Blog

Bespoke Survey Insights

BNPL | Top Five Takeaways

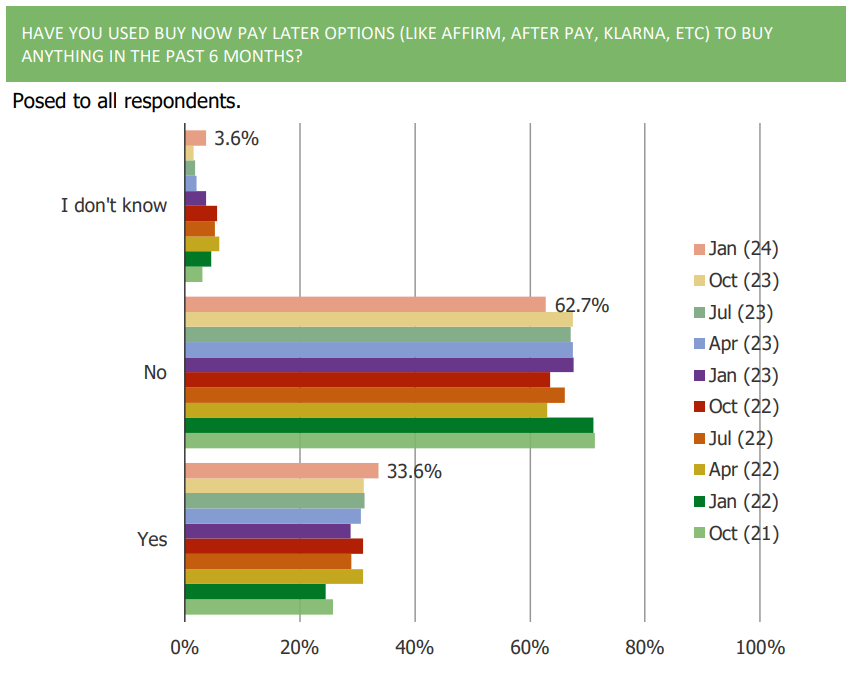

1. The share of consumer who have used BNPL options has increased q/q and sits at series highs.

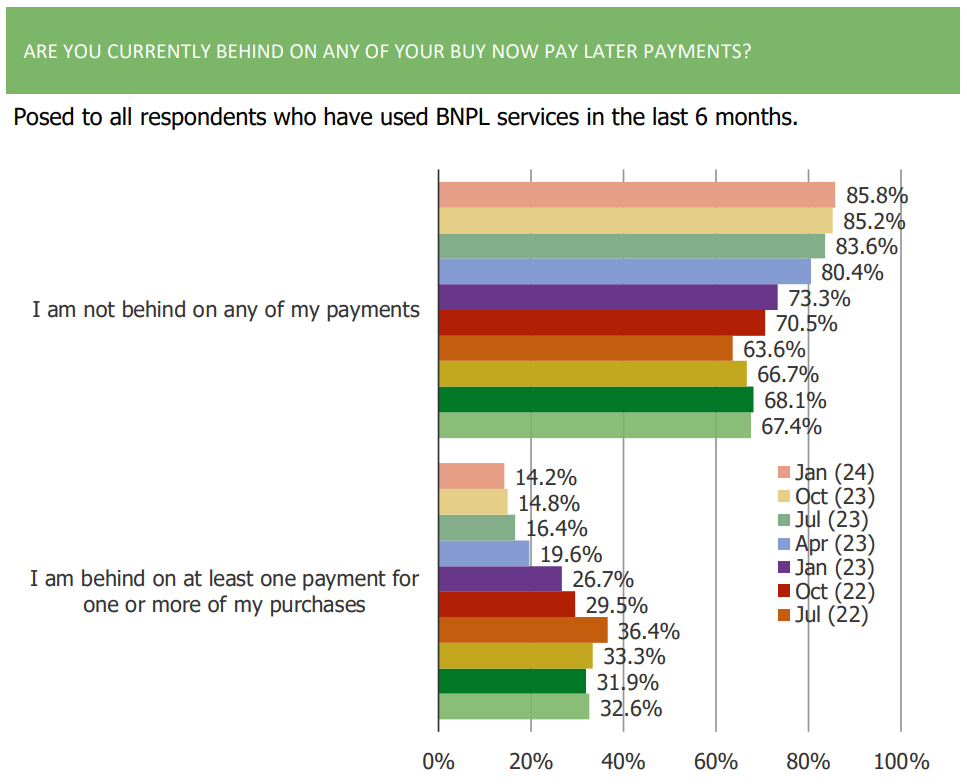

2. Delinquency rates on BNPL have improved slightly with over 85% saying they are not behind on payments.

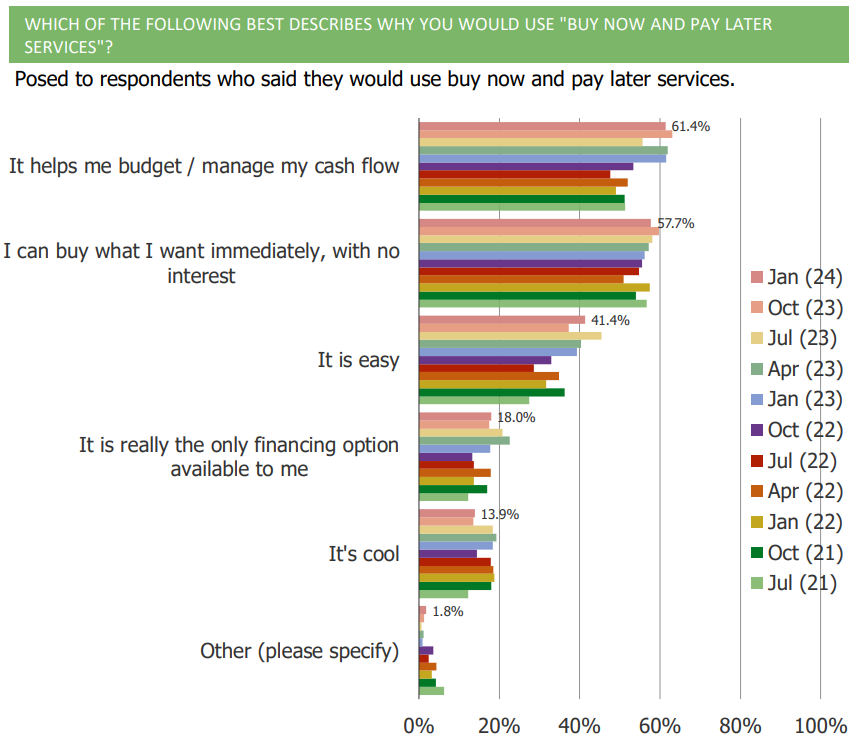

3. 61.4% of respondents note that they would use BNPL services because it would help them budget/manage their cash flows.

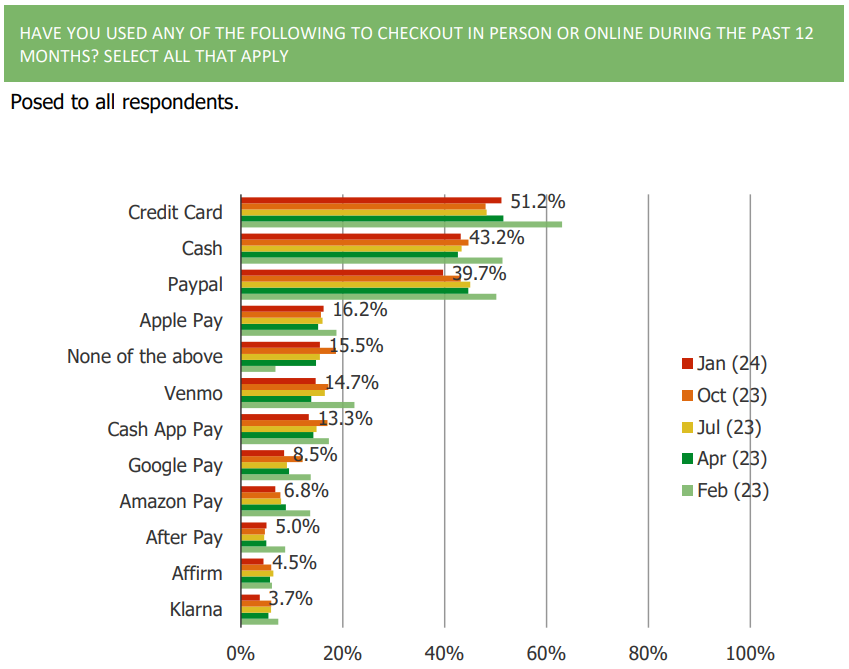

4. Overall, BNPL offering such as Affirm, Klarna, and AfterPay continue to lag far behind credit cards, Apple Pay, and cash in terms of usage.

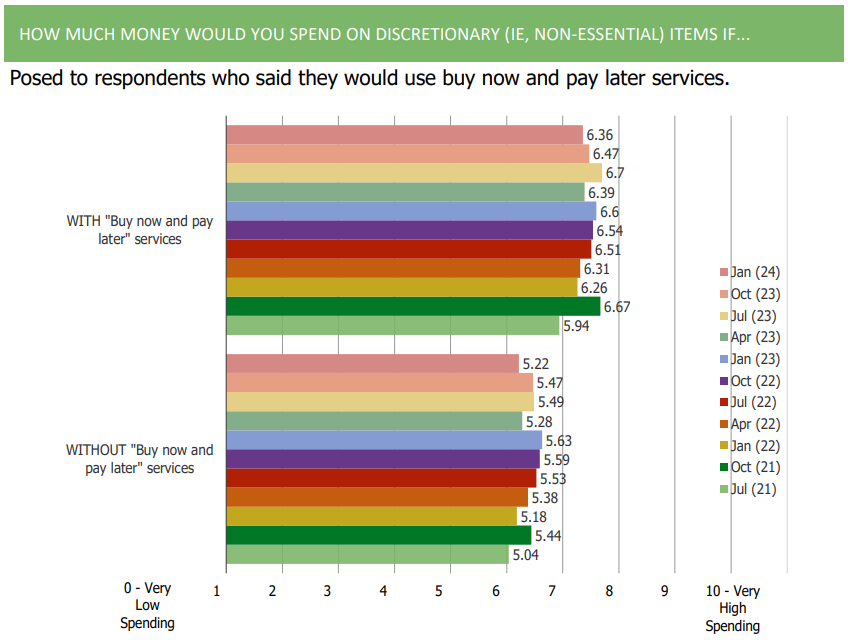

5. Consumers continue to note that they would increase their discretionary spending behavior with BNPL services vs. without.

