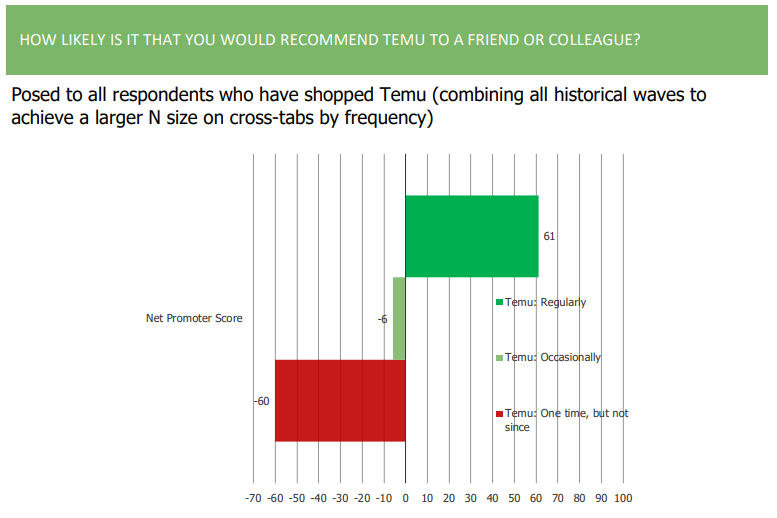

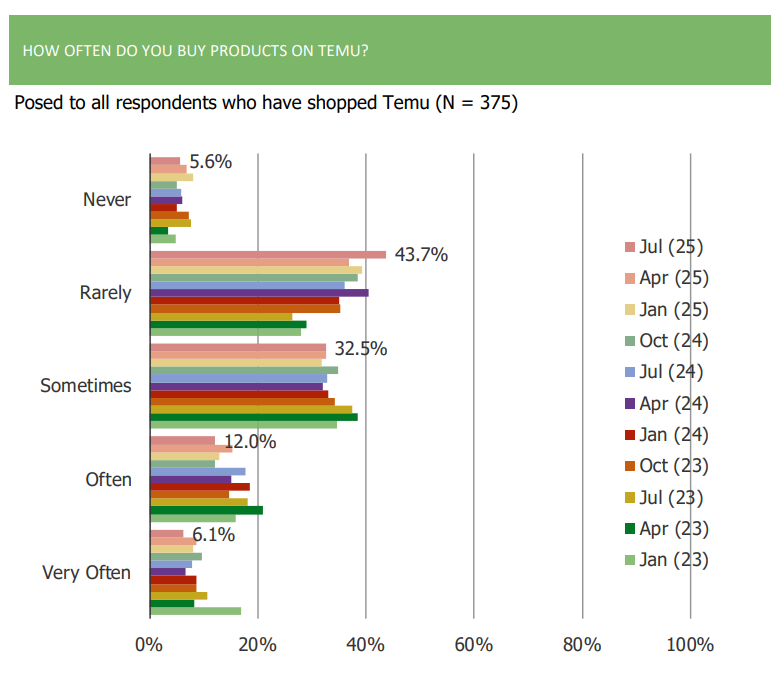

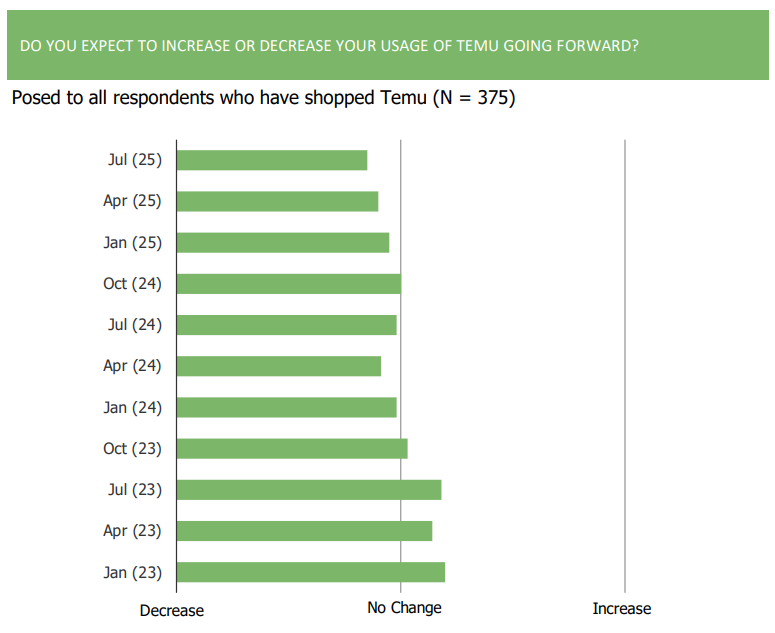

Consumer Adoption of Temu

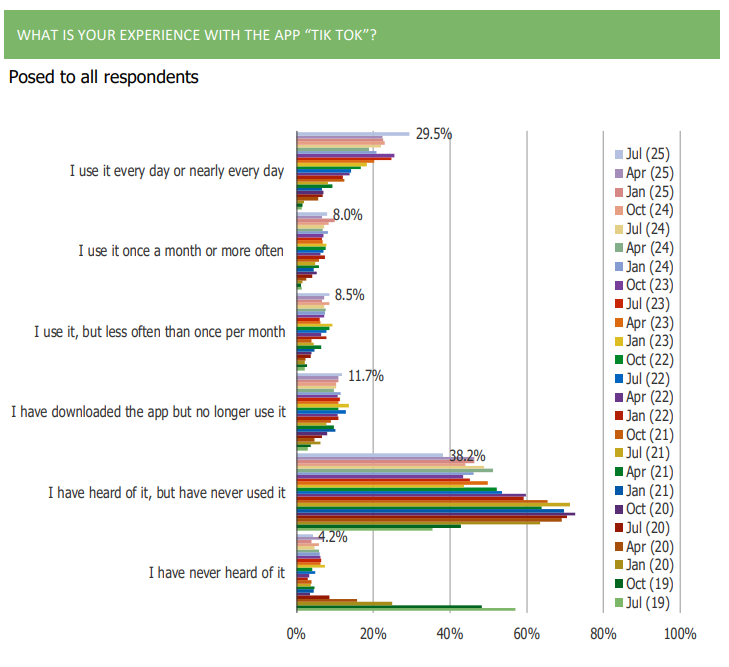

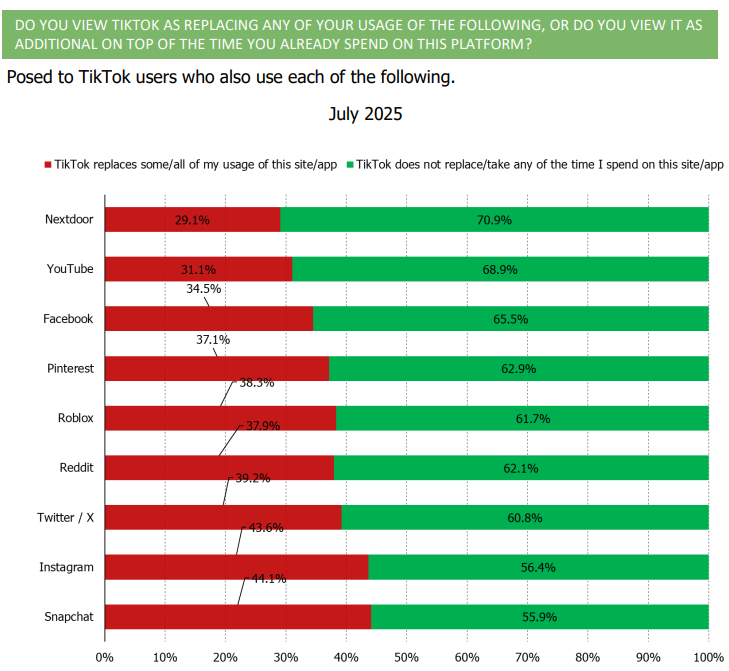

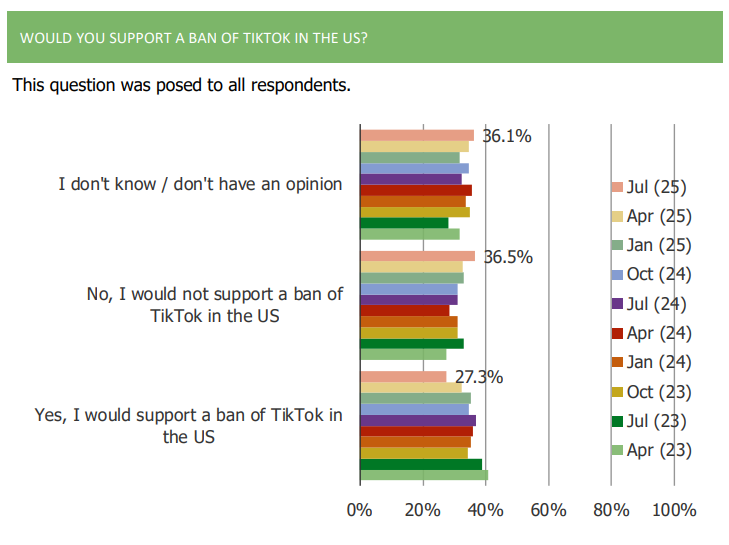

TikTok Growth and Market Position

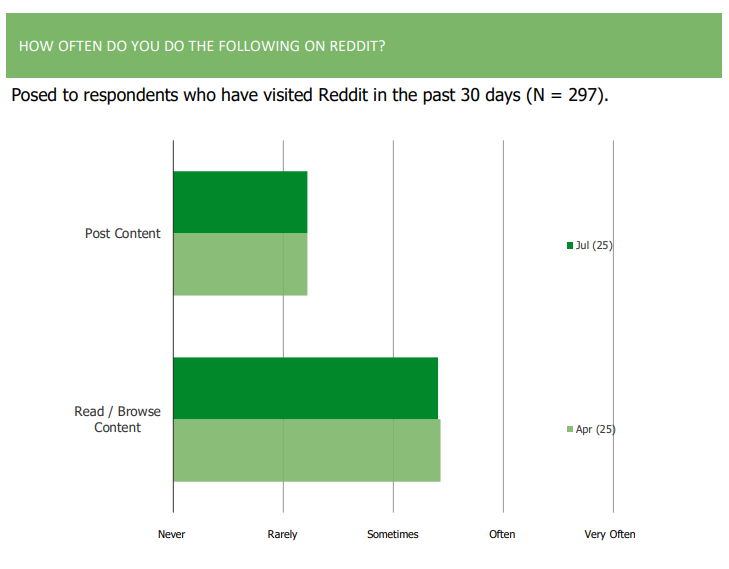