Social Media | Top Five Takeaways

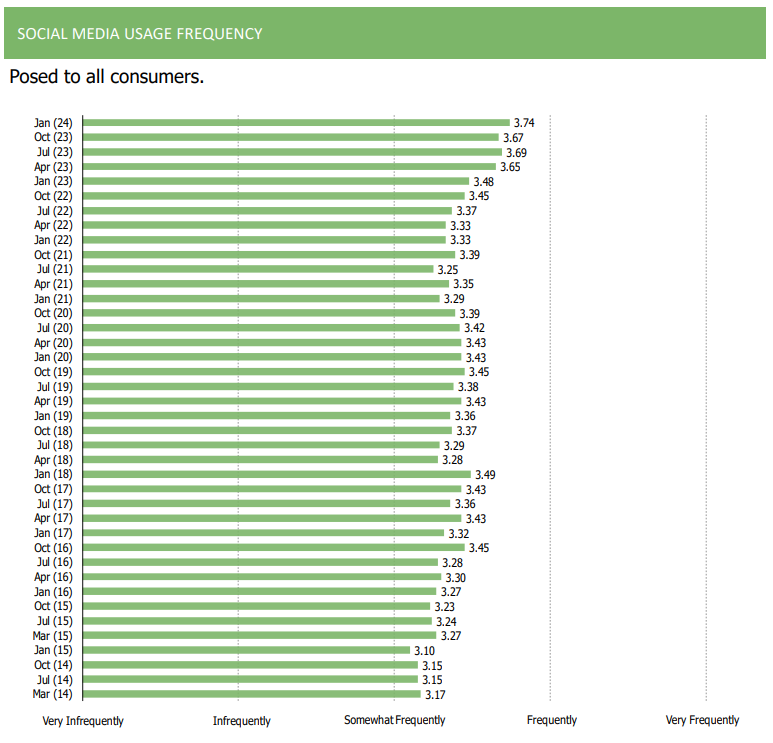

1. Social media usage frequency has strengthened recently (and over time) with readings hitting new highs

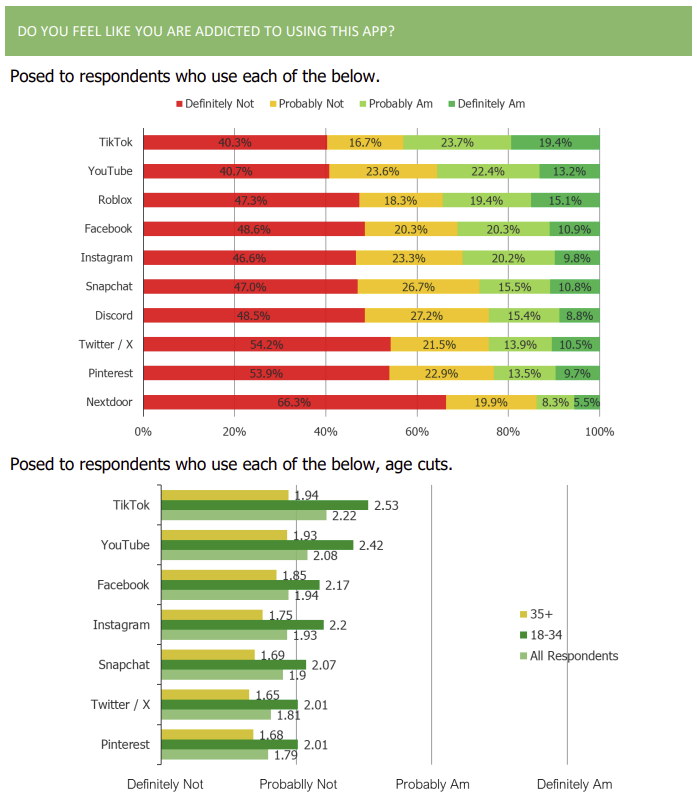

2. Users of TikTok are the most likely to feel that they are addicted to using the app. For all platforms, younger respondents are much more likely to feel they are addicted.

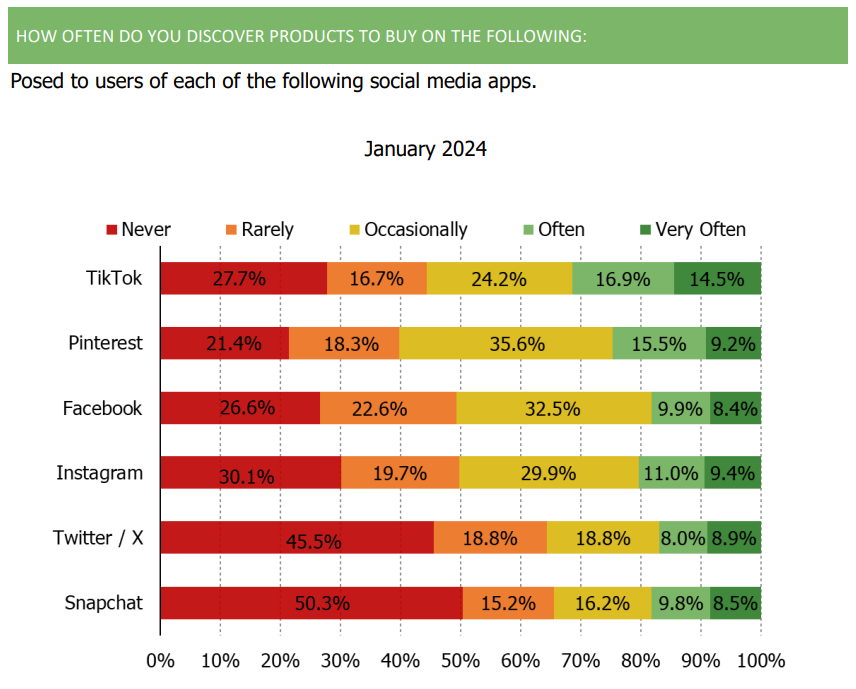

3. Users of TikTok are the most likely to say they discover products to buy while on the app. Pinterest was the second most likely userbase to say the same. Consumers have a net favorable (and improving) view of buying products through social media platforms.

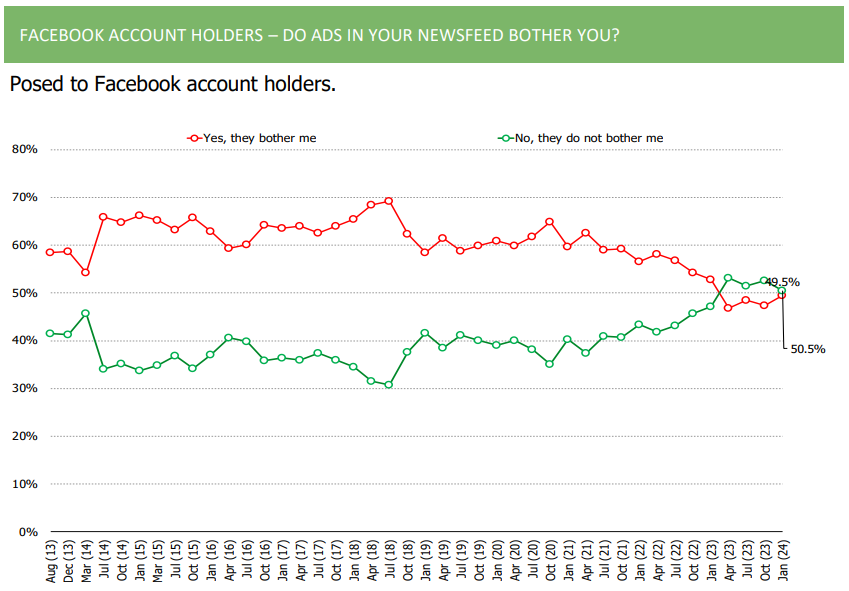

4. Since October of 2020, Facebook user feedback around ads has improved a good deal (how much ads bother them and if they have noticed an improvement in the quality and relevance of the ads that appear in their newsfeed).

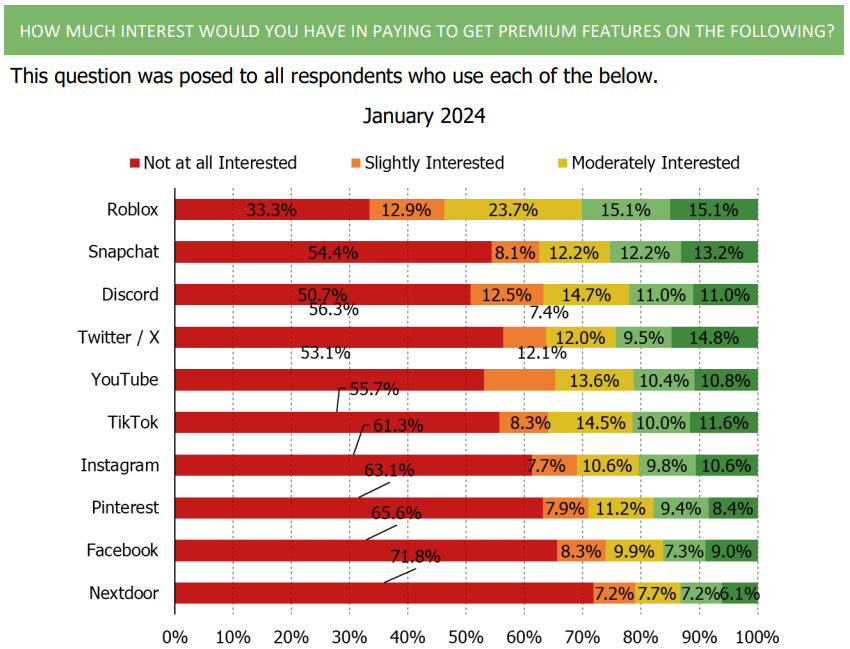

5. Snapchat users have been shifting their usage sequentially more and more toward using the platform for messaging and less for stories. We would also note that of all the user bases, Snapchat users are among the most likely to say they would be willing to pay for premium features.

Temu Deep Dive | Five Takeaways

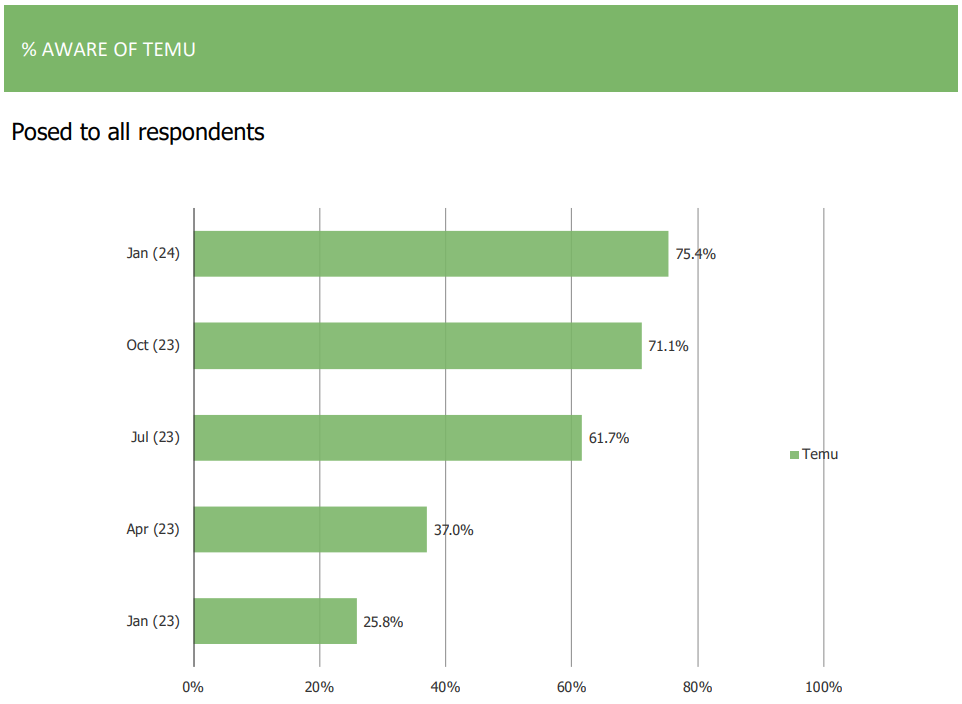

1. Temu awareness and the share of consumers who shop the platform increased sequentially continuing a trend of relatively consistent growth observed by our survey over the past year.

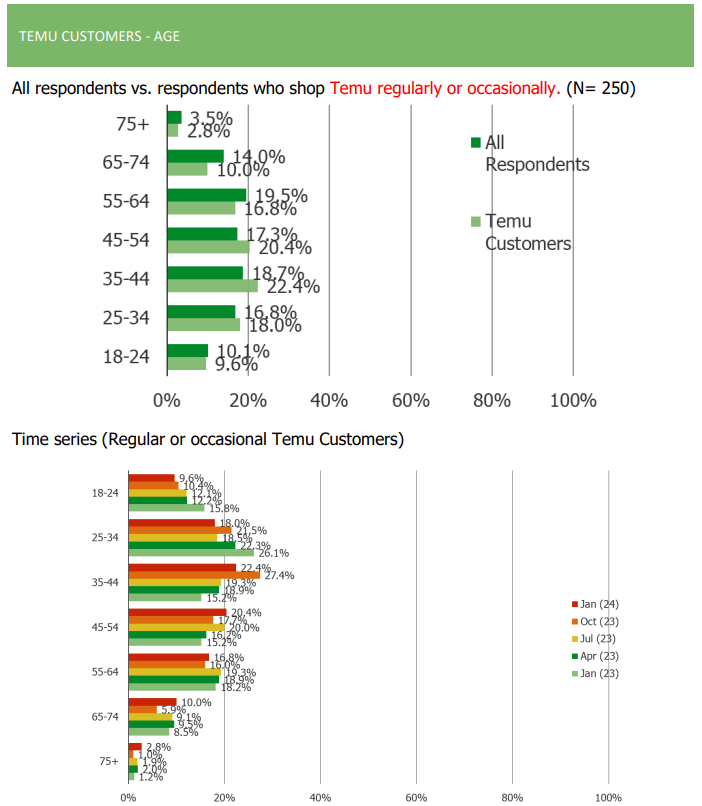

2. Temu users over-index to younger age groups, females, and lower income demographics. Over time, the average age of Temu users has increased with older bands adopting usage of the platform.

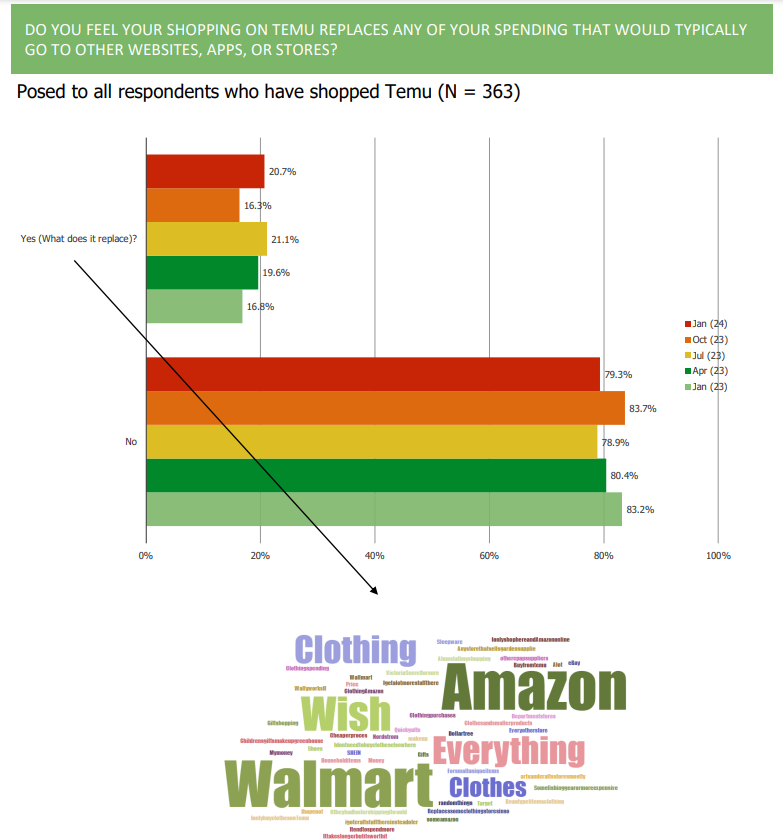

3. Most of those who have tried Temu do not feel as if it is replacing spending that would typically go elsewhere.

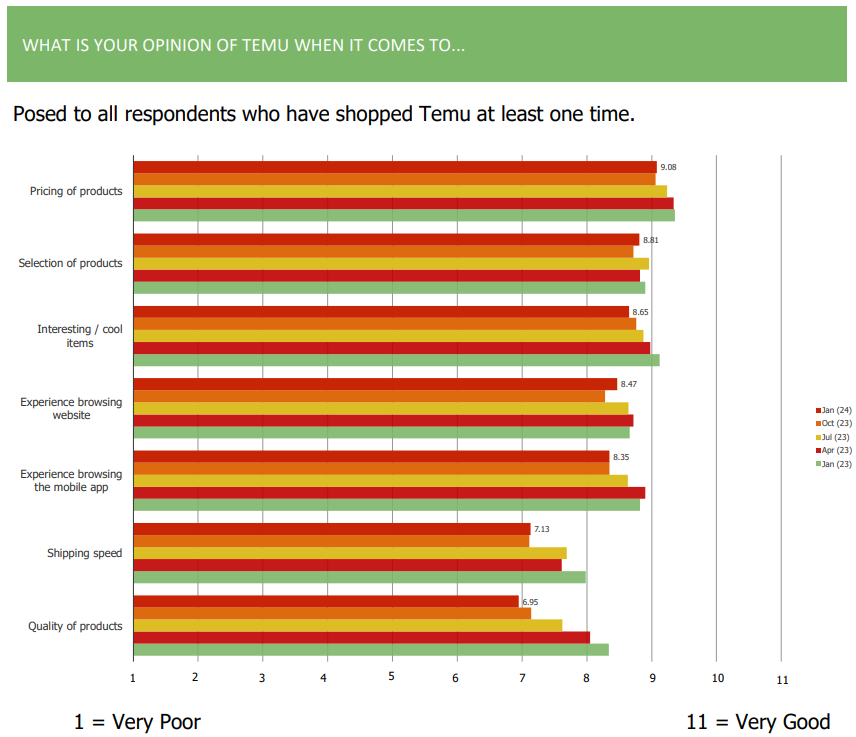

4. Diving deeper into individual Temu platform attributes, consumer satisfaction with pricing of and selection of products has been strong and mostly unchanged.

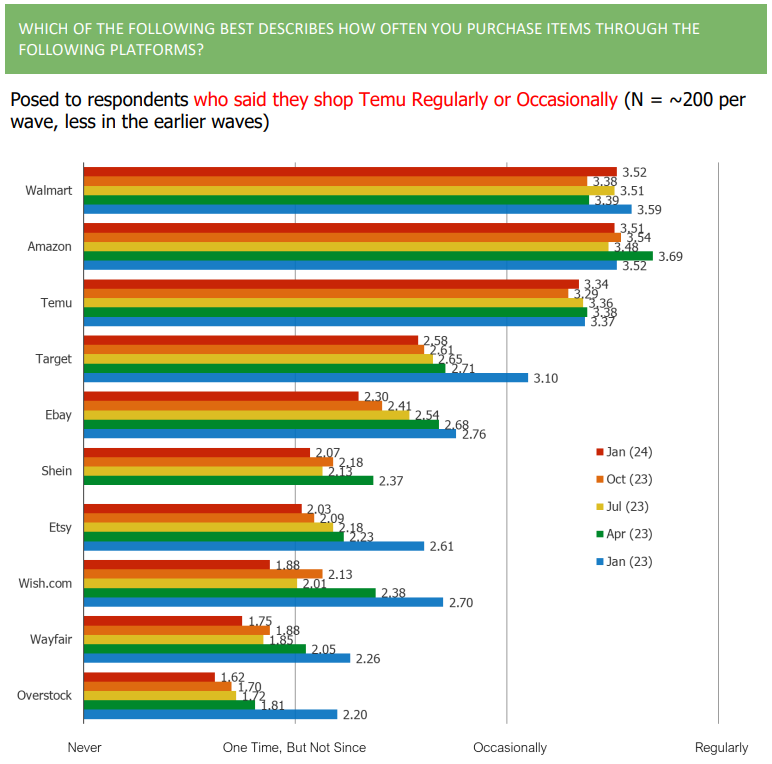

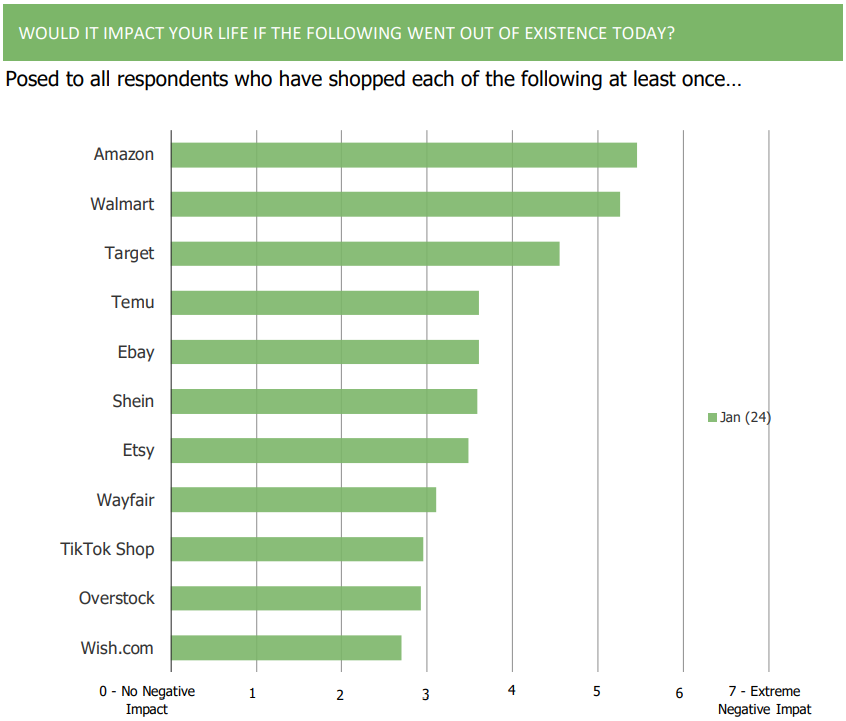

5. Broadly speaking, it appears that Amazon and Walmart are the most insulated from the Temu competitive threat.

(AMZN, W, TEMU) Online Retailers | Five Takeaways

1. Consumers self-report more discretionary confidence compared to our last wave in October of 2023. Feedback is still softer than series highs, but has improved q/q.