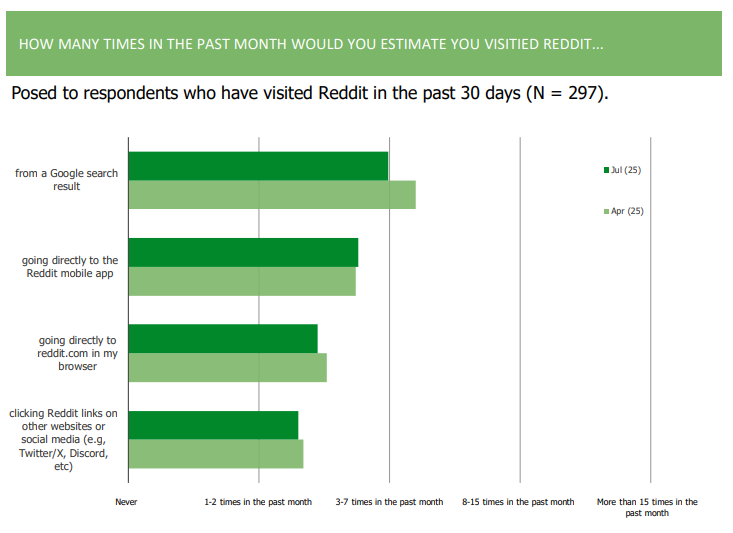

Google Importance to Reddit

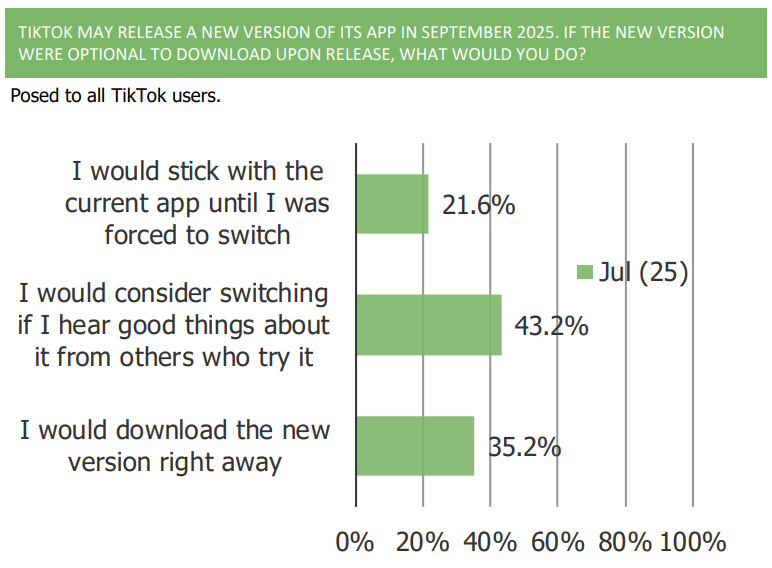

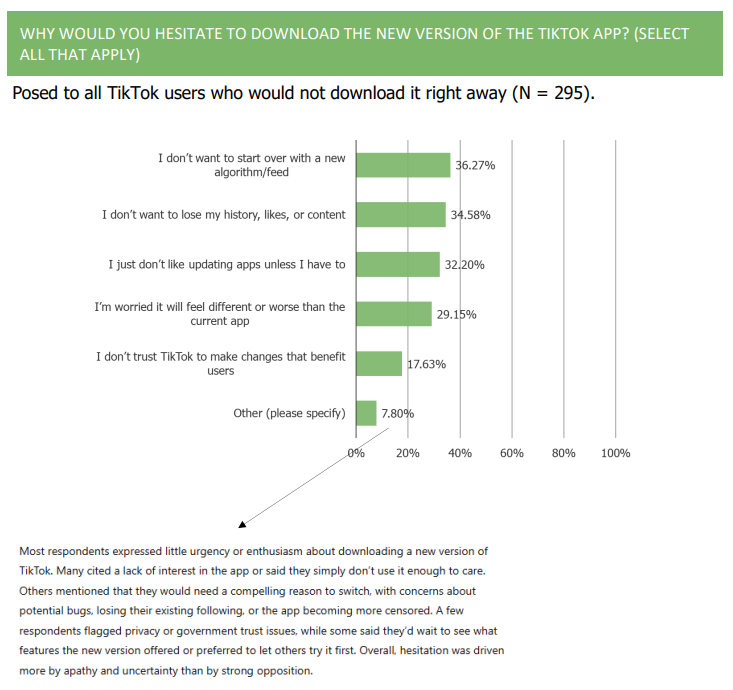