2. Among those who have used each of the retailers and etailers in our survey, Amazon is the customer base that would find it the most painful if the platform went out of existence today, followed closely by Walmart. Target ranks third on the list, followed by a cluster consisting of Temu, Ebay, and Shein

3. With regard to shopping frequencies, customers of Amazon, Walmart, Target, and Temu are the most likely to see their shopping as “regular” while shoppers of Overstock, Etsy, Wayfair, Wish.com, and Ebay are most likely to see their shopping as “episodic.”

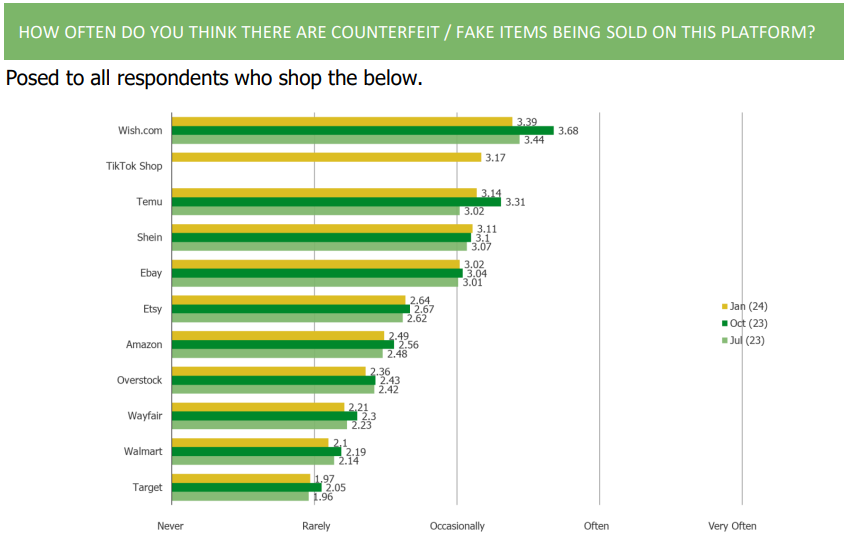

4. Respondents who shop platforms like Wish.com, TikTok Shop, Temu, Shein, and Ebay feel as if they encounter counterfeit and fake items more than users on other platforms. Trust is lower on platforms like Wish, Temu, TikTok Shop, and Shein relative to other etailers and retailers.

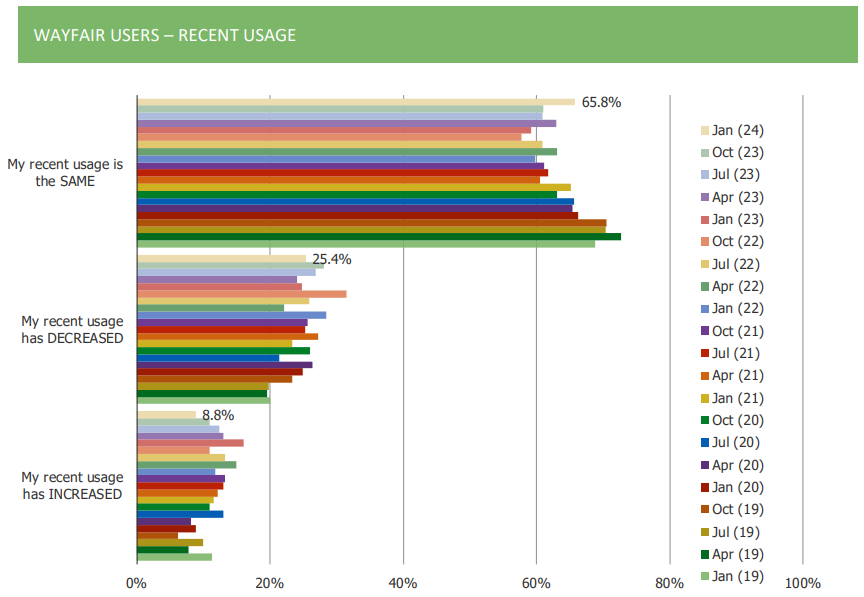

5. A number of tracking KPIs that ask about Wayfair have been flat to worse after reaching series highs during the pandemic.

(VVV) Oil Changes | Three Takeaways

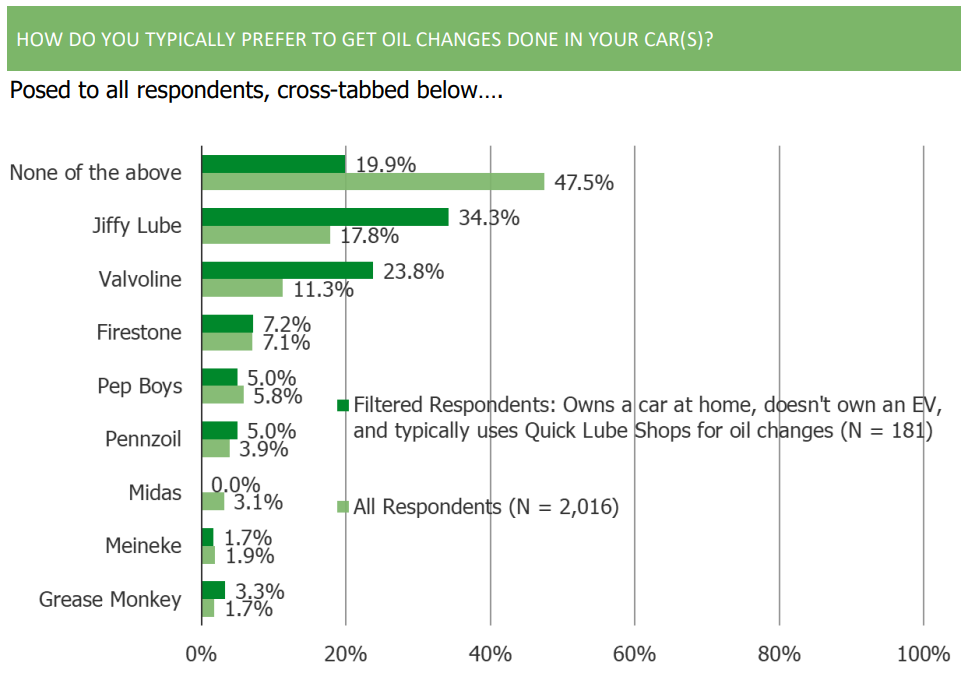

1. A plurality of respondents prefer to get their oil changes done at the dealership (32.8%). Quick Lube shops ranked second, at 19.1%.

2. Among those who prefer Quick Lube Shops, a plurality would choose Jiffy Lube (34.3%) followed by Valvoline (23.8%). There is a large gap between the top two choices and the third (Firestone, at 7.2%).

3. Respondents say they prefer Valvoline because of the location, how quick it is, because they like the brand, and because of the rewards.

(AAPL, MSFT, AMZN) Consumer Electronics | Five Takeaways

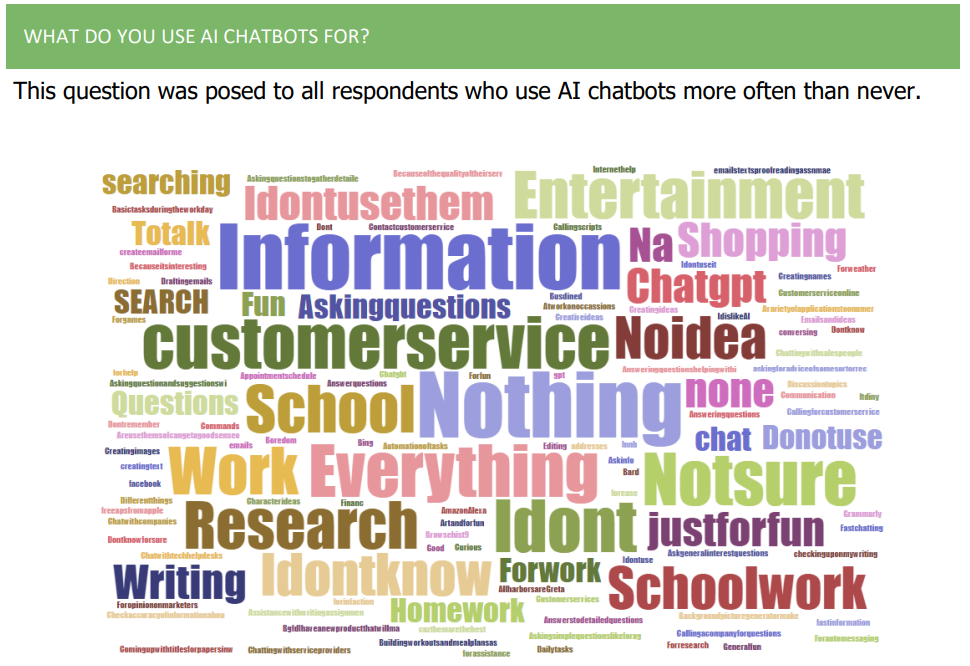

1. Consumers who use AI Chatbots describe a range of different activities that they use them for. A smattering of information, asking questions, entertainment, and work or school related help.

2. Based on our reading of fill-in responses, there is a mixture of hope for possible applications around AI and caution/fear around possible risks that could materialize from AI.

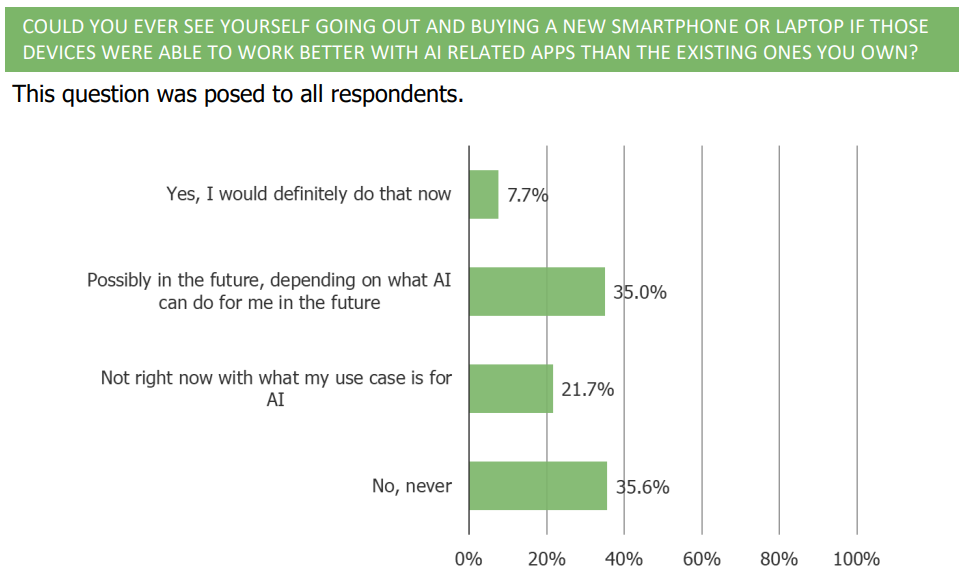

3. A relatively low percentage (7.7%) of consumers said they would buy a new

smartphone or laptop today if those devices worked better with AI related apps. At the

same time, only 35.6% said they would never do that. In between, the majority of

respondents either said possible in the future depending on what AI could do for them

(35%) or not right now based on their current use case for AI (21.8%).

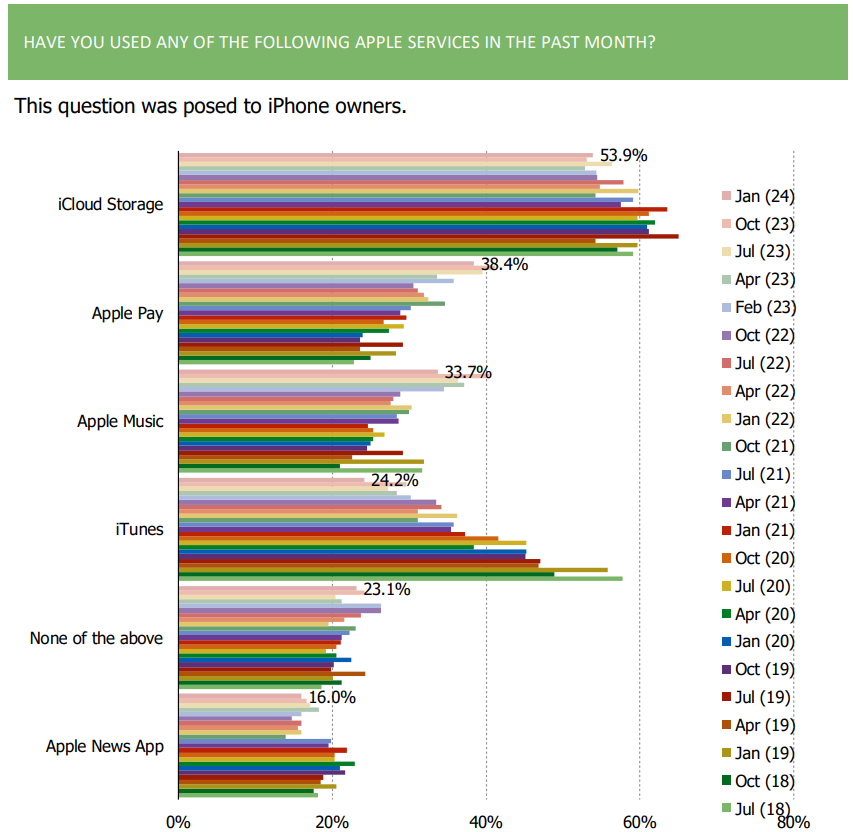

4. The share of iPhone users who utilize Apple Pay and Apple Music has increased

considerably over the history of our survey.

5. Over the past year in particular, our survey has detected an improvement in sentiment toward Apple (overall, willingness to pay a premium for their products, etc).

(TSLA) Autos & Electric Vehicles Survey | Five Takeaways

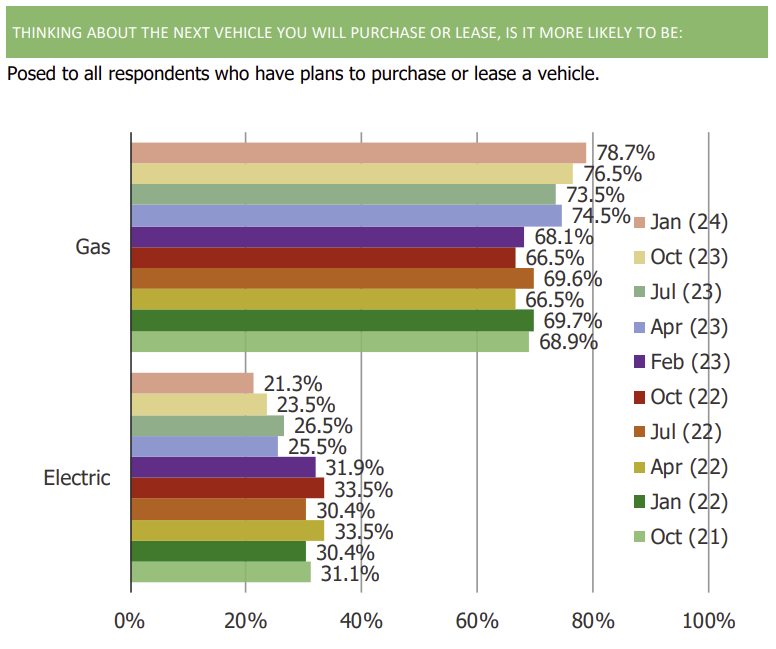

1. Intentions to purchase an electric vehicle for their next vehicle purchase continue to move lower (currently sits at a series low).

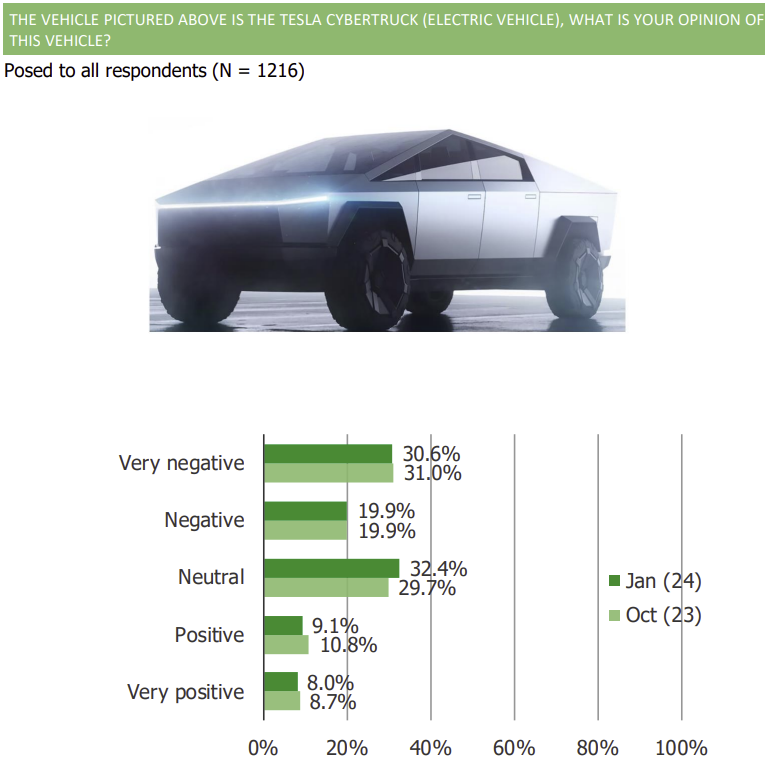

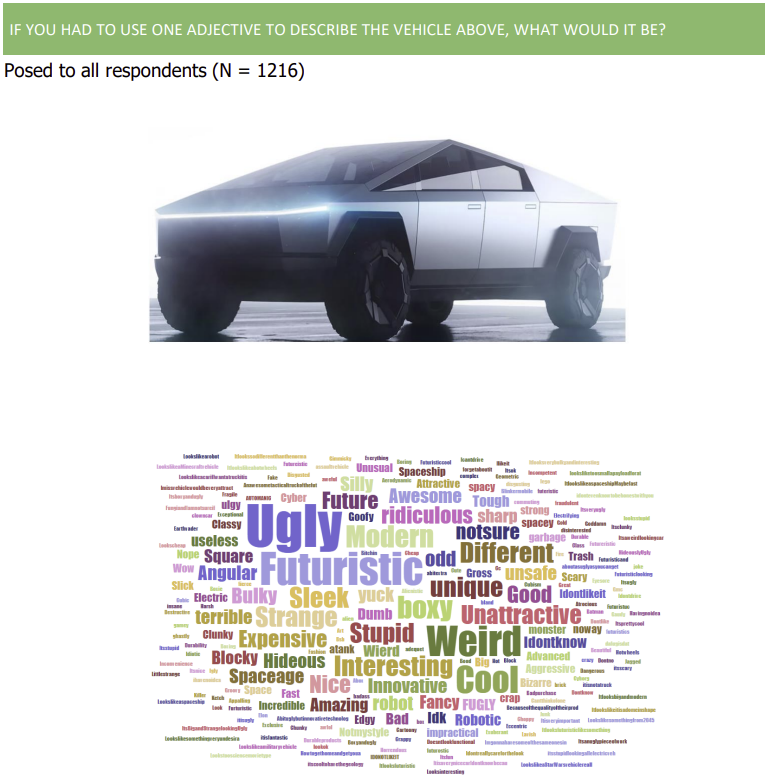

2. Consumer opinions on the Tesla Cybertruck continue to skew neutral to negative.

3. In fill in responses, consumers wrote that they associated the Tesla Cybertruck with the words “ugly,” “boxy,” and “futuristic.”

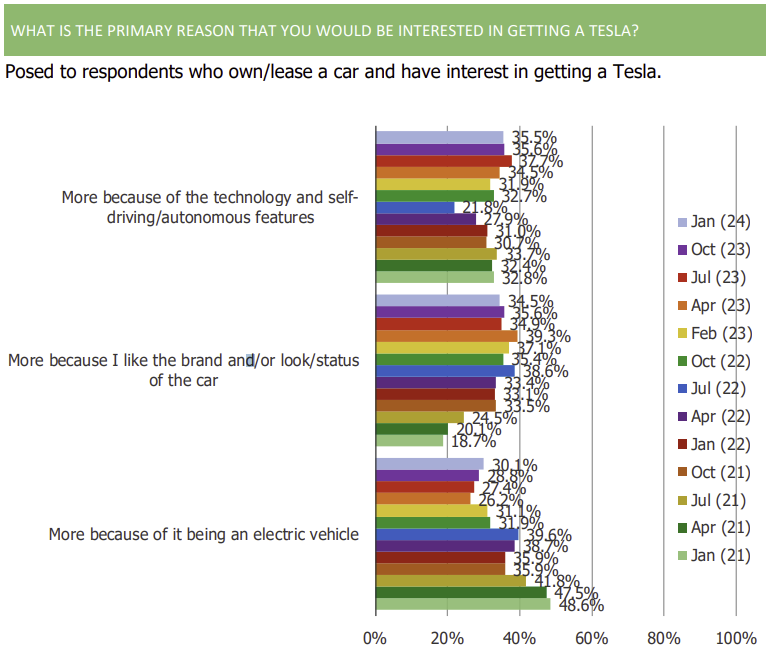

4. Among those who said that they are interested in getting a Tesla, the share who said they are interested because it is an electric vehicle has declined over time. During the same period, the share who are interested in the tech and car features increased.