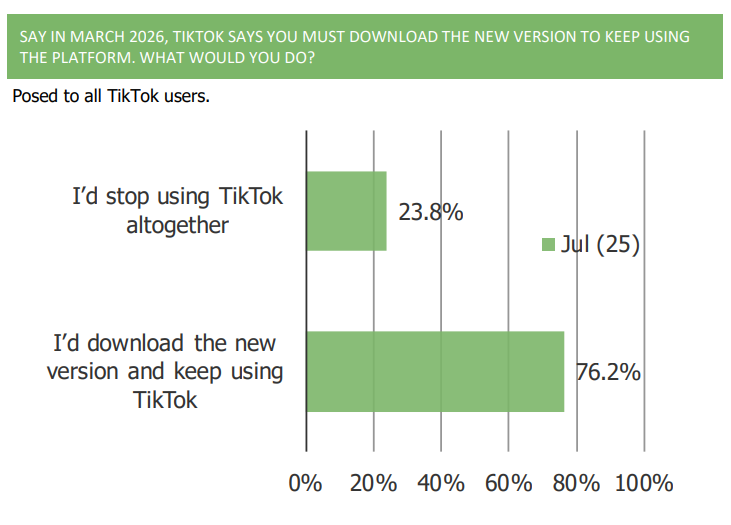

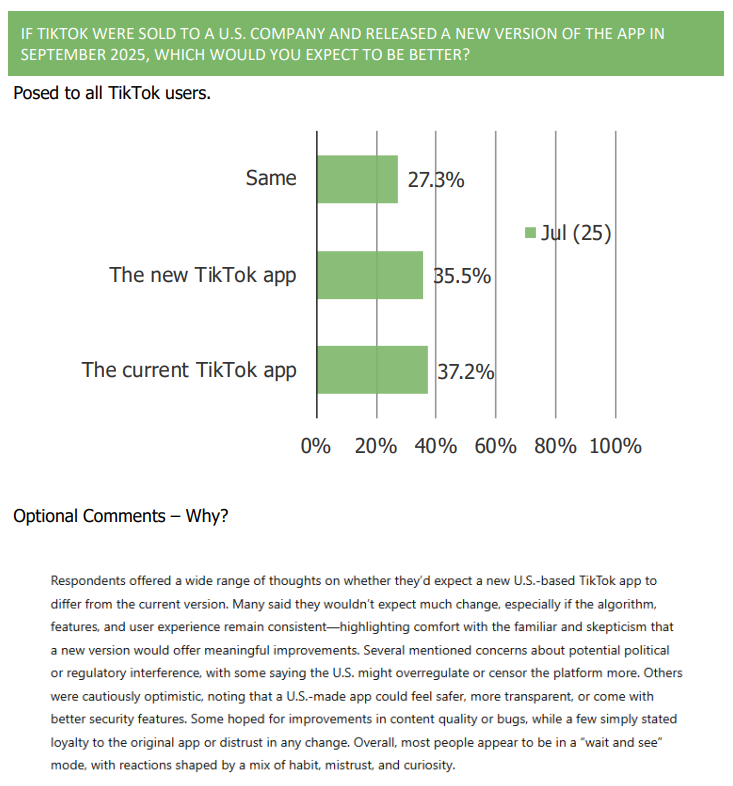

Potential Release of New TikTok App

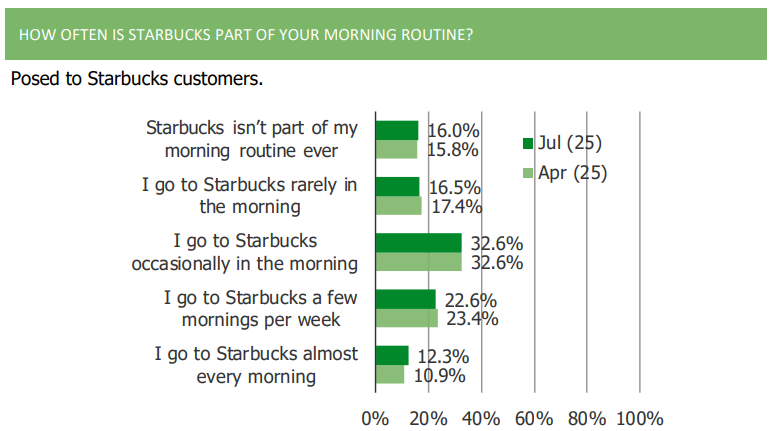

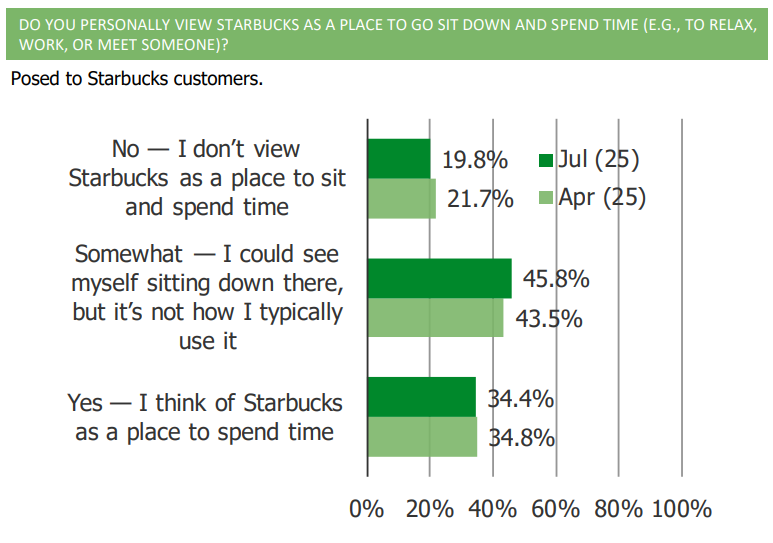