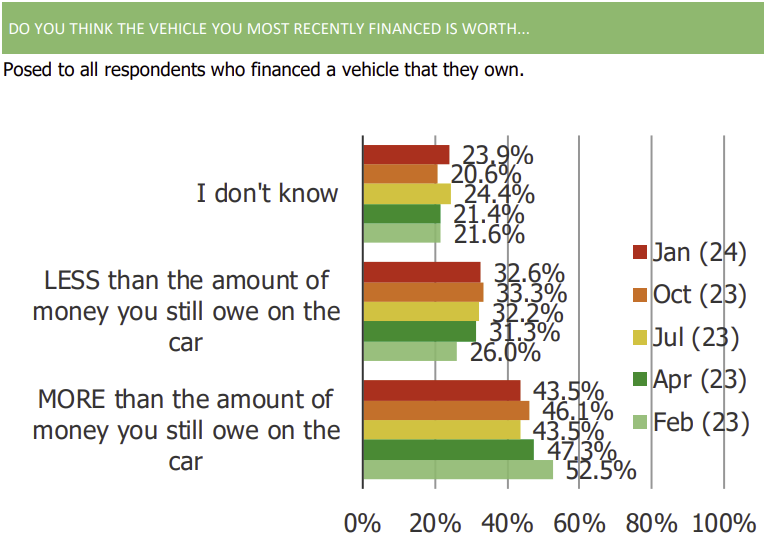

5. Over the past year, the share of those who own a car who think that their car is worth less than the amount they have left to pay on it has increased.

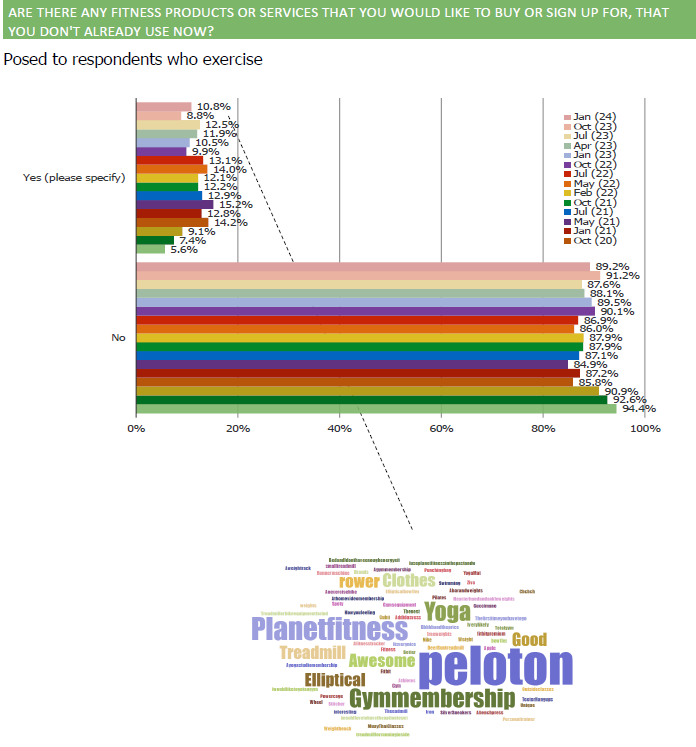

(PTON) Fitness Survey | Five Takeaways

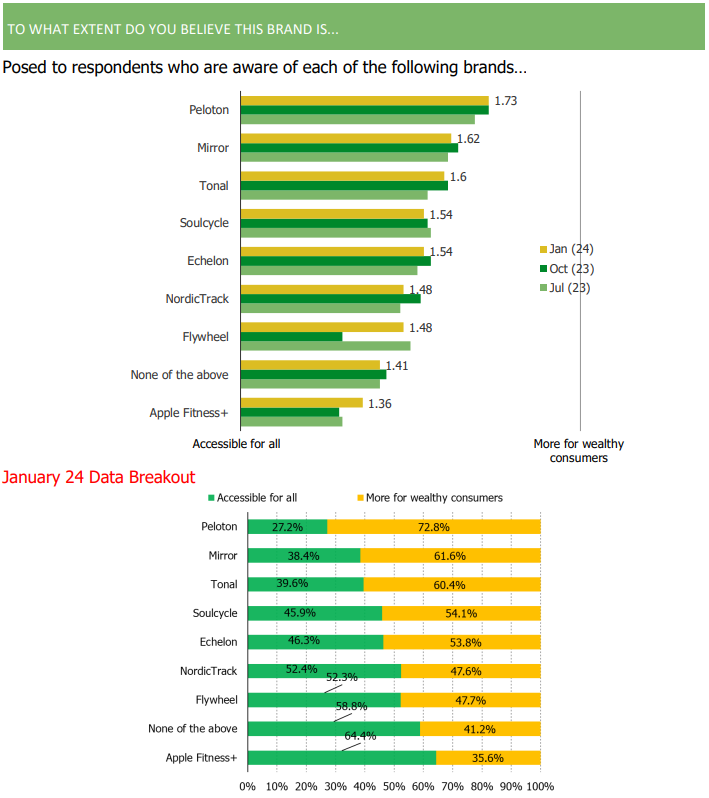

1. Consumers continue to view the Peloton brand as a brand that’s more for wealthy consumers than for all. The sentiment has been more flat/unchanged q/q.

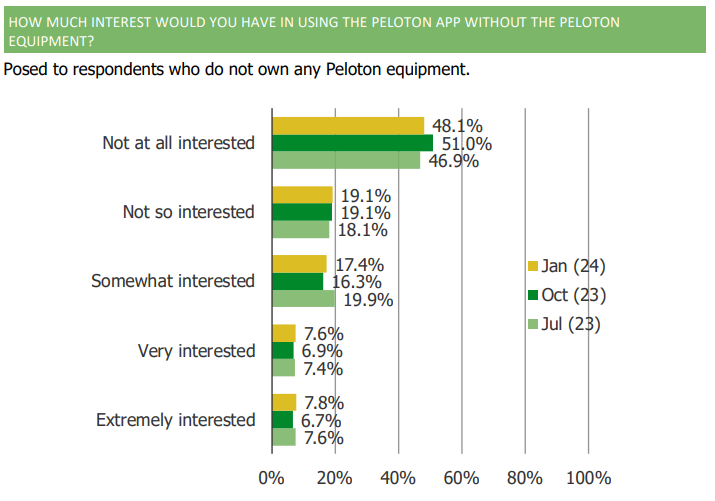

2. Among those who aren’t currently customers of Peloton, the majority don’t have interest in app-only access.

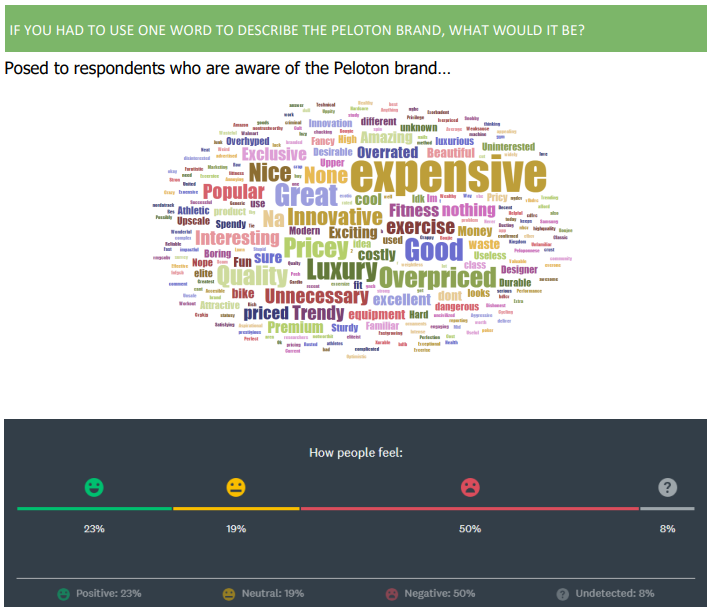

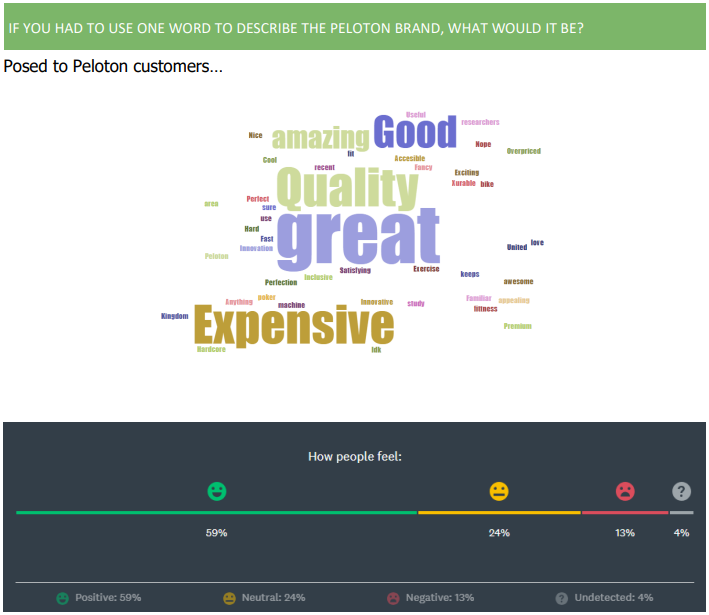

3. There is a large delta in sentiment readings towards Peloton by respondents who are customers of the brand vs. respondents who are just aware of the brand. Customers love it, but those who aren’t customers view it as expensive, overpriced, and luxury.

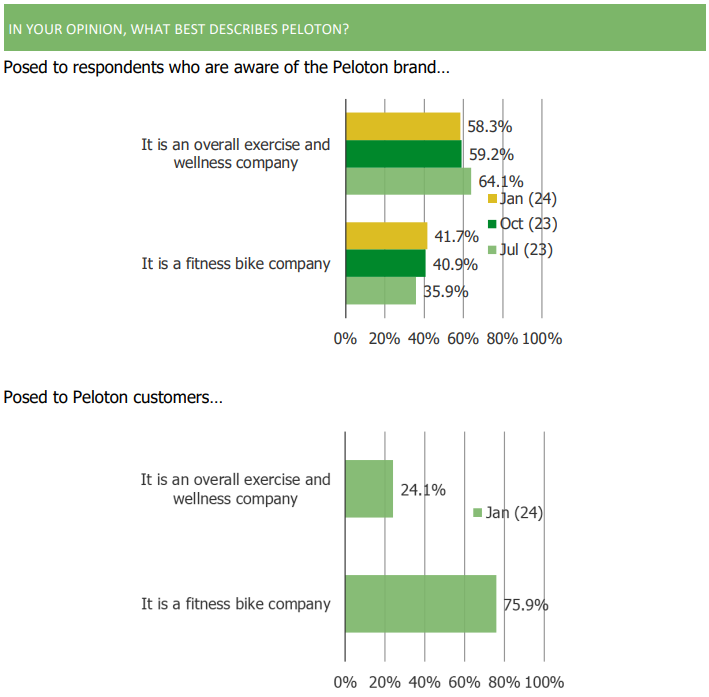

4.Peloton customers are more likely to see Peloton as a fitness bike company while the broader population views it more as an exercise and wellness company.