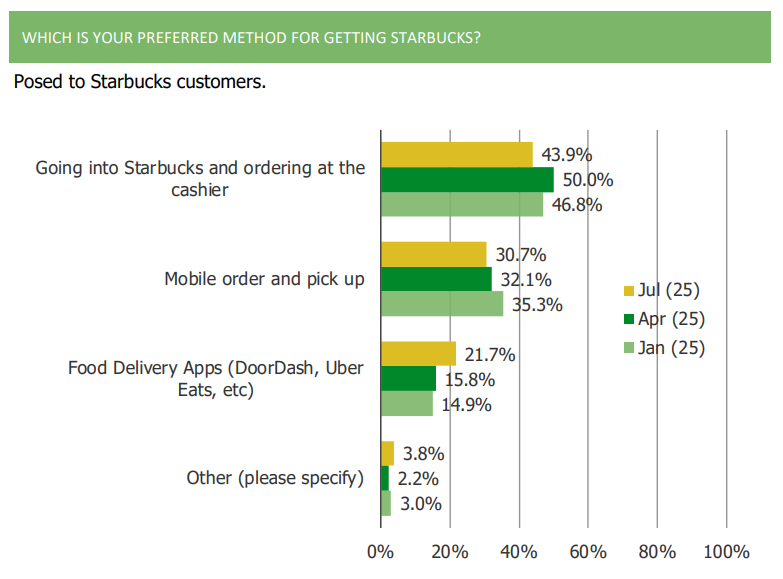

Starbucks Turn Around Plan

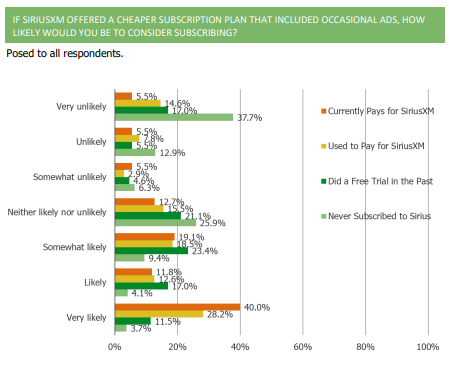

Consumer Views of Potentially New SiriusXM Offering

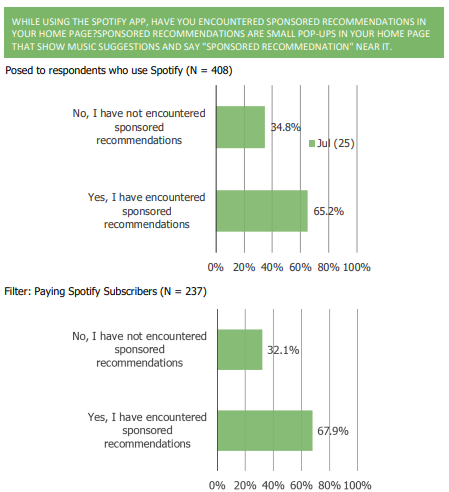

Spotify Sponsored Recommendations

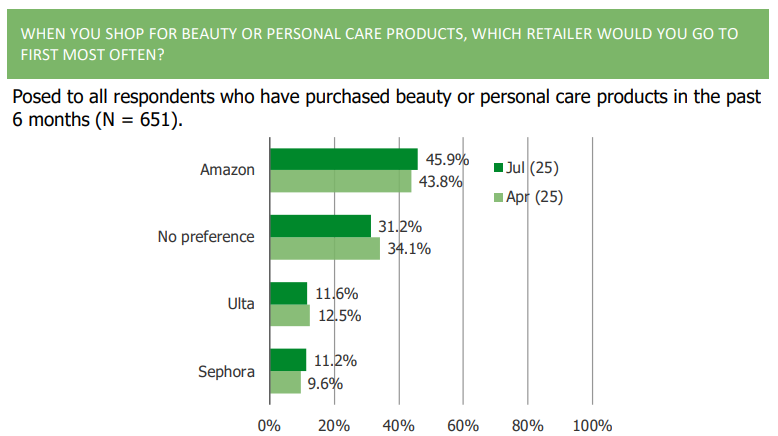

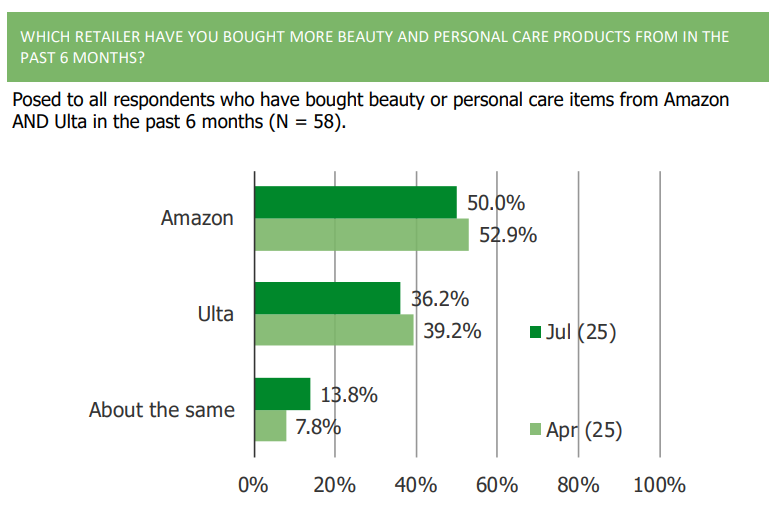

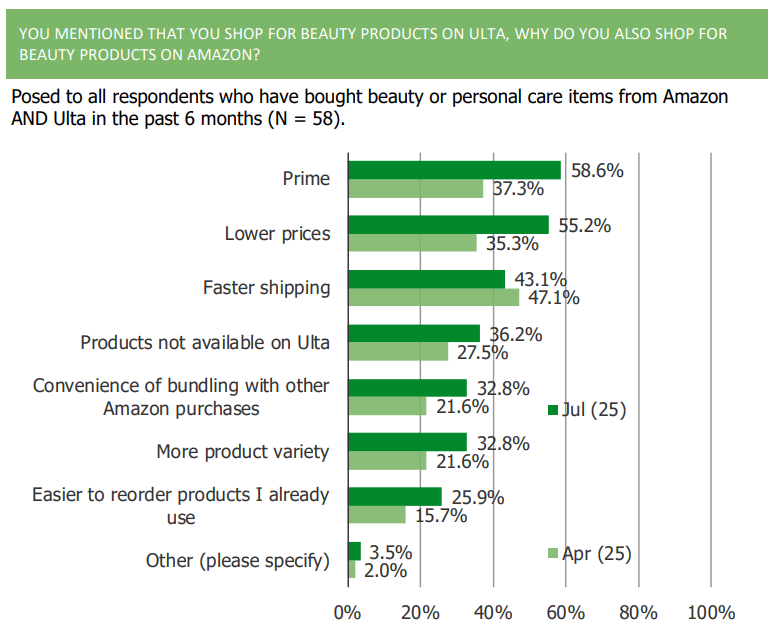