5. Consumer interest in at-home fitness brands/products peaked during the pandemic and readings remain lower at the moment compared to that peak.

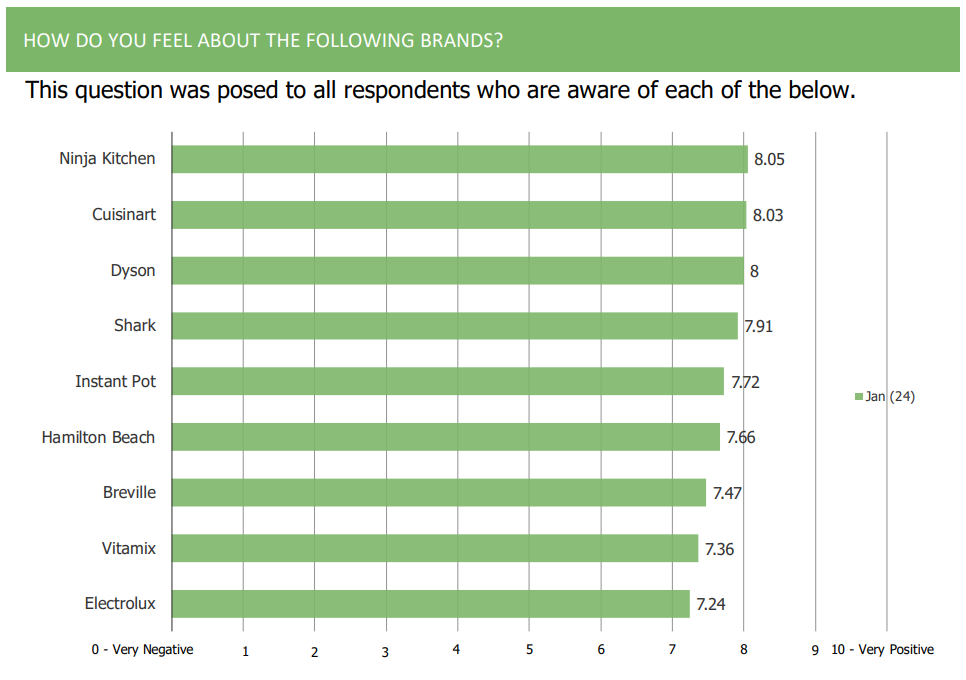

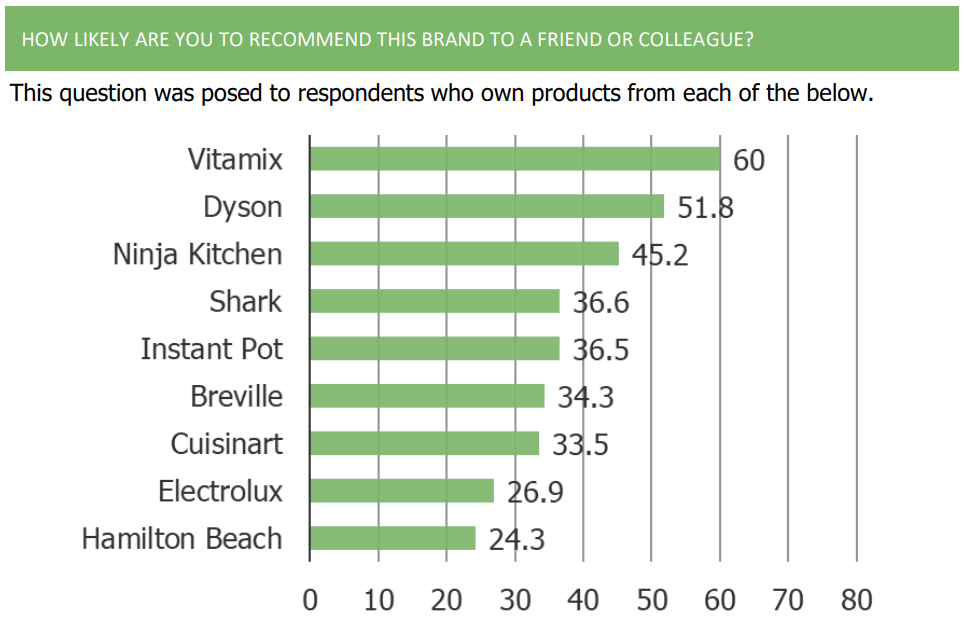

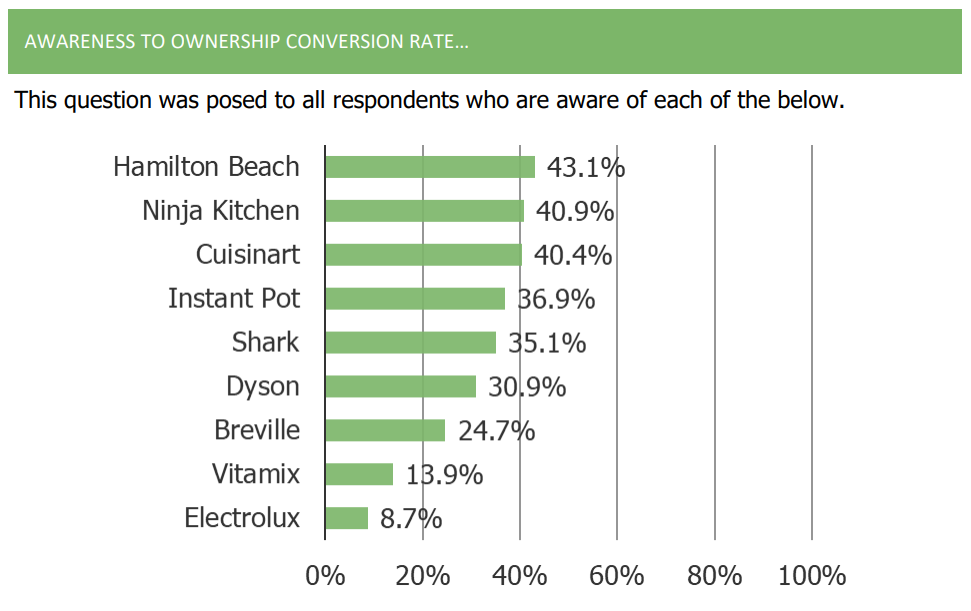

(SN) SharkNinja Survey | Three Takeaways

1. Sentiment toward both Ninja and Shark brands among consumers is very positive on an absolute basis and on a relative basis compared to peers

2. Ninja Kitchen has an NPS of 45.2 and Shark has an NPS of 36.6

3. Both Shark and Ninja are at the higher end of our rankings when it comes to awareness ownership conversion rate (ie, % of those who are aware of the brands who own products from the brands)

(NFLX) Quarterly Survey, Volume 43 | Five Insights

Highlighting five interesting takeaways from our 100+ page survey report on Netflix. If you are a client, login to view the full report. If you are not a client and want to learn more, email [email protected] or call 914-630-0512.

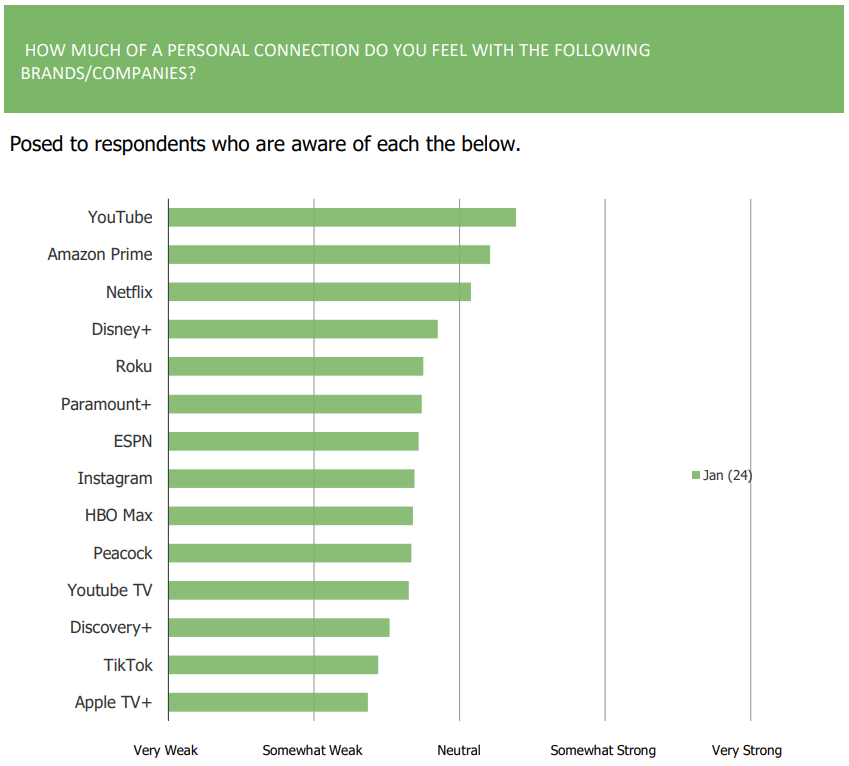

1. Consumer sentiment regarding Netflix is very positive, trailing only YouTube and Amazon, and ahead of a number of the other brands that we ask about including Paramount+, Disney+, and Apple TV+

2. Consumers feel more of a personal connection to Netflix relative to other brands including Disney+, Roku, ESPN, Roku, and Peacock, to name a few