Ulta Competitive Position vs. Amazon

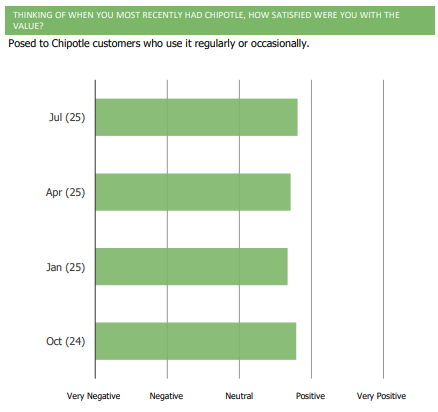

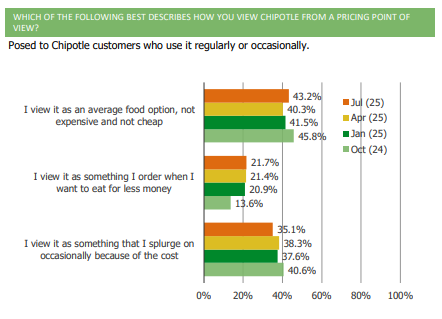

Chipotle Pricing and Consumer Perceptions

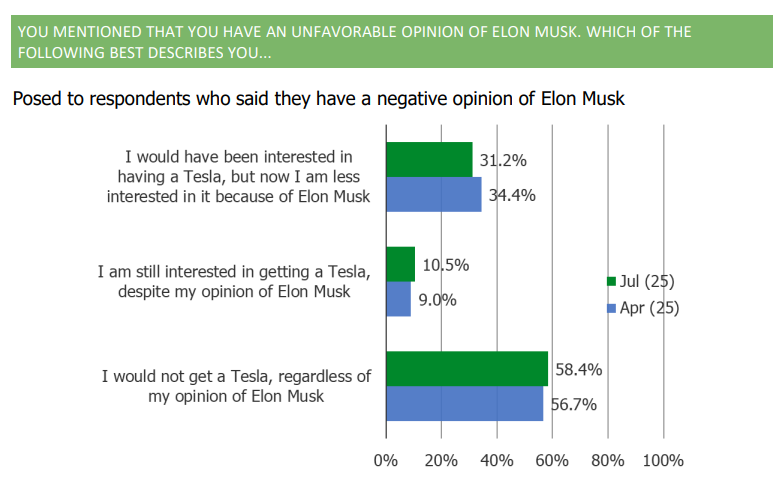

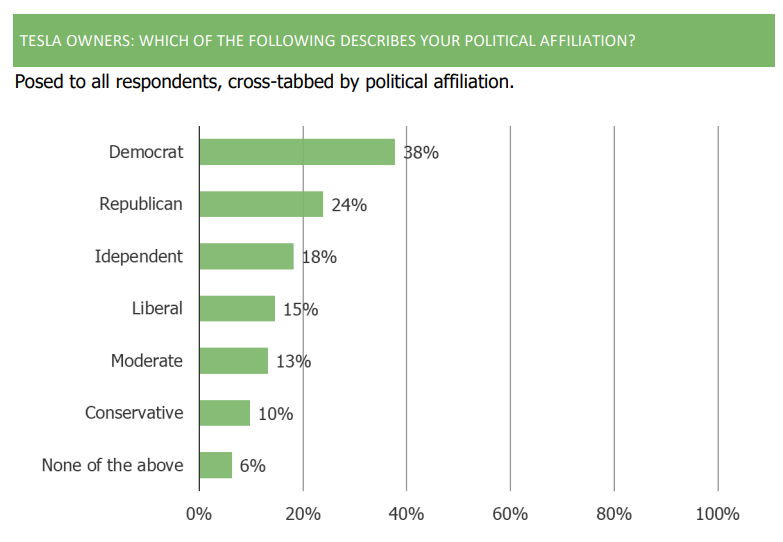

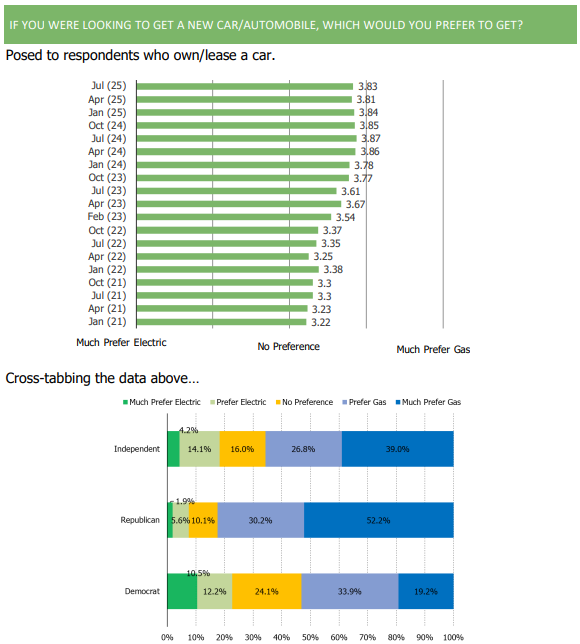

Tesla and The Current Political Environment