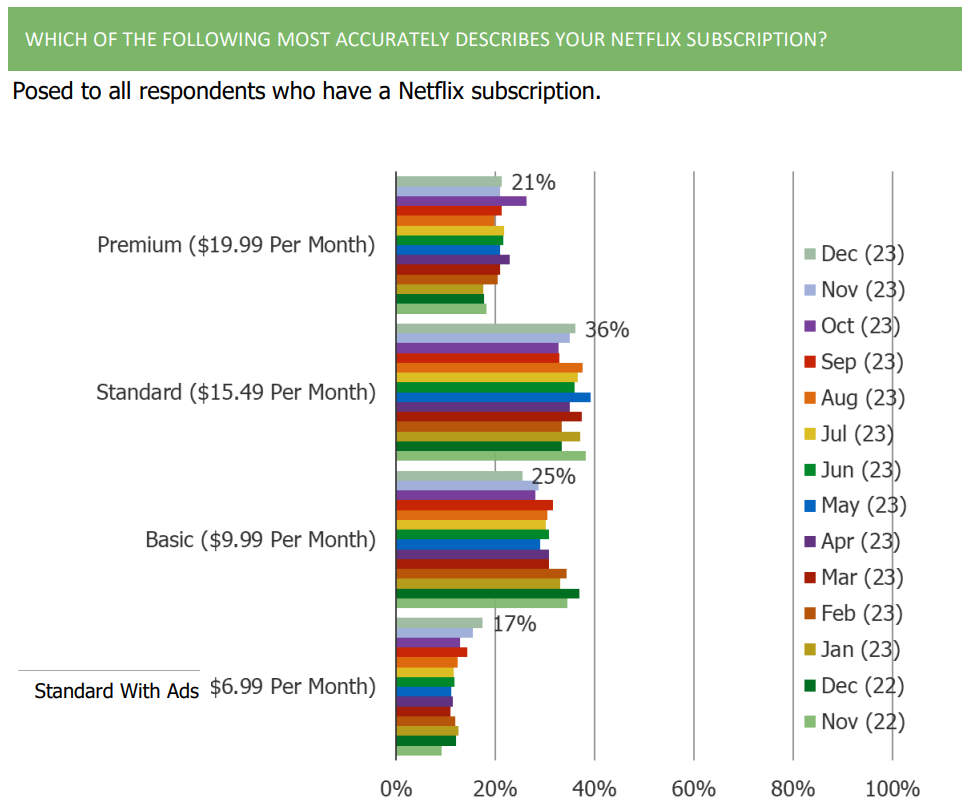

3. The percentage of respondents who are on the Netflix Standard with ads subscription continues to increase

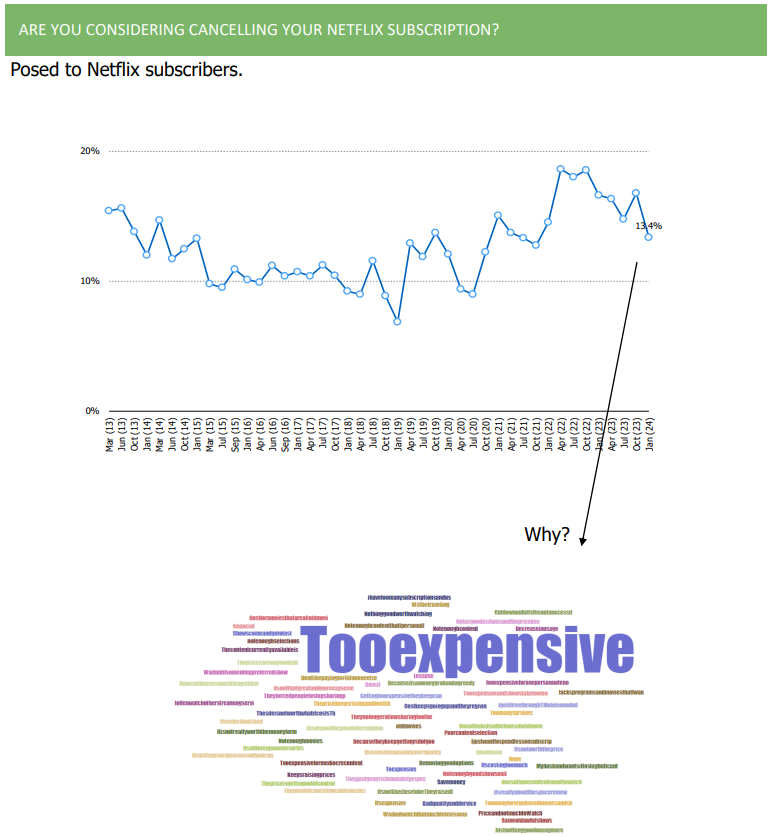

4. The share of Netflix subscribers considering cancelling at the moment declined sequentially. Those who are considering cancelling complain about price / say it’s too expensive

5. The share of Netflix watchers who had trouble accessing the account of someone they don’t live with (in the past month) increased for two consecutive waves since we started asking the question in July of 2023.

Streaming Video, UK (NFLX)

Key Takeaways:

- Streaming video has gained as the preferred method for consuming TV and film content over the history of our survey.

- The share of consumers who subscribe to cable, satellite, or telco television has declined over the history of our survey. An increasing share of those who do not have cable TV said they cancelled to use internet streaming services instead.

- Interest in ad-supported streaming platforms has grown sequentially over the past 4-6 quarters.

- Most of the engagement related topics on Netflix are consistent with what we observed in recent prior waves.

Full Report:

(SPOT, SIRI, AAPL, GOOG) Top 5 Takeaways From Audio Survey

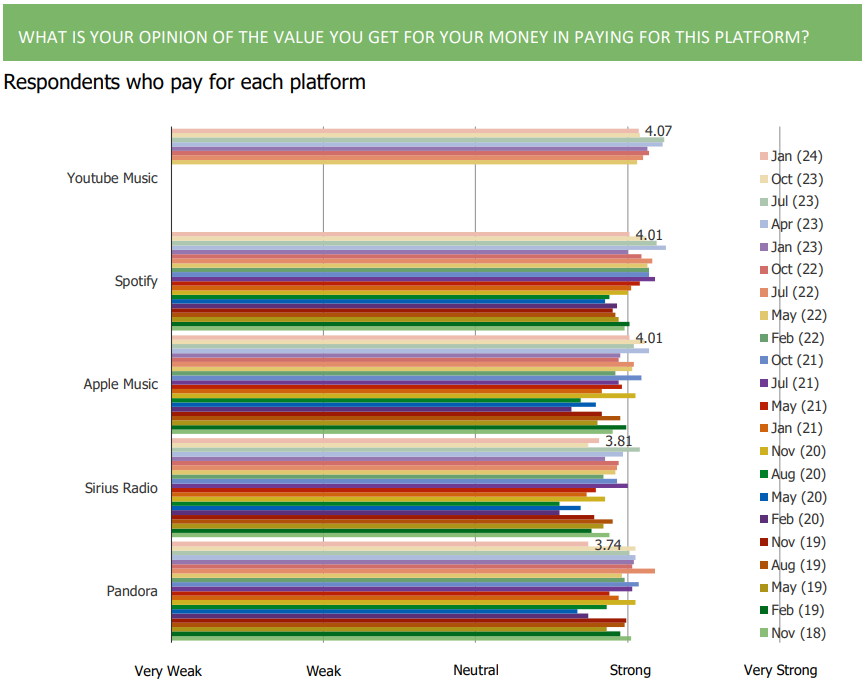

1. Sentiment based feedback toward both YouTube Music and Spotify remains positive

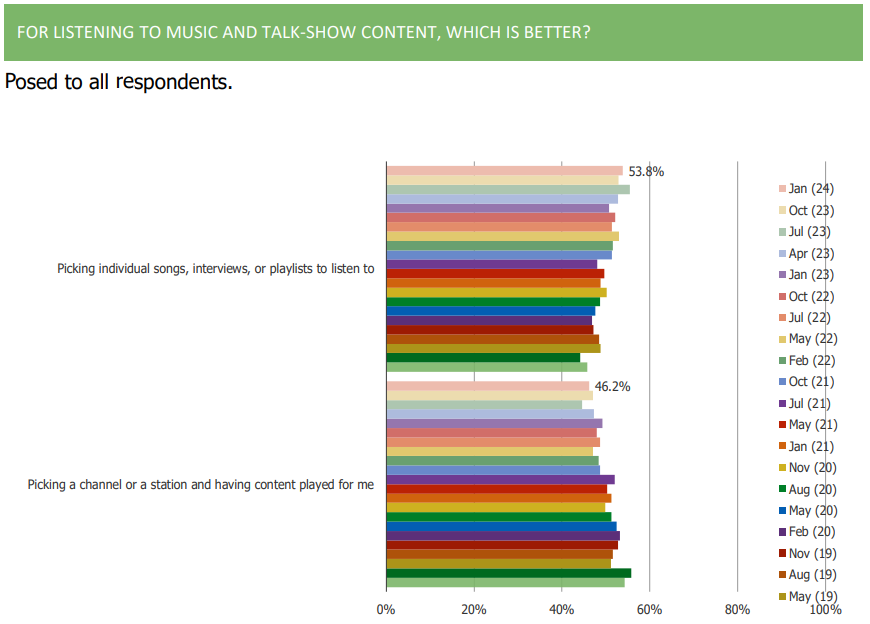

2. Consumers continue to shift their preferences toward picking individual song, interviews or playlists to listen to and away from picking a channel or station and having it play content for them

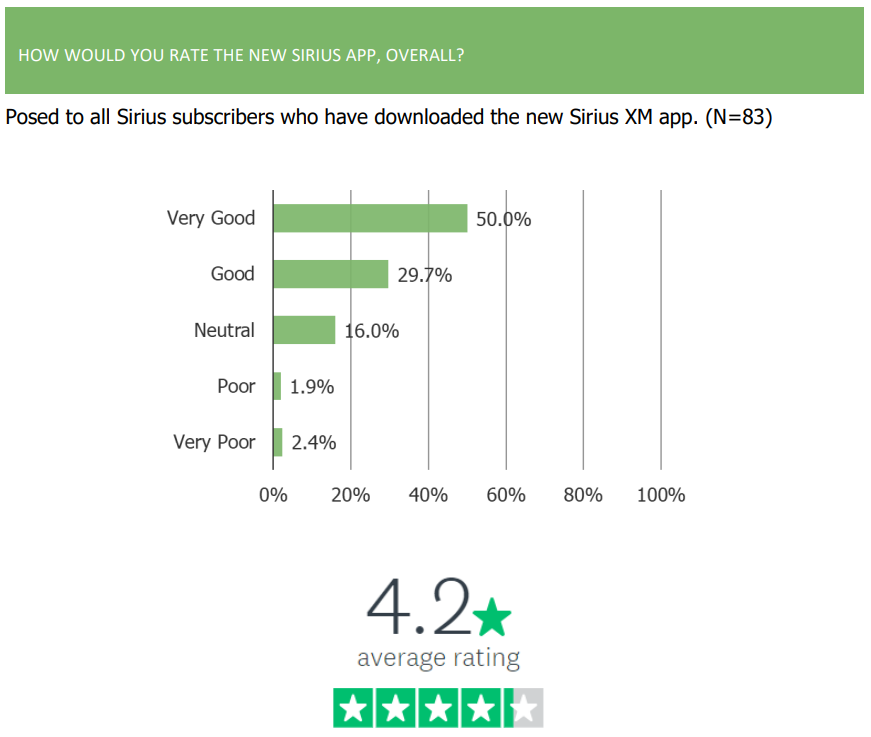

3. Sirius App Revamp: Consumers offer net-positive feedback around the design and interface of the revamped Sirius app. Among those who report having downloaded the app, feedback was generally positive (4.2 stars)

4. While consumers offered generally positive sentiments on the Sirius App – commentary on content on the app was more positive than commentary on interface

5. Among streaming music users, the top catalysts for choosing apps include ease of use, variety, price, and no ads